In part 5 of the narratives driving crypto series, we’re talking about memecoins! If you haven’t read the rest of the series, catch the intro here. Memecoins are a pillar of the crypto ecosystem, despite the fact that many “serious” people scoff at them. And as we also know, memes are part of the ethos of internet and crypto culture. So much so that some people have made and lost millions on memecoins, yet still have the courage to hodl because they believe in the effectiveness of memes as a cultural and narrative tool.

Even before Dogecoin — the original memecoin — was created, memes were deeply embedded in how crypto was talked about online. But now we’re more than a decade in and some strong narratives driving crypto have emerged.

There are three different memecoin narratives. One is an overarching narrative, and two are industry narratives. The overarching narrative is one that everyone knows, even your uncultured coworker that’s never heard of crypto wallets or seen the OG Doge meme itself. But let me stop tantalizing you and instead just get into the three memecoin narratives and how they’ll affect crypto culture going forward.

The normie narrative

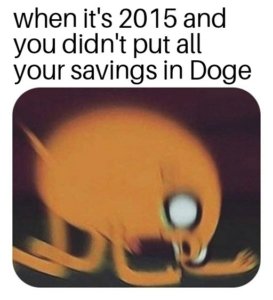

Everyone has that friend of a friend who allegedly made a bunch of money on memecoins and has no problem saying so. It’s the guy who went from nothing to stacked in a matter of months. The details of his life and how he handles his newfound investments are invisible to his friends and acquaintances in the peripherie. All we know from the outside looking in is that we all have a desire, an urge, a jealousy to be the one that makes it big and gains time and freedom through financial stability.

Everyone has that friend of a friend who allegedly made a bunch of money on memecoins and has no problem saying so. It’s the guy who went from nothing to stacked in a matter of months. The details of his life and how he handles his newfound investments are invisible to his friends and acquaintances in the peripherie. All we know from the outside looking in is that we all have a desire, an urge, a jealousy to be the one that makes it big and gains time and freedom through financial stability.

That’s the overarching narrative about memecoins. It’s the one that gives hopium to masses of retail investors who blindly ape into memecoins without fully realizing the risks, understanding why it’s a good or bad idea, or realizing that there are narratives driving crypto which influence their decision making.

The crypto market is volatile, but memecoins are the most volatile of all because they can pump and dump so easily. All it takes is a bit of clever marketing, some social influencers, and an excitingly bullish move to sweep everyone into the narrative: I, too, can be the guy that’s set for life on a few trades.

The laser eyes narrative

On the flip side of the WAGMI attitude that springs from an overarching, normie memecoin narrative, there’s the crypto enthusiast or “cooler heads” narrative that assumes a different standard of risk assessment before investing. Most people who understand what blockchain is, how crypto is valuable in a monetary sense, and what fintech can gain from crypto usually look at memecoins with a bit of side-eye. After all, it’s hard to look them straight on with lasers in your eyes.

On the flip side of the WAGMI attitude that springs from an overarching, normie memecoin narrative, there’s the crypto enthusiast or “cooler heads” narrative that assumes a different standard of risk assessment before investing. Most people who understand what blockchain is, how crypto is valuable in a monetary sense, and what fintech can gain from crypto usually look at memecoins with a bit of side-eye. After all, it’s hard to look them straight on with lasers in your eyes.

Because Dogecoin was started as a literal joke and has no utility and no supply cap, most long-term investors that try to do their due diligence can only shake their heads at memecoins. It’s not even just BTC maxis that think memecoins haven’t earned their spot in the market, even if they have in crypto culture.

The more knowledge you have about crypto, the more skeptical you tend to become about memecoins, aka: shitcoins. Developers, decentralization revolutionaries, and even those who want to see crypto taken seriously in the world all push the narrative that memecoins are junk and shouldn’t be invested in seriously — or even at all.

The trader narrative

The other industry hot take also requires some skill and education to adopt as your own. This one is not as bearish as the hodlers’ about whether memecoins are one of the profitable narratives driving crypto. It’s the trader narrative.

The other industry hot take also requires some skill and education to adopt as your own. This one is not as bearish as the hodlers’ about whether memecoins are one of the profitable narratives driving crypto. It’s the trader narrative.

So “memecoins,” or “shitcoins,” or “garbagio,” whatever you like to call them, may be kinda worthless. In a tokenomics, or long-term investment, or utility sense, this narrative accepts that memecoins don’t have real value. But at the same time… ARBITRAGE!!!

It doesn’t matter if the actual token is a piece of trash, if you can buy it low and sell it high, it has value to you! This is the attitude of many traders who are willing to bet small in multiple places, knowing they’ll lose some to get some — but that when they get some, they’ll get a lot. It does require a bit of learning to actually pull it off, but the promise of the story is motivation for enough people that it’s certainly become a part of crypto culture.

Which is the super narrative?

Every narrative influences different people differently. As with most stories that move people to action in large swaths, the easiest to understand and the one that requires the smallest effort is the most pervasive. Thus, the normie narrative we’ve all heard is the strongest. But will one of the other narratives driving crypto memecoins emerge victorious?

Every narrative influences different people differently. As with most stories that move people to action in large swaths, the easiest to understand and the one that requires the smallest effort is the most pervasive. Thus, the normie narrative we’ve all heard is the strongest. But will one of the other narratives driving crypto memecoins emerge victorious?

It’s not a certainty, and no one can tell the future, but I’m inclined to think the skeptical narrative will win out in the end. The reason is because, until now, crypto culture has been heavy on the memes and light on the utility and adoption. As that flips and more technology is created, more adoption creates more credibility, and the more real-world use cases are available, the less people will need memecoins. Of course, memes themselves are not going away. But back in the day, you could invest in BTC, ETH, or DOGE and that was just about the whole list.

Today, there are so many flourishing sectors in the crypto space with actual development for fintech that a funny name and appealing logo is not enough to make a solid cryptocurrency. Memecoins may always have their place in crypto culture, but betting for the long-term that one of the narratives driving crypto as an entire industry will stay strongly in memecoins seems unlikely to me.

Investing in the narratives driving crypto

What does all of this mean for your own investment strategy? If you’re reading this right now, you likely have more knowledge of the cryptosphere than most people. If that’s the case, you can probably ignore the overarching narrative because you have too much information to believe it.

If you’re in camp-laser-eyes, that might require that you steer clear of memecoins all together — unless you just want to hold a few for novelty and to participate in crypto culture.

The best shot of actually investing in a memecoin narrative in a productive way is if you’re willing to hunt for arbitrage opportunities in the short-term. If you do this, however, make sure you know your risks and you DYOR.

Conclusion

For better or worse, since the early days, memecoins have been one of the strong narratives driving crypto. That may not be the case forever, but Doge is certainly ensconced in history and crypto culture since it became one of the most well known jokes on the internet. However you decide to invest in the narrative, just remember that if you’re not laughing along the way, you’re not taking memecoins seriously enough.