If you’re into collectibles and are curious about what it takes to buy, sell, or even earn an NFT, but aren’t sure where to get started, you’ve landed on the right spot.

NFTs are becoming more popular every day; you’ve probably noticed quite a few articles on NFT millionaires and even the first NFT billionaires being made. NFT prices (and NFT rarity) depend on who wants it and how much they’re willing to pay for it or sell it for. So, the ranges of availability and pricing vary quite a bit.

As mentioned, NFTs can be redeemed for other things – including real estate. Those tokens (non-fungible tokens) can be used for democratizing the purchase of high-value items, precious metals, and even to secure personal data.

Let’s learn a little bit more about NFTs, shall we?

NFT terms to know

In case you’re unfamiliar with the term itself, NFT is short for “non-fungible token”. I get it. That’s a mouthful of words you may have never said before out loud; so, you can imagine why the media really latched onto just calling ‘em “NFTs”…!

NFTs are basically a digital token that you can use to redeem for all sorts of things – including digital art. You can display the NFT art on your computer, your phone, or even your TV screenshot!

NFTs are basically a digital token that you can use to redeem for all sorts of things – including digital art. You can display the NFT art on your computer, your phone, or even your TV screenshot!

Here are some other NFT terms to know:

10k project (aka “PFP project”, “profile picture”) – 10k is a term used to describe a collection of NFTs that contain around 10,000 avatars. It’s not an exact number, but the term 10k will be something you see frequently to describe the type of project. If you’re specifically interested eventually in learning more about how to create a 10k NFT avatar collection, there’s a great step-by-step guide on Medium.

Airdrop – this is when an NFT is “dropped” into users wallets for free. It’s also a term you may read in the cryptocurrency space, too. This is a common marketing strategy that is often used to build awareness of a new maker, exchange, or currency.

Burn – if a team decides to burn an NFT – or a collection of NFTs – it basically means it will be destroyed. This can happen when a collection maker wants to make the collection more rare. For example, if only 5,000 of a 10,000 collection sold, the maker may let the owners burn two in order to receive a newer, rarer NFT.

DAO (aka “decentralized autonomous organization”) – DAOs have been in the news recently – from trying to buy a sports team or a copy of the U.S. Constitution. DAOs are essentially groups that organize for the purpose of working together in a community to collectively own and manage something.

Declining-price listing – If you have a range you’d be willing to accept, you can list it for auction that goes to the highest bidder. Alternately, the declining-price listing is an interesting option. With a declining-price listing, you will initially list your NFT for your top asking price, but the price will go down over a period of time that you select.

Fixed-price listing – If you have one price in mind you want to sell your NFT for, most marketplaces have an option to select “fixed-price listing” and the duration of the sale.

Minting – this is the term used to describe the process for how a digital file is turned into non-fungible tokens that can be purchased using digital currencies. Basically, “minting an NFT” is how your art gets stored into the blockchain where it will be stored in the public ledger; once it’s stored, it’s unchangeable and tamper-proof. As the maker, you are the only person who can “burn” an NFT, which is the only way to destroy and remove it from the blockchain.

Rugpull – ever hear the term “pull the rug out from under them?”… well, that’s a rug pull. A rug pull is a term used to describe when a scammer quickly cashes out after launching a project, which then devalues it instantly. It usually happens immediately after the scammers have driven up the price quickly and as high as they can before they “pull the rug out from under” unsuspecting NFT owners. (note to self: don’t invest in a project if it seems like it could be a “rug pull”!)

Sweeping (aka “floor sweep” or “sweep the floor”) – this essentially is equivalent to a “stock buy-back” where the project buys back all of its NFTs at the current floor (minimum) price. It’s used to “democratize the broom”, which is another way of saying it makes the process of buybacks accessible to everyone in the project.

Whale – probably not the most flattering term unless you are into marine biology, the term “whale” when it comes to NFTs or cryptocurrency investing is used to describe an investor with the buying power to make a purchase (or sale) that is so steep it could move the market.

How did NFTs get so popular?

NFTs as digital art have been popular for a few years now, ever since the first NFT was minted in 2018.

They seem to have exponentially grown in popularity over the past 12 months, though. An estimated 28.6 million wallets traded NFTs in 2021, totaling more than $41 billion in value. The market value of NFTs in 2021 nearly reached the $50 billion market value of conventional art and antiques.

From an investor perspective, there’s an allure to the rarity of an NFT. There are benefits to enhanced transparency and traceability, as well. NFTs allow art collectors to own pieces of art that cannot be duplicated, cloned, or copied. They’re also proving to have the potential to appreciate in value. While most go for well under $1,000 each, there have been a few in recent months that have sold for over $50,000.

Outside of investors, though, NFTs appeal to a broad audience – from gamers and collectors to businesses and brands. NFTs are being used in all different types of games, digital worlds, online games, advertising, and e-commerce. NFTs can help improve user experiences, help brands build communities with their fans, and help creators and collectors earn income.

Where do people buy NFTs?

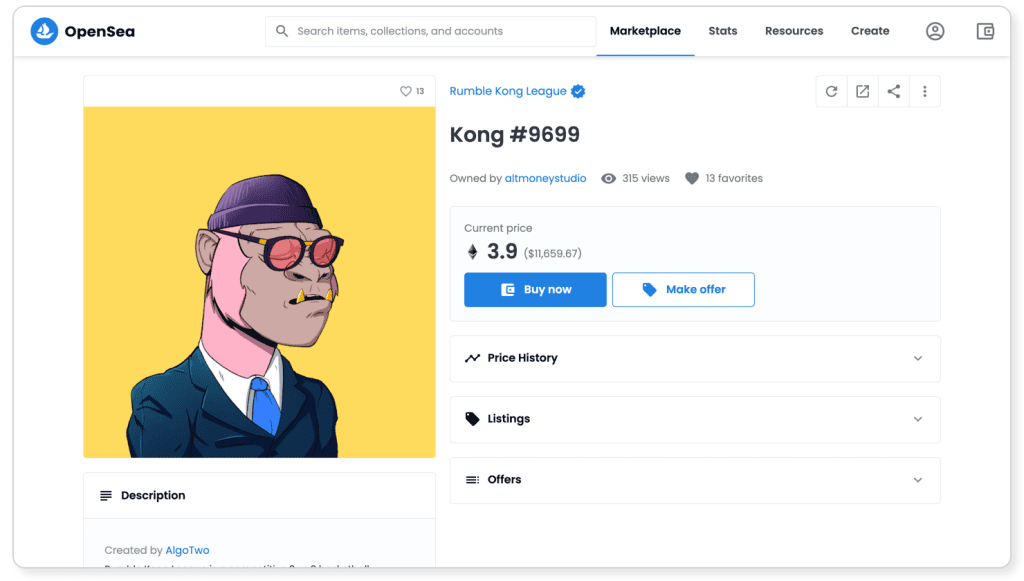

Nft enthusiasts typically buy NFT art on marketplaces like OpenSea and Rarebits. The NFTs community is growing as digital art is becoming more well-known. NFT tokens are also bought on cryptocurrency exchanges like Binance and EtherDelta.

Is it easy to create and sell NFTs?

That’s a tricky question. It can be easy to create NFTs if you have some experience with digital art software programs. If not, it will take a little time to learn a tool that you can use to create NFTs. Selling doesn’t require creative skills if you’re selling one you already own. However, it can take a few hours to go through the process of setting up a wallet, a marketplace account, and then acquiring (or creating) an NFT to sell.

Here’s a guide you can use to learn how to create and sell NFTs when you’re ready to get started.

What are other ways to get NFTs?

Buying and creating the most popular way to get NFTs, but they aren’t the only ways. You can:

- Trade NFTs. NFTs can be traded with other NFT holders between your account and theirs for ETH, ERC-20 tokens, or NFTs

- Receive NFTs as a gift. An individual can send an NFT to you as a gift through their wallet

- Receive NFTs as an airdrop. Companies also give NFTs to their community – called “airdrops” – as a promotion or for contesting and rewards. Some local governments and municipalities like the City of Miami are exploring the concept of “airdrops” to their residents.

- Play-to-earn NFTs. If you are a gamer, you can also earn NFTs through play-to-earn games like Axie Infinity. Play to earn games have actions and side missions for players to take while playing the games in order to earn NFTs.

How popular will digital art like NFTs be in the future?

NFT art has experienced a rapid rise in popularity, which critics say could signal they are a fad.

Even celebrities like Keanu Reeves have expressed concern, hinting that NFTs are taking away the enjoyment of art, “which should be appreciated.” Though NFTs have been around for several years now, the concept of NFT digital art is still considered very new and adoption by the late majority has not yet happened. So, it’s normal for there to be some skepticism.

However, the NFT market surpassed $40 billion in 2021 alone, and the use cases for non-fungible tokens span far beyond just digital art.

It’s hard to predict how popular NFTs as digital art will be in the future, but it seems certain that the concept of assigning a unique digital asset with a signature to prove its authenticity and ownership. Consider this:

- Auction houses like Sotheby’s and Christie’s are now selling digital art collections for tens of millions of dollars;

- Athletes and celebrities are starting NFT companies or licensing their likeness to sell digital collectibles; and

- Multiple industries from real estate to finance and finding usages for them.

So, it seems more likely than not that NFTs – in some form or another – are going to have a bigger impact on society and spawn more technological advancements that we can possibly realize in the near future.

About the Author

Julie C

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.