Welcome to the April 8th edition of the Decentral Weekly Crypto News Wrap-Up, where Neil and Em keep asking the same question every week: “Is this a thing?”

What can you expect from this week’s crypto news-wrap up? There’s a promising new Gemini survey regarding crypto ownership, an update on the Axie Infinity hackers, the Bored Ape Yacht Club Discord hack, OpenSea offering more purchasing options, and more.

Almost 50% of cryptocurrency owners in 2021 are newcomers

Let’s start the crypto news-wrap up with some promising news for the crypto industry: it looks like there are more new investors and traders than ever before. Specifically, a survey has concluded that almost half of crypto owners in 2021 were people who bought digital assets for the first time. The survey comes from cryptocurrency exchange Gemini.

The survey spanned around 30,000 people across 20 countries, and it was conducted between November 2021 and February 2022. Interestingly enough, Gemini found that both Brazil and Indonesia lead the world in crypto adoption.

Does this surprise you, and do you think this kind of adoption momentum will continue this year?

Neil says:

Yeah, I think this is pretty incredible news. You might see a lot of hate for cryptocurrency on social media, but surveys like this help put things in perspective. It’s also interesting to see countries in so many different parts of the world embracing it, as well. I do think this kind of adoption will continue, especially with other “gateways” to crypto now (like DeFi and NFTs).

Em says:

Yep, last year was a crypto year as far as buzz for normies. Hell, I’ll admit I finally pulled the trigger last year even though I was one of the ones who’d been meaning to since 2010. Ha! People thought they were late in 2015, and again in 2018, and again in 2021. I think you’re still not late if you’ve waited until now. Go for it.

Bottom line:

Neil thinks it’s a positive thing, Em thinks it’s a “you’re still early” thing.

Who do you agree with?

Axie Infinity hackers begins unloading crypto

We’ve written about the rise of play-to-earn gaming before, and Axie Infinity remains one of the most popular games in the space. In late March, hackers were able to steal over $600 million in cryptocurrencies from the game. The cybercriminals infiltrated Ronin, the underlying blockchain that fuels the game.

The hackers are now working to unload the crypto loot, using crypto mixers to evade law enforcement. The Sky Mavis COO has stated publicly that the company will reimburse all players affected by the hack.

How bad is this, and do you think that this will have an effect on Axie Infinity’s future? Any other thoughts on what happened here?

Neil says:

Axie Infinity has millions of users, so I’m not going to say this is fatal. However, this definitely does make people question the incentives of play-to-earn gaming, if hacks like this can happen. At the end of the day, it’s one of the biggest DeFi hacks in history. The fact that they’re reimbursing everyone is great, but… what if this happens again?

Em says:

They’ll survive but, ooof. Hacks like these are rough. That’s kind of the nature of the space still where the only way to truly test security is to get hacked. It does sting for users who lost money, but hopefully it will make the protocol stronger in the end. As new tech gets developed and stress tested, this will always happen.

Bottom line:

Neil thinks this is a bad thing, Em thinks it’s a “new tech” thing.

Who do you agree with?

Ledger partners with The Sandbox

We know the metaverse is coming, which raises new questions about how people will interact with virtual worlds. Ledger, a cryptocurrency hardware wallet provider, is teaming up with The Sandbox to offer crypto education in the metaverse. While the partnership was announced at the Non-Fungible Conference in Lisbon, more details will be released shortly.

Ian Rogers, the Chief Experience Officer at Ledger, pointed out there will be an emphasis on security. “Self custody really gives you personal freedom, but it’s also a responsibility,” he offered. The Sandbox metaverse recently hit 2 million registered users.

What do you think about partnership? Do you have any additional thoughts on education in the metaverse?

Neil says:

The first thing that came to mind was that this was a brilliant play: Ledger can teach people about keeping their crypto safe, and those same people may end up purchasing Ledger products. It’s a great example of a win-win situation: a company makes money, but more importantly, people new to crypto learn how to keep their digital assets safe.

Em says:

Honey childddd—people need to understand security better. Most people are walking around with all their information hanging out like someone who came out of the bathroom with toilet paper flapping behind them in the wind. If Ledger is educating people about how to keep their information secure, let them make money on it.

Bottom line:

Neil thinks this is a win-win thing, Em agrees.

What do you think?

The UK is minting an official NFT

It looks like the British government wants to get in on the NFT boom. Chancellor Rishi Sunak has asked the Royal Mint to mint an NFT. The Royal Mint is the government-owned company responsible for minting coins in the UK. This is all part of a regulatory approach where the UK hopes to “lead the way” in crypto and eventually become a crypto hub.

There are currently no details regarding the object or image that will be associated with the NFT. A Treasury spokesman claims more details will “be released soon.” The NFT will reportedly be released sometime in the summer. The news was also confirmed by John Glen, the Economic Secretary to the Treasury.

What are your thoughts on this? Is this more symbolic than anything else?

Neil says:

Yeah, see this is actually pretty annoying to me. The UK has made a big deal of a looming deadline, which has led a lot of crypto firms to go elsewhere. Then they extended the deadline. Now, all of a sudden, you want to be a global cryptocurrency hub? This just reeks of a symbolic gesture more than anything else.

Em says:

Watching governments getting into crypto is one of the funniest and most entertaining things of this century. It’s like watching a grandpa trying to ride his grandkids’ hoverboard on Christmas morning and sprawling headlong into the tree — you hate to see it, but you’re gonna get some laughs, guaranteed.

Bottom line:

Neil thinks it’s an empty gesture thing, Em thinks it’s a “government and crypto” don’t mix thing.

What do you think???

OpenSea opens up purchasing options

NFT sales might not have the same momentum as several months ago, but that isn’t stopping the world’s largest NFT marketplace from making major moves. OpenSea has partnered with MoonPay to offer NFT purchases that don’t have to involve cryptocurrency.

Thanks to the partnership, users can buy NFTs with bank cards, Google Pay, and Apple Pay. The goal is to expand the reach of NFTs to anyone with a debit card, credit card, or digital wallet. Nifty, another major NFT marketplace, also recently announced a similar partnership with MoonPay.

What do you think about the announcement? Do you think NFTs will have the same kind of success in 2022 as 2021?

Neil says:

I think this is a great thing. There are lots of artists that might want to get into NFTs, or collectors that might want to start an NFT collection. If they feel a certain way about cryptocurrency, why not let them buy and sell NFTs with their bank cards? They may end up getting into cryptocurrency down the line. If not, it’s still money for OpenSea. As for NFTs in 2022, we might not repeat 2021 in terms of volume/sales – but I think it’ll be close.

Em says:

I don’t think this is a great thing because it’s integrating too closely with TradFi. I don’t think people need MORE ways to ape recklessly into the NFT trading market. I’ll always give props to the NFT scene for bringing crypto into the public conversation, but luring people into investments that cost them TradFi sacrifices plus the risk of crypto is crazy town.

Bottom line:

Neil thinks this is a great thing, Em disagrees.

Consensus!

Bad idea of the week: The BAYC Discord hack

With emerging technologies; there’s always the problem of dealing with innovative cybercriminals who find ways to manipulate and exploit those technologies. The Bored Ape Yacht Club’s Discord ticket tool was compromised, leading users to mint fake NFTs. With these fake NFTs, hackers could steal both NFTs and user information.

The Bored Ape Yacht Club is certainly a “blue chip” NFT collection with many analysts claiming it’s the most prestigious collection in the world. There should be an understanding that any hack associated with it is terrible PR for NFTs as a whole, but it looks like Yuga Labs has dropped the ball here.

One NFT from the Mutant Ape Collection was stolen. Several other Discord servers also featured the same phishing messages, suggesting the cybercriminals attacked multiple NFT-centric Discord servers. Bored Ape Yacht Club warned users not to mint any NFTs from their official Twitter account.

Any thoughts on the BAYC Discord hack?

Neil says:

Yuga Labs is valued at somewhere around $4 billion. The Bored Ape Yacht Club is pretty much the most high-profile NFT collection in the world. This is definitely the kind of thing that should never be happening, at least not with BAYC. They caught it quickly, but it’s bad PR – no way around it. Luckily, I’m sure they’ll have announcements that will make people forget about this pretty soon.

Em says:

BAYC has been getting some bad PR lately. It’s, of course, one of the most successful NFT collections ever and expanding into new things every day, so they’ll probably be fine. But better watch out if they don’t want to get themselves a bad rap.

Bottom line:

Both Neil and Em agree this is a bad look for BAYC.

Consensus again!

Meme of the week

As always, Em brings you the meme of the week:

And that’s our crypto news wrap-up!

Did you buy cryptocurrency for the first time in 2021, and what was your experience? Would you buy an NFT with a credit card if you did your proper due diligence? Do you think Axie Infinity will come back stronger than ever or is this hack a big blow to their future?

Let us know all of your thoughts/opinions/perspectives at @decentralpub with the hashtag #weeklycryptonews on Twitter. You may be featured in an upcoming newsletter!

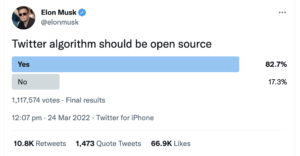

Elon recently hinted at the future of DeSo, asking his Twitter followers if they think

Elon recently hinted at the future of DeSo, asking his Twitter followers if they think

Vitalik Buterin might be 28, but he’s also arguably the most influential figure in the cryptocurrency space. For those who don’t know, Buterin is a co-founder of Ethereum.

Vitalik Buterin might be 28, but he’s also arguably the most influential figure in the cryptocurrency space. For those who don’t know, Buterin is a co-founder of Ethereum. Many companies have entered the

Many companies have entered the  Several years ago, there was one lingering question in the cryptocurrency world: when was the institutional money coming in? In 2022, we know the institutional money is here, and it looks like

Several years ago, there was one lingering question in the cryptocurrency world: when was the institutional money coming in? In 2022, we know the institutional money is here, and it looks like  We’ve previously reported about

We’ve previously reported about  There are many

There are many  If there’s one thing that the Matt Damon

If there’s one thing that the Matt Damon  And that’s our crypto news wrap-up!

And that’s our crypto news wrap-up!