Many decentralization advocates roll their eyes at stablecoins because they’re the worst of both worlds: their value is artificially controlled like fiat but they’re not guaranteed by anything real (though you could argue the government guarantee on fiat isn’t that real). Stablecoins do have a place in the market, however, which you can read more about here.

But even if there’s a current use for stablecoins, are they ideal to push the space forward and will they do so in the future?

To answer these questions, there are several considerations. There’s the question about how regulation affects their usefulness. Another question is whether they’re undermining the entire purpose of crypto, which was to make a complete break from fiat. Plus, the existence of stablecoins could be hindering adoption. Here’s why stablecoins are so status quo, ughhhh.

Mitigating risk

Stablecoins are meant to mitigate risk by reducing volatility. When investors have watched Bitcoin’s price drop 20% in two weeks, they tend to get scared. Stablecoins hover around the price of the dollar, so they’re…safer?

That’s one way of looking at it.

But I like to say that they’re more like bonds: something your grandfather got for you 40 years ago that are now worth three whole dollars more than they were then. Plus you got to loan the government money while it inflated fiat by way more than the bond appreciated—what a deal! Let’s face it, there’s mitigating risk and then there’s decimating it.

After all, isn’t crypto a space that’s meant to be high-risk? The goal of cryptocurrency was always to challenge the status quo, combat regulation, diffuse power, push development, force growth, and encourage exploration. Stablecoins are like the kid who always screams, “Mercy!” every time the wrestling match gets interesting. What a buzzkill.

Comfort zone

In barely more than a decade, crypto has not only managed to throw a wrench in governments, institutions, and investors at every level, it’s also the tip of the spear for technology in gaming, data architecture, security, and social applications like the metaverse.

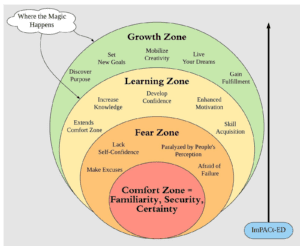

Creating world-changing waves at the same magnitude as the internet and smartphones is not by accident. In order to drive innovation like that, it’s necessary to exit the comfort zone. This means breaking away from familiarity, security, and certainty. Granted, stablecoins do diverge from the comfort zone of fiat by being a cryptocurrency, but they only make it to the fear zone.

Creating world-changing waves at the same magnitude as the internet and smartphones is not by accident. In order to drive innovation like that, it’s necessary to exit the comfort zone. This means breaking away from familiarity, security, and certainty. Granted, stablecoins do diverge from the comfort zone of fiat by being a cryptocurrency, but they only make it to the fear zone.

Tether, for example, the most popular stablecoin, is lauded by crypto lobbyists because it has the potential to comply with regulation more easily than other cryptocurrencies. It’s also more understandable and attractive to reluctant investors who don’t want to take the time to appreciate why crypto is so volatile and why that’s not wholly a bad thing. But the problem with Tether and other stablecoins is that they’re making an excuse for fiat by just taking the central bank model and moving it to blockchain. If stablecoins argue that they’re drawing investors from the fear zone into crypto because they’re more like known assets (fiat), then what happens to the fear of those same investors when Tether loses its peg and the price drops? Something tells me no one is leaping into the learning and growth zones.

Regulation

Another problem that stablecoins face is regulation. Because they operate essentially like a central bank, expanding and contracting supply to manipulate the price and holding a central reserve, they’re an easier target for regulation. One of the reasons Bitcoin can’t be regulated is because it’s completely decentralized and no one’s efforts are being profited from.

Making a digital currency that operates the same way central banks operate with fiat draws the attention of regulators. And if the SEC manages to require KYC-AML for all stablecoin holders, like it seems to want to do, a lot of the cryptosphere would be disrupted. Currently, centralized exchanges require KYC, but once you’ve got some stablecoins out in the wilderlands of DeFi, you’re home free. If that were to change, many people think the innovation DeFi is trying to bring to the financial sector would come screeching to a halt—likely just as the government hopes.

Stablecoins also get in the way of CBDCs, which would be a great triumph for centralized powers. Of course, all of the proposed regulations are in the name of protecting consumers. But any number of financial scandals and the history of our trust in banks should raise some eyebrows.

Stalemate

Stability and innovation have always had somewhat of an inverse relationship. People have understood this since forever, just listen to them talk about balancing the risk in their traditional investment portfolios. Simply in terms of investing, it’s probably wise to have both risk and stability. But at this point in the crypto game, it’s not just about investing. It’s about technology and how people relate to controlling powers that they have, until now, been unable to escape.

If you’re a traditional investor who just wants a different kind of asset class but you embrace the status quo, stablecoins might actually mitigate some risk for you. Even if you’re a DeFi enthusiast who needs them to make your eye-popping APY returns, Tether can be quite useful. But don’t misunderstand what stability is for: it’s for security and maintaining the status quo. It’s not for revolutionizing old systems and dreaming up newer, better ones.

Smoothing adoption

As crypto continues to evolve and grow, more people adopt it, and legacy interests are forced to catch up, we can see that there’s a sticky point in the transition between the current stalemate and the future. Early adopters embrace risk. They blaze trails and create new paths. They also lose big, when they lose. Attracting the majority of the herd who tend to have a higher risk aversion than innovators requires some sense of stability. That’s a sticky point for any new idea to gain mass adoption.

Stablecoins wish to lubricate that sticky point. But are they actually the answer to opening people’s minds? Or are they one more scale on the eyes of people who don’t want the world to change? Do we actually need stablecoins to mitigate risk in the future if we reduce or eliminate other risks like inflation and savings depletion caused by fiat? The only reason the majority are content with the risks imposed by holding government-backed fiat is because they’ve had no choice. Reframing people’s understanding of the actual risks to their wealth would, in a sane world, steer them away from anything even remotely resembling fiat currency.

User experience

When people fail to adopt crypto because they’re afraid of volatility and they don’t understand how to even use it, stablecoins may actually be a counterproductive solution. There are often two reasons people have not started using crypto:

1) it’s too risky

2) it’s too complicated to navigate

Stablecoins definitely don’t help with the second reason. Changing fiat into crypto by moving between stablecoins and the coins you want to hodl or trade can be a headache so large it completely stops a person from getting into the ecosystem.

For all my beefs with Apple and its proprietary everything (yes, I’m an Android kid), I have to hand it to them when it comes to the ease of use and integration. I can’t say the same thing for stablecoins. They are not helping crypto adoption in the user experience realm. They make using crypto more complicated, not less. Simplicity and understandability are important in gaining adoption of new ideas. Stablecoins don’t reduce complexity for users, they increase it. And that’s not innovative.

The future for stablecoins

There are a couple of paths forward that I see for stablecoins. One is that they simply slide into obsolescence because new solutions are created for the problems that they’re now solving. The other is that regulators squeeze the life out of them (as perhaps they should) and the rest of the crypto world keeps moving like Roadrunner zooming ahead of Wile E. Coyote.

There may be other options. Perhaps there’s a world where stablecoins continue to have a place in crypto, though anyone would be hard-pressed to convince me that place will be very valuable.

But, whether they’re replaced by truly decentralized, algorithmic stablecoins or some other new tool remains to be seen. For now, my view of stablecoins is that they’re a mill around the neck of crypto innovation. You can’t sail to new horizons by tying yourself to the dock.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.