Price stability and maximum employment is what the Fed claims as the reason it crowns itself with the high honor and privilege of manhandling inflation in the US with impunity. According to the Fed’s monetary philosophy, inflation at a controlled rate is a good thing for the economy. My eloquent and thoughtful response to that is: lmaoooooooo!! Ok, maybe that’s a tiny bit hyperbolic. But just because the US dollar is the world reserve currency and the banking cartel has a monopoly on meddling with the money supply, claiming it’s “helping,” doesn’t mean it actually is.

Price stability and maximum employment is what the Fed claims as the reason it crowns itself with the high honor and privilege of manhandling inflation in the US with impunity. According to the Fed’s monetary philosophy, inflation at a controlled rate is a good thing for the economy. My eloquent and thoughtful response to that is: lmaoooooooo!! Ok, maybe that’s a tiny bit hyperbolic. But just because the US dollar is the world reserve currency and the banking cartel has a monopoly on meddling with the money supply, claiming it’s “helping,” doesn’t mean it actually is.

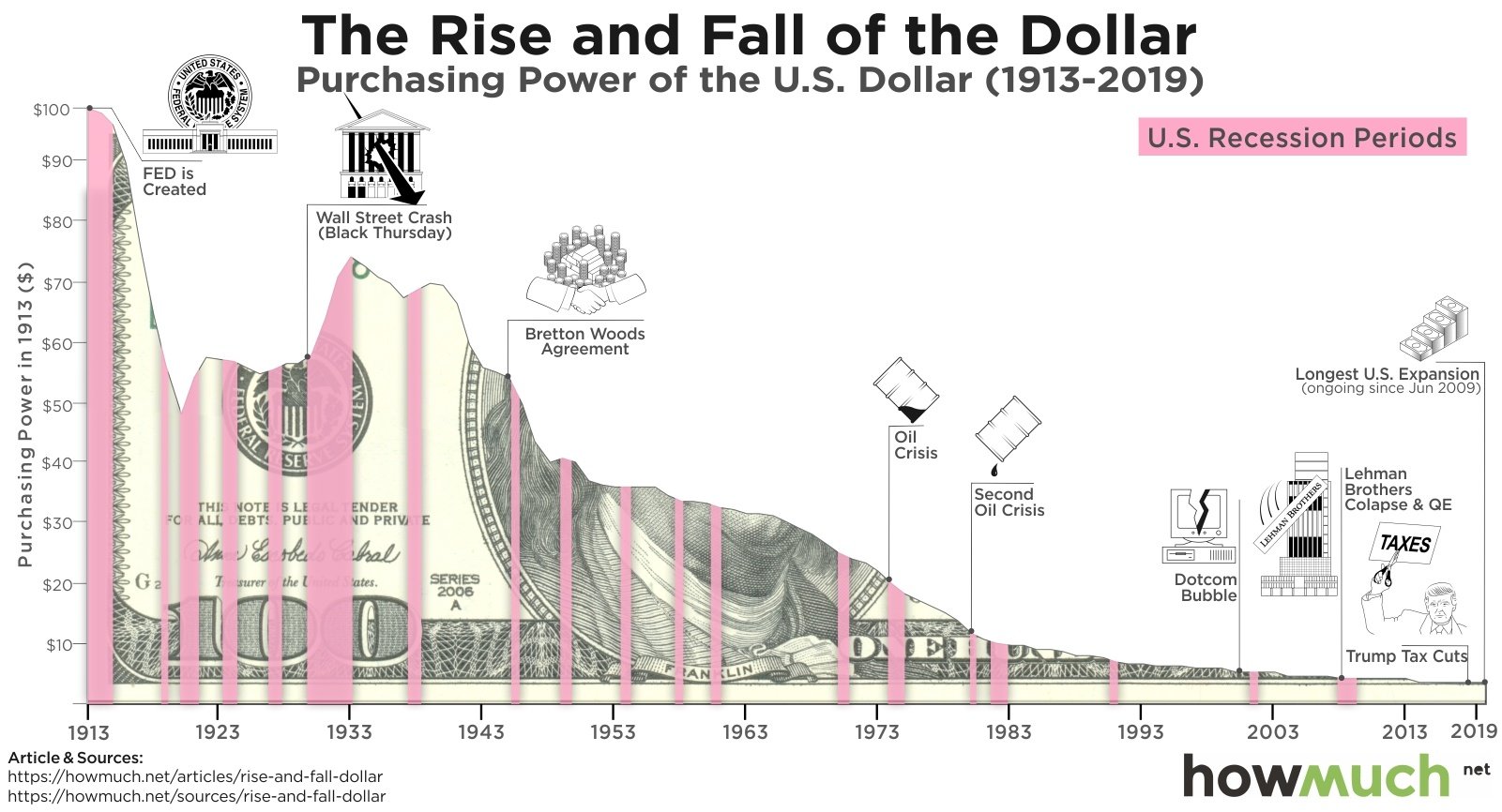

There are economic arguments to be made about inflation versus deflation and economic instability in uncontrolled markets. We’re not diving into those today. One thing is for sure though, inflation in the US has increased in the last 100 years and, as a result, your money has lost purchasing power. This is happening faster and faster today—despite claims to the contrary.

Let’s not waste time talking around the water cooler, here are some of the important milestones in the history of inflation in the US.

Timeline of inflation in the US

With the creation of the Fed in 1914 that allowed banks and the government to secure a trust monopoly on the US monetary system, the value of the dollar took a nosedive—and hasn’t stopped. What you could buy with $1 in 1913 would cost about $26.14 in 2020. Just after the Fed’s creation and its bright idea to use war as an excuse to increase its balance sheet, inflation in the US went crazy. Between 1914 and 1920, the value of the dollar fell by half.

With the creation of the Fed in 1914 that allowed banks and the government to secure a trust monopoly on the US monetary system, the value of the dollar took a nosedive—and hasn’t stopped. What you could buy with $1 in 1913 would cost about $26.14 in 2020. Just after the Fed’s creation and its bright idea to use war as an excuse to increase its balance sheet, inflation in the US went crazy. Between 1914 and 1920, the value of the dollar fell by half.

1930s: deflation in the great depression

In the roaring 1920s, the money cartel kept interest rates artificially low, incentivizing speculative investments. Unsurprisingly, a market correction hit and hit hard. The deflationary times during the great depression in the 1930s slightly increased the value of the dollar, but it caused a lot of economic pain—a perfect incentive for the Fed to continue meddling in the economy.

1944: Bretton Woods

The Bretton Woods Agreement was made by 44 countries. It established the US dollar as the world reserve currency by pegging other countries’ currencies to the dollar, which, itself, was pegged to the value of gold. This intertwining of global monetary and fiscal policies further complicated the system and further entrenched the Fed’s power. Bretton Woods ended, however, because of “Inflationary monetary policy that was inappropriate for the key currency country of the system.”

1965–1982: the great inflation

The collapse of Bretton Woods led straight into The Great Inflation, which was one of the worst periods of inflation in the US. According to Federal Reserve history, “Inflation began ratcheting upward in the mid-1960s and reached more than 14 percent in 1980.” Though the great inflation spanned a wide range of years, there were some other important events within that time.

1971: no more gold standard

President Nixon removed the gold standard completely by ending the dollar’s convertibility to gold. By removing the gold standard, the dollar was no longer pegged to the value of gold and the Fed’s ability to increase the money supply lost its last shackles. Unsurprisingly, the Federal Reserve bank of St. Louis argues that ending the gold standard wasn’t a bad thing because governments can also control access to gold—a thin argument in the face of inflation that has followed the gold standard’s removal.

President Nixon removed the gold standard completely by ending the dollar’s convertibility to gold. By removing the gold standard, the dollar was no longer pegged to the value of gold and the Fed’s ability to increase the money supply lost its last shackles. Unsurprisingly, the Federal Reserve bank of St. Louis argues that ending the gold standard wasn’t a bad thing because governments can also control access to gold—a thin argument in the face of inflation that has followed the gold standard’s removal.

1970s: oil crisis

Inflation and devaluing of the US dollar caused oil profits to decrease for oil producers in the 1970s. Britannica says, “Arab members of OPEC (Organization of the Petroleum Exporting Countries) decided to quadruple the price of oil” in 1973, causing a shock to the US economy. With a similar oil crisis in 1979, “The cost of oil rose from a nominal price of $3 before the 1973 oil crisis to over $30.”

1979: The Volcker Era

During the Volcker Era, inflation in the US was affected by controlling the money supply instead of trying to keep interest low. Interest rates did shoot up above 20%, but it also forced some deflationary pressure that brought inflation down from 13.5% in 1981 to 3.2% two years later.

1980: CPI revisions

Over the years, there has been controversy over the actual rate of inflation. It’s a complex calculation that has been revised many times. There are people who argue that the revisions were made so the government could protect itself by reporting inflation rates that are lower than reality. According to older methods of calculation inflation in the US, the 2021 inflation rate is closer to 15% than the officially stated 6.8%—which is still well above the annual target of 2%.

Over the years, there has been controversy over the actual rate of inflation. It’s a complex calculation that has been revised many times. There are people who argue that the revisions were made so the government could protect itself by reporting inflation rates that are lower than reality. According to older methods of calculation inflation in the US, the 2021 inflation rate is closer to 15% than the officially stated 6.8%—which is still well above the annual target of 2%.

2008: GFC

Inflation in the US has clearly had a long and storied history with snowballing effects from things like the creation of the Fed and the removal of the gold standard. But without question, the devaluing of the dollar accelerated wildly during the Great Financial Crisis of 2008. Quantitative easing policies created an increase in the money supply like never before. M2 ballooned by one third as “The central bank increased its assets by $3.6 trillion to a total of $4.5 trillion.”

2020: COVID

The money printing didn’t stop after the GFC, either. More quantitative easing and stimulus during COVID-19 increased the money supply by more than $3 trillion—that was about 20% of the dollars in existence

in 2020. Many people argue that increasing the money supply won’t increase inflation, but history shows that regardless of the CPI, the dollar’s purchasing power is steadily declining.

Summary of inflation in the US

Macroeconomics is a very complex topic with smart and educated people arguing from multiple different angles. Because it is so complex, it also tends to remain a largely abstract discussion. That’s part of why there can be so many differing opinions on what is and is not a good thing in the economy.

Whether inflation is helpful or deflation should be avoided is something you could argue about until the cows come home. Whether the US will remain the world reserve currency and help it retain value is another argument for another day. What you cannot argue, however, is that Americans have lost purchasing power by astounding measures over the last 100 years.

Inflation in the US can be justified away by those who would like to try, but the fact remains that if you are holding fiat, it will be worth less tomorrow than it is today. You can decide for yourself what you’re motivated to do about that. *cough* hodl crypto *cough*

About the Author

Emily Weber

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.