Welcome to the February 11th, 2022, edition of the Decentral Weekly Crypto News Wrap-Up, where Neil and Em examine the latest cryptocurrency news headlines and address the ever-relevant question: “Is this a thing?”

Bitcoin is back over $40,000, which means you may just be able to buy your Valentine one of many romantic crypto-related gifts. This week’s crypto news headlines include: Gensler wants exchanges to come to the table, the Super Bowl is selling NFTs, and job opportunities in the metaverse.

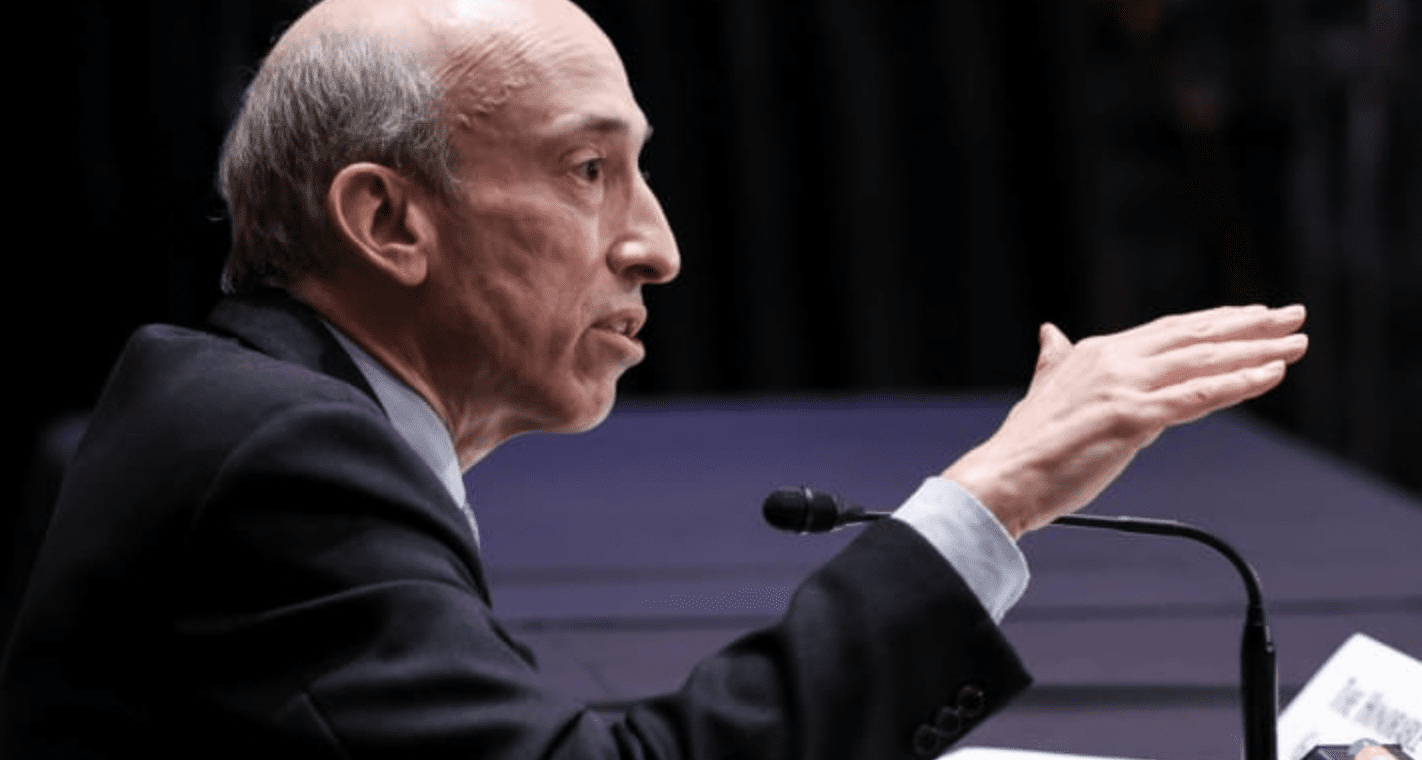

Gensler wants some cooperation

We pointed out last week that Biden was attempting to regulate Bitcoin, and that he was framing it as a national security matter. It looks like SEC Chairman Gary Gensler wants more crypto platforms to voluntarily work with the SEC to help define regulations.

Gensler isn’t exactly the cryptocurrency industry’s friend right now, so the olive branch may be a bit late. Countless crypto experts and insiders assumed Gensler would take a crypto-friendly approach to regulation since the former MIT professor has taught classes on blockchain technology in the past.

Gensler also admitted that some coins can qualify as commodity tokens, and that the SEC would work with the Commodity Futures Trading Commission to regulate those particular coins.

Should crypto exchanges consider this approach, or is it just too late to take Gensler at his word?

Neil says:

I wouldn’t trust Gensler. He’s made it clear he wants to protect investors, but it’s not like crypto exchanges will get anything out of actually meeting with the SEC. Gensler has made it clear that he wants to be the villain here, so why would anyone suddenly latch on to this olive branch?

Em says:

Everything that happens in the bureaucracy is a power play. If they can get the upper hand in controlling market players, they will. The whole point of crypto was to step outside of government control — now it’s just a battle to see who will win.

Bottom line:

Neil thinks this is a “don’t trust Gensler” thing; Em thinks it’s a power play thing.

Who do you agree with?

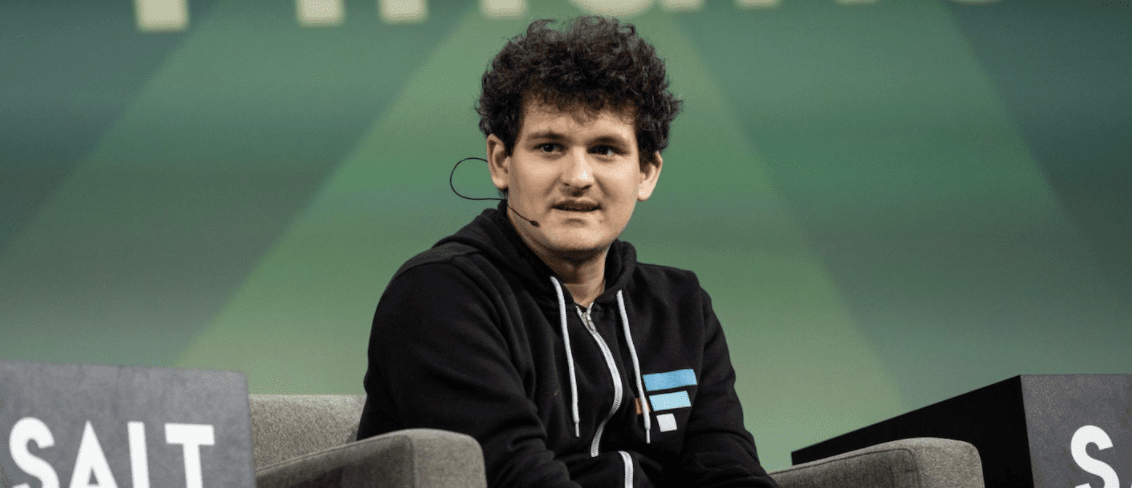

FTX enters Japanese markets with Liquid acquisition

It seems like every week, FTX seems to make the news. The crypto exchange made last week’s cryptocurrency headlines with its $32 billion valuation, and now it looks like FTX is aggressively pursuing Asian markets.

FTX has acquired the Japanese crypto exchange Liquid for an undisclosed sum. The acquisition is expected to close by March 2022, and Sam Bankman-Fried has been previously open in interviews about his international ambitions for FTX. The crypto billionaire has also previously stated he doesn’t believe we’re in a “crypto winter,” but that markets in general were “moving” more than usual.

FTX plans on more acquisitions, and its rise has already been meteoric. At what point should we be concerned about decentralization?

Neil says:

Yeah, I’m not going to lie – there’s something a bit disturbing about this. FTX is already massive, and they’re purchasing other large crypto exchanges. How does this not lead to more centralization? Some platforms will be more successful than others, but centralization should be a concern.

Em says:

The way companies and large endeavors are structured dictates that, as they grow and become successful, they’ll become more centralized. Only a conceptual shift can change that, and DAOs are trying to do it. Maybe with DAOs, even big companies like FTX can decentralize some day.

Bottom line:

Neil thinks this is a “stay wary” thing; Em thinks it’s a “maybe DAOs can help” thing.

Who do you agree with?

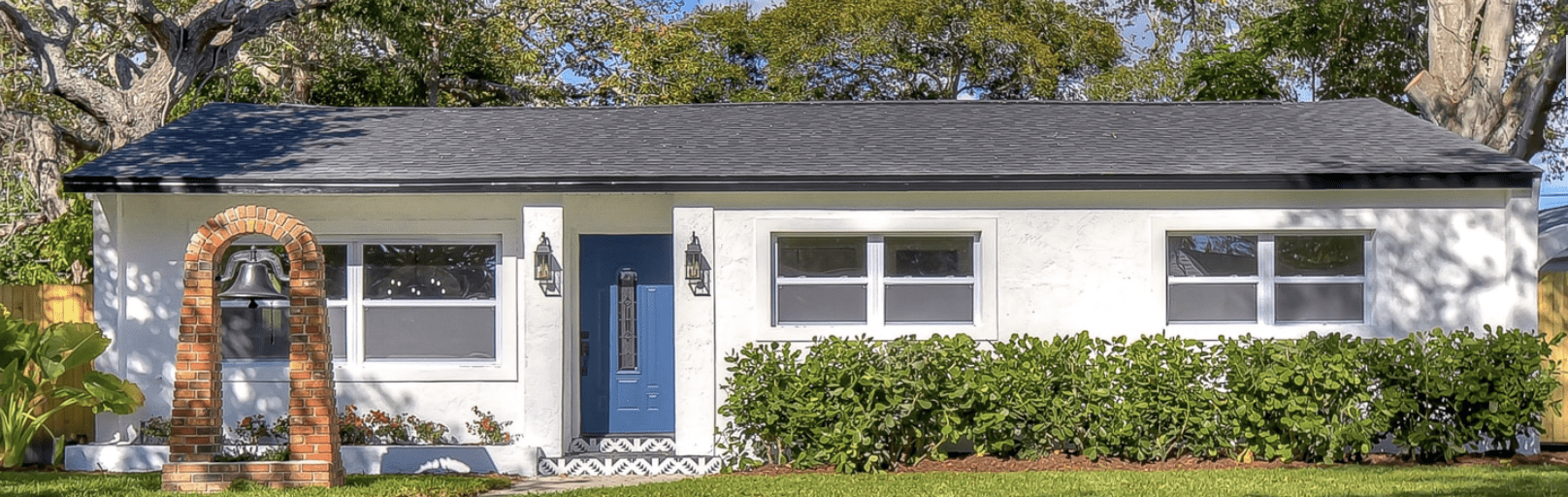

Will Florida be home to the first NFT purchase?

One of the most interesting things about blockchain technology is that it allows for tokenization. Any individual can tokenize their assets and sell them as a digital asset rather than a physical asset. It looks like a Gulfport home may just be the first home to sell as an NFT in the United States.

The house is located in Tampa Bay. The realty group is claiming that ownership of the home will be transferred in the form of an LLC, and that ownership will be transferred with the NFT. The owner hopes to “stimulate conversation” regarding real estate and blockchain technology.

The auction will be hosted by Propy, a blockchain proptech startup that was previously involved in the world’s first-ever NFT real estate transaction. The starting price is $650,000. The sale will also include a mural by a local Florida artist. Around 1,500 bidders have already lined up.

If this sale is successful, will we see a lot more U.S. homes sold as NFTs? Or is this really just a novelty thing?

Neil says:

This is one that might take a while to catch on. I think blockchain can absolutely disrupt real estate, but we also have to consider that the real estate sector has done things a certain way for a long time. Even the fact that it took THIS long for a home to be sold as an NFT in the U.S. kind of proves that. I think, for now, this will remain a novelty.

Em says:

Tokenized real estate is something people have been talking about since early NFT days. Everyone saw the possibility and the ideas of it, but the execution is only now starting to come to fruition. Hopefully, this won’t be the last time, but the beginning of the idea playing out in reality.

Bottom line:

Neil thinks it’s a novelty thing; Em thinks it’s a “just the beginning” thing.

What do you think?

The metaverse hiring spree continues

The “metaverse” buzzword gained a lot of traction in 2021, thanks especially to Facebook’s rebrand to Meta. It hasn’t exactly done wonders for Meta stock, which recently suffered its biggest one-day stock drop ever.

However, it doesn’t seem to be stopping many companies from actively hiring for the metaverse. In just the past two weeks, Nike posted five metaverse-related job positions. Disney is also recruiting for a metaverse-related business development manager position.

The hiring spree isn’t just limited to entertainment companies: fashion companies and athletic leagues and organizations are also hiring for similar positions. There are recent reports that Roblox will pay somewhere around $430,000 a year for metaverse-related positions.

Even with Meta’s recent fiasco, will we see a continued hiring spree for metaverse job positions?

Neil says:

I completely understand why people are skeptical about the metaverse, or think it’s dystopian. But it’s ridiculous to blame the metaverse for what happened with Meta. Facebook’s reputation has been terrible for a long time. The hiring spree won’t stop, and Meta is far from the only company pursuing the metaverse.

Em says:

The metaverse is going to happen. It doesn’t matter what people or the market want. When you have huge players like Meta and Disney sinking billions into it, the consumers will get on board. It just depends on whether it’s the “metaverse” that we envisioned or just another plutocracy.

Bottom line:

Neil thinks it’s a “the metaverse is bigger than Meta” thing; Em thinks it’s a “money talks” thing.

Who do you agree with?

Super Bowl NFTs are here

We know crypto companies have created Super Bowl commercials to help reach the masses, but it looks like the Super Bowl itself is interested in NFTs. This year, Super Bowl attendees will receive virtual commemorative tickets in the form of NFTs. The championship game remains one of the biggest television events in the world. Some are now referring to the Super Bowl as “The Crypto Bowl.”

This isn’t a massive surprise, considering the NFL has previously issued commemorative tickets as NFTs. Super Bowl LVI will take place in Los Angeles on February 13, 2022, between the Los Angeles Rams and the Cincinnati Bengals.

If you had to guess, what do you think these Super Bowl NFTs will be worth by this time next year?

Neil says:

Well, it doesn’t get more mainstream than the Super Bowl. I’m going to assume it will be worth more this time next year – maybe several thousand dollars each. Let’s say $3,000 each.

Em says:

I like tokenization and NFTs. Do I like Super Bowl or sports NFTs? Personally, no. Do I think, despite my salty opinions on sports, they may have value in the future… um, no. Ok, so I’m not unbiased but only time will tell.

Bottom line:

Neil thinks this is a thing; Em disagrees.

Who’s side are you on?

Bad idea of the week: Don’t drug your father

We cover unfortunate stories in the “bad idea” section, but this one is particularly horrendous. Imagine this scenario: a 24 year-old offers a cup of tea to his father. Heartwarming, right?

In this case, no. Liam Ghershony told his father he was adding an “energy boost” in the form of a white powder to the tea – but it was benzodiazepine that he added. Benzodiazepine is a form of depressant, and Ghershony purposely added it to the tea to knock him out. Why?

Well, naturally, he wanted to steal his father’s cryptocurrency. He moved $400,000 from his father’s account into an account he could control. He claims now that he did not realize the amount of benzodiazepine he had added to the tea was lethal. He claims he believed his father would wake up. He was also struggling with drug abuse at the time.

Officers eventually found Ghershony’s father on the floor, where he was unresponsive. The father spent four days recovering at the hospital. Liam Ghershony was originally charged with attempted murder, but pled guilty to felony assault. Thanks to his parents’ wishes, Liam only spent 125 days in jail and also underwent two months of residential drug and mental health treatment.

There’s nothing much to say here: don’t drug your dad and try to steal his cryptocurrency.

Neil says:

Wow. Yeah, this story is pretty astonishing… I understand we are changing the way we think about drug addiction, but the fact that he didn’t go to jail for a long time is kind of crazy to me. Just a depressing situation, all around.

Em says:

Yikes!!! People will get up to some crazy hijinks and this is definitely an example of that. I can’t imagine a scenario where that would be worth it, even if you succeeded. Everyone please protect your keys and get a poison taster.

What do you think?

Meme of the week

As always, Em brings you this beloved meme of the week:

And that’s our cryptocurrency weekly wrap-up!

Who are you rooting for in the Super Bowl, or are you more looking forward to Valentine’s Day? Do you feel like the markets are finally rebounding out of crypto winter now that Bitcoin is back over $40K?

Make sure to tweet us your thoughts/opinions/perspectives at @decentralpub with the hashtag #weeklycryptonews on Twitter.

In episode ten of the Uncensored Crypto docuseries, Michael Hearne sits down with crypto experts to discuss how beginners can get started in cryptocurrency and tell which projects are worth investing in.

In episode ten of the Uncensored Crypto docuseries, Michael Hearne sits down with crypto experts to discuss how beginners can get started in cryptocurrency and tell which projects are worth investing in. “So I think community is very important because no matter how great the project is, no matter what real world problem it solves, and I think that’s another thing you have to look at, what’s the real world problem that this solves? What’s the market for it? But no matter how big that is, if they don’t have interest in the actual token or the coin from people within the community that are going to be buying it, then it doesn’t matter. It’s going to go nowhere. It’s going to sit at a stalemate and not move. And if you’re doing it for investment purposes, then you really want, again, you want that particular coin to move.” – Cecil Robles

“So I think community is very important because no matter how great the project is, no matter what real world problem it solves, and I think that’s another thing you have to look at, what’s the real world problem that this solves? What’s the market for it? But no matter how big that is, if they don’t have interest in the actual token or the coin from people within the community that are going to be buying it, then it doesn’t matter. It’s going to go nowhere. It’s going to sit at a stalemate and not move. And if you’re doing it for investment purposes, then you really want, again, you want that particular coin to move.” – Cecil Robles It’s safe to say that 2021 was a big year for

It’s safe to say that 2021 was a big year for  In 2021, crypto investments

In 2021, crypto investments  When I started

When I started  2021 was an overall great year for crypto. But by the end of the year,

2021 was an overall great year for crypto. But by the end of the year,  As far as my

As far as my

“Anything that’s not Bitcoin, in my opinion, is pretty much a s*itcoin. Now, can you make money on that? Absolutely […] and I think they’ll be around forever, but they aren’t good stores of value.” – Josh Malinkovich, student and CTO of Bitcombine

“Anything that’s not Bitcoin, in my opinion, is pretty much a s*itcoin. Now, can you make money on that? Absolutely […] and I think they’ll be around forever, but they aren’t good stores of value.” – Josh Malinkovich, student and CTO of Bitcombine “I think if we want to take back our human sovereignty, we have to first take back our attention and we have to first take back our data and our usage on the internet. And I think the first way to do that is to really introduce the idea that Bitcoin allows for financial sovereignty, Lightning allows for database sovereignty within a social network.” – Justin Rezvani

“I think if we want to take back our human sovereignty, we have to first take back our attention and we have to first take back our data and our usage on the internet. And I think the first way to do that is to really introduce the idea that Bitcoin allows for financial sovereignty, Lightning allows for database sovereignty within a social network.” – Justin Rezvani  “In the US, we generate four terawatt-hours of electricity. We lose 200 to 300 gigawatts of electricity per hour just through friction in the transmission lines. All of the Bitcoin miners in the US use less than 200 gigawatts of electricity. So we’re just using energy that otherwise would be wasted. Over time, Bitcoin mining becomes more and more energy efficient.” – Fred Thiel

“In the US, we generate four terawatt-hours of electricity. We lose 200 to 300 gigawatts of electricity per hour just through friction in the transmission lines. All of the Bitcoin miners in the US use less than 200 gigawatts of electricity. So we’re just using energy that otherwise would be wasted. Over time, Bitcoin mining becomes more and more energy efficient.” – Fred Thiel One key takeaway from the docuseries is about Bitcoin’s future. Some in the cryptocurrency space view Bitcoin as outdated, especially considering that there are blockchain platforms out there that offer faster transaction times, better scalability, and lower fees.

One key takeaway from the docuseries is about Bitcoin’s future. Some in the cryptocurrency space view Bitcoin as outdated, especially considering that there are blockchain platforms out there that offer faster transaction times, better scalability, and lower fees.

Robinhood started rolling out crypto wallets, and there are reportedly over

Robinhood started rolling out crypto wallets, and there are reportedly over

“Crypto mining has a dirty reputation in terms of its utilization of energy, and one of the things that I really enjoy about what we do is we help people take that power that goes into these crypto mines and find alternative applications for the heat […] For me, those are the types of applications that are exciting. We have people heating their homes, heating their pools. We have customers up in Scandinavia that are heating the sidewalks of their towns in an effort to prevent the use of salt and carbon in order to clear that snow.” – Gary Testa

“Crypto mining has a dirty reputation in terms of its utilization of energy, and one of the things that I really enjoy about what we do is we help people take that power that goes into these crypto mines and find alternative applications for the heat […] For me, those are the types of applications that are exciting. We have people heating their homes, heating their pools. We have customers up in Scandinavia that are heating the sidewalks of their towns in an effort to prevent the use of salt and carbon in order to clear that snow.” – Gary Testa “If you think about Bitcoin as like an energy battery where you translate electrical energy into financial energy, and then you can transact that across time and space, that is going to lead to a whole bunch of innovations that are actually going to accelerate the transition to renewable energy-based infrastructure.” – Alex Brammar

“If you think about Bitcoin as like an energy battery where you translate electrical energy into financial energy, and then you can transact that across time and space, that is going to lead to a whole bunch of innovations that are actually going to accelerate the transition to renewable energy-based infrastructure.” – Alex Brammar

“But the bottom line is the entire legal structure for how to regulate these things needs to be redesigned. And it’s not crazy. This happened with the internet in the mid 1990s.” -Ryan Sean Adams, Founder, Mythos Capital

“But the bottom line is the entire legal structure for how to regulate these things needs to be redesigned. And it’s not crazy. This happened with the internet in the mid 1990s.” -Ryan Sean Adams, Founder, Mythos Capital “They’ve often been very self-regulating entities. They abide by their own interpretations of what is ethical and what is not. It has its limitations, but to suggest that it’s just an anarchistic free for all in the blockchain space, it’s not.” -Jeremy Gardner, Founder of Augur and Blockchain Education Network

“They’ve often been very self-regulating entities. They abide by their own interpretations of what is ethical and what is not. It has its limitations, but to suggest that it’s just an anarchistic free for all in the blockchain space, it’s not.” -Jeremy Gardner, Founder of Augur and Blockchain Education Network U.S. banks are bringing in

U.S. banks are bringing in  Brock Pierce is a well-known

Brock Pierce is a well-known