Welcome to the March 4th, 2022, edition of the Decentral Weekly Crypto News Wrap-Up, where Neil and Em tackle the always-relevant question: “Is this a thing?”

This week’s crypto news wrap-up includes Ukraine raising millions of dollars in cryptocurrency, NYC’s NFT vending machine, some closure to the infamous Bitconnect scandal, and more.

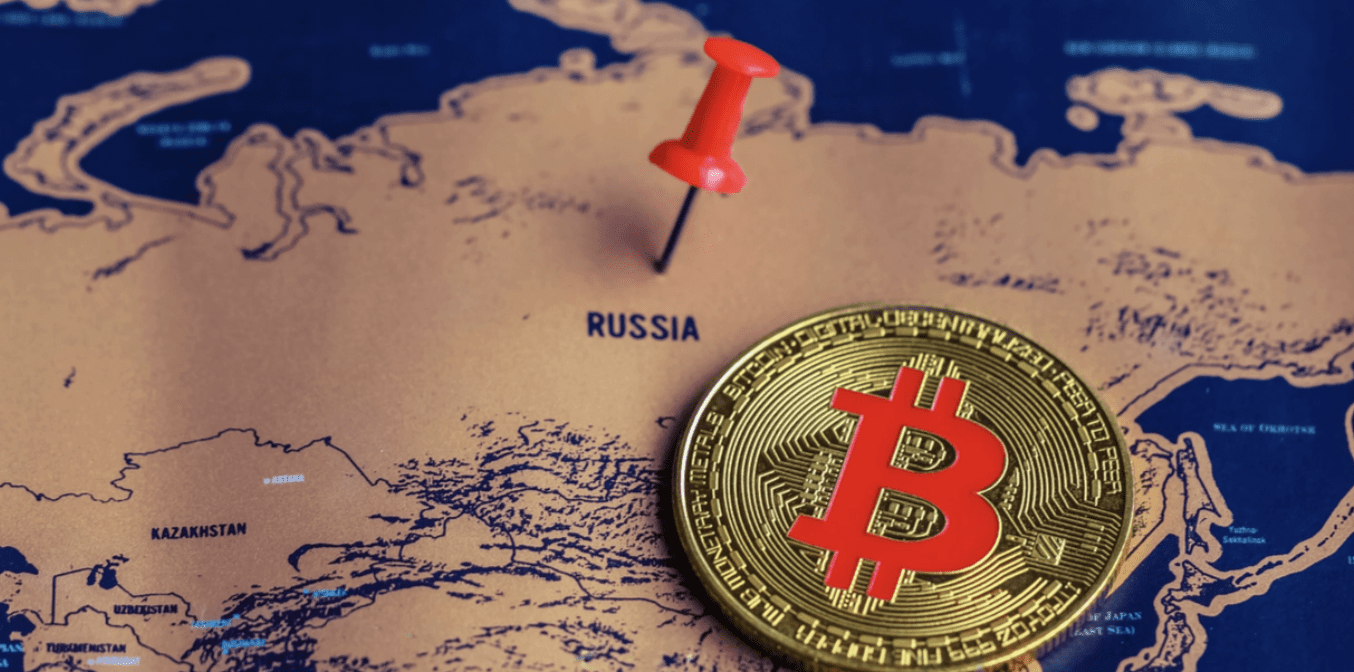

Ukraine raises over $50 million in cryptocurrency

The world’s news headlines are dominated by Russia’s invasion of Ukraine, but cryptocurrency has emerged as a relevant talking point. The country has managed to raise over $50 million in cryptocurrency and has even kept wallet addresses in a pinned tweet on their official Twitter account. There’s more: UkraineDAO has also raised millions of dollars in support of the Ukrainian army.

The situation is also a bit interesting given the fact that Ukraine now wants to weaponize cryptocurrency by also asking crypto exchanges to block Russian users. Several exchanges have chosen to refuse.

What are your thoughts on how crypto is playing a role in the Russia-Ukraine conflict?

Neil says:

I think crypto is really proving its power when it comes to raising money for Ukraine, and I also think it was smart for crypto exchanges to refuse to block Russian users. Times like now prove that cryptocurrency is useful. Overall, I think a lot of cryptocurrency critics should recognize how it’s helping Ukraine here.

Em says:

In a war, everyone will use every tool they have. At the end of the day, crypto is just a tool. Whoever uses it best will win. It’s also true that this economic, social, technological, and international upheaval we’re experiencing is what crypto was created for. Hold on, everyone.

Bottom line:

Neil thinks it’s a “crypto proving its power” thing, Em thinks it’s a “crypto is a tool” thing.

Who do you agree with?

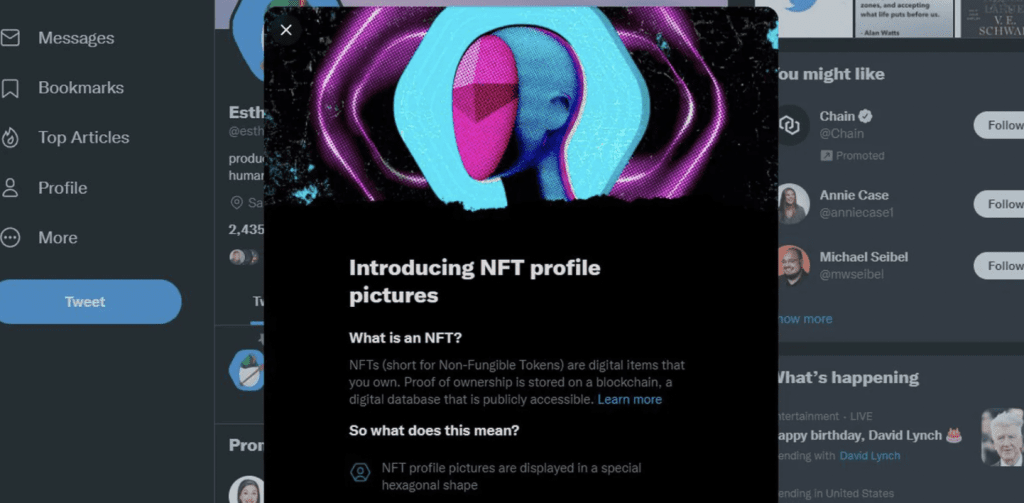

The world’s first NFT vending machine is here

The world is still crazy about NFTs, but it looks like it might get a bit easier to buy them if you live in the Big Apple. The world’s first NFT vending machine has arrived in Manhattan’s Financial District. The machine is open for 24 hours a day and allows customers to purchase Solana-based NFTs.

Neon, a Solana-based NFT marketplace, is behind the machine, and the CEO claims he’s trying to help people understand they don’t need cryptocurrency to buy NFTs. The machine accepts both debit cards and credit cards.

NFT vending machines: Is this something that will catch on, or is this really just about novelty?

Neil says:

I’m not really a fan of this one. I don’t think it’ll catch on, and I think the entire concept is a bit ridiculous. In the Guardian story where a reporter actually visits the machine, multiple things go wrong. This is just one of those ideas that isn’t really going to pan out right now.

Em says:

Maybe this idea is kind of silly and counter to the most philosophical and “pure” uses of crypto — according to the enthusiasts. But also… we know giant-claw-plushie-toy vending machines are also a complete scam, but we like them anyway. Maybe there’s a place for NFT vending machines at Dave & Buster’s! 😛

Bottom line:

Neil thinks this isn’t a thing, Em thinks it could be a thing.

Who do you agree with?

Bitconnect founder finally charged

If you’ve followed cryptocurrency for several years, you probably know Bitconnect was one of the biggest crypto scandals in recent history. The saga is finally coming to a close, with Bitconnect’s founder, Satish Khumbani, indicted by a federal grand jury for the $2.6 billion crypto scheme. He was charged in San Diego, but reportedly still remains at large.

Bitconnect operated as a Ponzi scheme, where money from newer investors was used to pay back earlier investors. This was marketed through a “lending program” that didn’t exist. Bitconnect went defunct in 2018.

Any thoughts on the Bitconnect scandal finally coming to a final conclusion? Do you think they will find Kumbhani soon, or not?

Neil says:

This whole fiasco was a huge deal in 2017 and 2018, and it’s a bit insane it took this long for Kumbhani to be charged. It’s even crazier that he has now apparently disappeared. Something tells me they might find him eventually, but it’s all a bit embarrassing.

Em says:

This dude kinda had is coming, and if he gets nailed, he gets nailed. Maybe it’s bad publicity for crypto, but at the same time, this kind of stuff happens in every new market. It happens in every old and established market too, tbh; it’s just hidden better by the big, influential players. *cough* the fed *cough*

Bottom line:

Neil thinks this is a bad thing, Em thinks it’s a “scammers are in every market” thing.

What do you think?

Bank of America denies “crypto winter”

Many people suggested that the cryptocurrency sector has fallen victim to a “crypto winter,” likely referring to the fact that both Bitcoin and Ethereum have fallen significantly from their all-time highs. Bank of America recently released a note suggesting that the idea of a “crypto winter” is exaggerated.

The note stated that user adoption and developmental growth means that “crypto winter” isn’t likely. The note was titled “”Digital Assets: In The Flow.” However, it also acknowledged that crypto upside would likely be limited thanks to “Federal Reserve and macroeconomic headwinds.”

What do you think of Bank of America’s note and/or their agenda behind the note?

Neil says:

Bank of America has been releasing some pro-crypto reports, but it is still a bit strange to see one of America’s biggest banks declaring that a “crypto winter” might not exist. Is Bank of America trying to embrace crypto more than the competition strategically, or is this just one random note? I’m not sure, but I wouldn’t take this too seriously.

Em says:

This does seem, on the surface, like it’s counter to BofA’s interests as a legacy finance institution. I can only conclude that it’s a PR play of some kind, or they’re actually resigned to the idea that crypto isn’t going away. Either way, I think it’s positive narrative hype for the crypto market in the short term, and I can’t complain about that.

Bottom line:

Neil doesn’t think this is a thing, Em thinks it’s a narrative thing regardless.

Who’s side are you on?

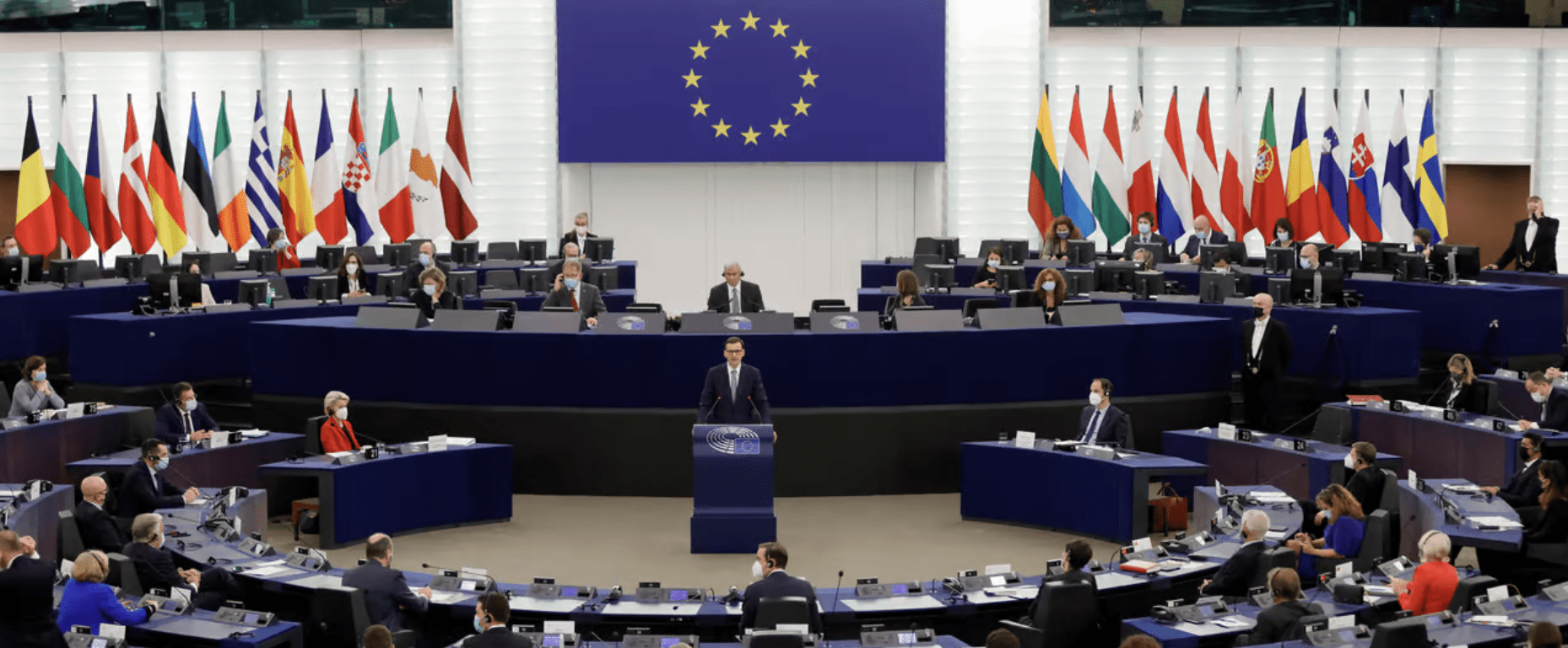

EU postpones crypto regulations vote

The European Parliament was expected to vote on crypto regulations on February 28, but that didn’t happen. Instead, the vote was canceled. Stefan Berger, the “rapporteur” (parliament member in charge), clarified that he didn’t want the framework to be misinterpreted. The vote has been postponed indefinitely.

What’s the reason for the sudden change? It might be that the draft included a provision hinting that lawmakers were hoping to ban proof-of-work cryptocurrencies starting January 2025. Both Bitcoin and Ethereum, the two largest cryptocurrencies in the world, rely on proof-of-work.

Is this postponement a good thing, or a bad thing? Any additional thoughts on cryptocurrency regulation in general?

Neil says:

Yeah, I have no idea why they even thought this would be feasible. I do think that there should be more concrete steps towards regulation, and it’s a bit surreal to see delay after delay. In this case, however, a postponement was a good thing.

Em says:

Listen. Regulators still don’t understand crypto. They have a long way to go before they do, so I’m glad this got the brakes before it was voted on. Governments are still trying to figure out what to do with crypto and how it can be regulated, but my view is that the longer they’re on the fence, the better for crypto.

Bottom line:

Both Neil and Em agree that the postponement was a good thing.

We have a consensus! Do you agree?

Bad idea of the week: BuyTheBroncos, hold your horses

Our crypto news wrap-up always ends with a bad idea, but this particular idea is more unrealistic than “bad.” I’m referring to the fact that there is now a DAO – the BuyTheBroncos DAO – that wants to buy the Denver Broncos.

Many have pointed out that DAOs can revolutionize crowdfunding. There’s a lot of potential here, but it’s not the time to try to raise billions of dollars to buy a sports team. There’s also no way the Denver Broncos would even allow themselves to be “governed” by a DAO.

Look – DAOs can raise millions of dollars. Just last week, we discussed Julian Assange raising millions of dollars thanks to his DAO. There’s also a massive difference between raising millions of dollars and raising BILLIONS of dollars.

What are your thoughts on BuyTheBroncos?

Neil says:

BuyTheBroncos wants to raise $4 billion, and there’s just no way I see this happening. At this point, there’s no real reason for this to happen. There’s a lot of well-deserved interest in DAOs, but this particular goal is not the move. How would a DAO govern a sports team? What about NFL ownership laws? It’s not realistic.

Em says:

It’s definitely ambitious, I’ll give them that. Buying the Broncos is a moonshot if I ever saw one. But at the same time, I’ve also written about how buying a sports team could play out in concept for DAOs. Even if they’re a bit premature to the game, it may be possible in the future. If it ever does happen, just know I told you so. 😀

Bottom line:

Neil thinks it’s an impossible thing, Em thinks it’s a possible thing.

What do you think?

Meme of the week

As always, Em brings you the meme of the week:

And that’s our crypto news wrap-up!

Would you ever buy an NFT from a vending machine? The Bitconnect founder might be charged, but when will he be found? How much will crypto play a role in the Russia/Ukraine conflict?

Make sure to tweet us your thoughts/opinions/perspectives at @decentralpub with the hashtag #weeklycryptonews on Twitter.

Robinhood started rolling out crypto wallets, and there are reportedly over

Robinhood started rolling out crypto wallets, and there are reportedly over

In October, Frances Haugen left her job as product manager at Facebook and became a whistleblower, exposing how the tech giant prioritizes profit over its users’ wellbeing.

In October, Frances Haugen left her job as product manager at Facebook and became a whistleblower, exposing how the tech giant prioritizes profit over its users’ wellbeing.  Up until China banned

Up until China banned