It’s the oldest crypto story there is: an alternate monetary system to escape the desperate clutches of a government-backed banking cartel. I’m old enough to remember the dawn of this crypto narrative. In fact, it’s so ancient it was being told way back in 2009, if you can believe that. Satoshi Nakamoto set it up from the very beginning in the Bitcoin whitepaper. The cypherpunks also helped with their suspicion of government control and enthusiasm for privacy, security, and trustless transactions.

Just because it’s the oldest crypto narrative doesn’t make it less impactful today, however. Like the rest of the narratives we’re discussing in this series, how people understand this story about Bitcoin as an alternate monetary system continues to drive adoption and buy-in today. That’s no small feat when active Bitcoin addresses passed 38 million in 2021 and venture capital investment in crypto reached $8.6 billion between January and July 2021.

What is the narrative?

So what exactly is the big-daddy of all crypto narratives? Let’s take a look.

We can’t trust government fiat currency

The history of monetary inflation in the US tells us that, no matter how benevolent a government claims to be, when centralized powers get control of a money supply, they cannot help but devalue it. Whether nefarious or necessity, debasing the currency through inflation and supply manipulation is stealing from the people. That’s why it’s called the “hidden tax.”

Money sovereignty is important

Because we cannot control how much our wealth will be worth in 10, 20, or 30 years, nor whether we’ll even be able to spend it, we are forced to realize that we don’t have monetary sovereignty. We want to believe we are a free people, but are we? Just because the government has created a monopoly on currency doesn’t mean it should have one. If the people can create an alternate monetary system, why shouldn’t they?

The alternative should be sound money

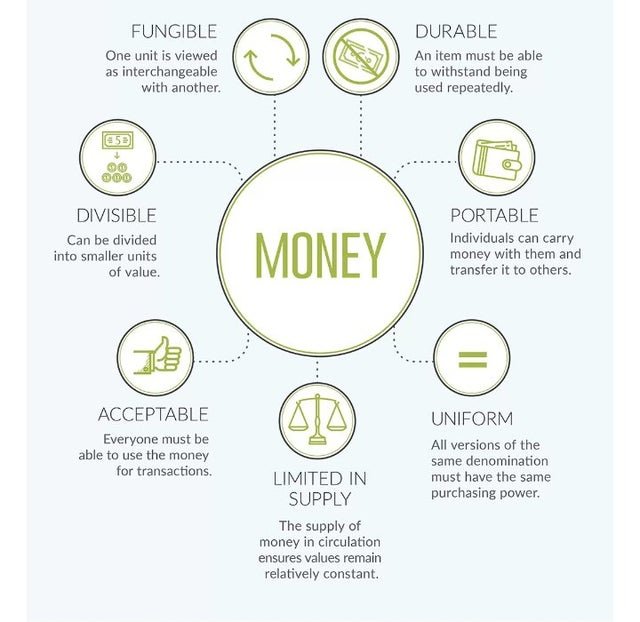

If we’re going to go to the trouble of creating an alternate monetary system, it should have the characteristics of sound money. Otherwise, that would be like putting lipstick on a pig. Thankfully, Bitcoin has all of the characteristics of sound money: it’s divisible, fungible, durable, portable, acceptable, uniform, and very importantly, limited in supply.

Why the alternate monetary system narrative works

This independence and sovereign-supporting crypto narrative is a powerful story for so many people. Really, it hits with anyone who wants to be free to live their lives, build wealth, and not have multiple hands reaching into their pockets for a cut of their hard-earned living. Basically everyone. The story of Bitcoin representing monetary freedom speaks to the very core of any human with self-agency.

It’s also a powerful narrative because it’s fairly easy to understand. A good narrative, after all, is a story that can be told to move and inspire people into action. The idea for a better and more stable monetary future appeals to people, even if they don’t understand the technology and programming innovation that Bitcoin embodies. After all, who really wants to hear the story of what SHA-256 hashes are?

If people believe the narrative that fiat currency is trash (it is), that they want control of their own financial futures (they do), and that Bitcoin can offer that possibility (it does) — that’s all they need to know. Investors will be moved to action. Retail investors don’t need to understand distributed ledgers, the Bitcoin halving, or public key cryptography to get a wallet and start hodling. Just look at the last Bitcoin all time high.

Are there other Bitcoin narratives?

Bitcoin as an alternate monetary system is definitely a strong narrative driving the OG cryptocurrency. But there are others. After all, not everyone is bearish on fiat currency — don’t ask me why.

Blockchain technology

For a while, in the early days of Bitcoin, “blockchain not Bitcoin” was the crypto narrative. That was all well and good at the time because the full crypto ecosystem had not emerged with its panoply of smart contracts, Web3, DeFi, GameFi, NFTs, and everything else. Blockchain was a promising new technology that has, in fact, panned out to be an important part of the cryptosphere. It’s no longer one of the main narratives, however.

Banking the unbanked

Another story that is told about Bitcoin is how it can help to provide banking and wealth-building opportunities for those who have, until now, been shut out of the system. This goes hand-in-hand with the alternate monetary system narrative, but it applies to a different audience because the unbanked are often a separate demographic.

Maximalism

A favorite crypto narrative for hardcore orange pillers is that Bitcoin is the only crypto that you’ll ever need. It’s the one, the only, the coin of coins. Bitcoin maximalism motivates people to only hodl BTC because it is, in this narrative, the only reliable, secure, and truly decentralized cryptocurrency.

Borderless money

Similar to the unbanked narrative, there’s one about the borderlessness of blockchain. If you’re dealing in fiat currency, it’s very difficult to make transactions across country borders because, in an unsurprising twist, fiat currencies are most usable in the country which issued them. Since Bitcoin isn’t issued by a government’s central bank, it can be used by anyone and sent to anyone.

Digital gold

If someone isn’t really digging the “Bitcoin as an alternate monetary system” narrative, in which humans make all our transactions in Bitcoin in the future, don’t worry. There’s a crypto narrative that holds Bitcoin not as a monetary system, but as a store of value. If you just want to buy Bitcoin and hold it to hedge against inflation, but you don’t want to transact or create financial applications with it, the digital gold narrative is for you.

Conclusion

In the end, Bitcoin as an alternate monetary system is not just a story we tell about crypto. It’s becoming reality every day. The best narratives are the ones that are both true and motivating and Bitcoin certainly has that going for it.

Governments are beginning to adopt Bitcoin as legal tender and even more are researching CBDCs to avoid being left behind in the fintech revolution. Banks, businesses and investment firms are all looking for ways to incorporate Bitcoin into their current business models. The old system may want to either cripple or integrate Bitcoin, but only time will tell if it truly becomes an independent, alternate monetary system.