Welcome to the January 14, 2022 edition of the Decentral Weekly Crypto News Wrap-Up, where Neil and Em analyze the crypto news and contemplate the all-important question: “Is this a thing?” We’re already two weeks into 2022, which means that you’re allowed to bring up NFTs at the dinner table again.

This week’s crypto news wrap-up is jam-packed: PayPal might launch a stablecoin, there’s a golf club DAO now, Disney wants to track you at its theme parks, Matt Damon getting roasted, and much more.

PayPal “exploring” a stablecoin

There are few companies as critical to the payments industry as PayPal, which was founded in 1998. For years now, many enthusiasts have pointed out the advantages of crypto over traditional financial intermediaries like PayPal. Now, the payments giant is trying to adapt.

It looks like PayPal is currently exploring the launch of a new stablecoin. This shouldn’t come as much of a surprise, considering that PayPal seems to have finally come around to the fact that crypto is here to stay. In October 2020, PayPal announced that users could buy, sell, and hold cryptocurrency on their platform.

What do you think? Is this the right move for PayPal, or is it too late?

Neil says:

It seems like every major payment company and social media platform has explored the idea of a stablecoin, but I don’t think a PayPal stablecoin will really work out. One of the reasons that Square grew so quickly is because they embraced cryptocurrency while PayPal lagged. It might just be too late for PayPal.

Em says:

Existing and old-school financial services have to do something to stay relevant. They’re losing their footing as new and different technologies get developed, so they might as well try to keep up. I don’t know if it will save them, but it looks like they’re trying to hang with the fellow kids.

Bottom line:

Neil thinks it’s a “too late thing,” Em thinks it’s a “keep up with the crowd” thing.

Who do you agree with?

Give a golf clap for a new DAO

One of the biggest crypto news stories of 2021 was that a DAO wanted to purchase a copy of The Constitution. Even though the effort ultimately failed, it looks like more people are interested in creating a DAO, or decentralized autonomous organization, than ever before. Remember that just last week, Shiba Inu announced that it plans on launching a DAO.

Mike Dudas, a well-known crypto investor, started a DAO called LinksDAO that raised $10.4 million in 48 hours. How? They sold NFTs, of course. The ultimate goal is for the DAO to buy a golf course and for investors to have more voting rights and control than a traditional golf course.

Funds from the NFT sales will reportedly go towards forming the DAO, and additional legal fees and operating costs. LinksDAO plans to launch officially in early 2022, and has already formed a C-Corporation, a necessary step if they hope to purchase real estate.

Does this contradict the “anti-establishment” messaging that appeals to many cryptocurrency investors? Should we embrace a decentralized golf club?

Neil says:

A decentralized golf club sounds cool, but it’s not the most interesting idea for a DAO I’ve heard of. I imagine the club could be a nice crypto networking space if they can pull it off. At the same time, isn’t crypto supposed to be SOMEWHAT anti-establishment? What’s more “establishment” than a golf club?

Em says:

Maybe DAOs will work for companies or even government structures. That’s unfolding as we speak. But currently, DAOs seem to be largely a community structure—what better place to try it out than a goold old golf club. Those certainly have their own kind of community vibe.

Bottom line:

Neil thinks this is an overrated thing, Em disagrees.

Who do you agree with?

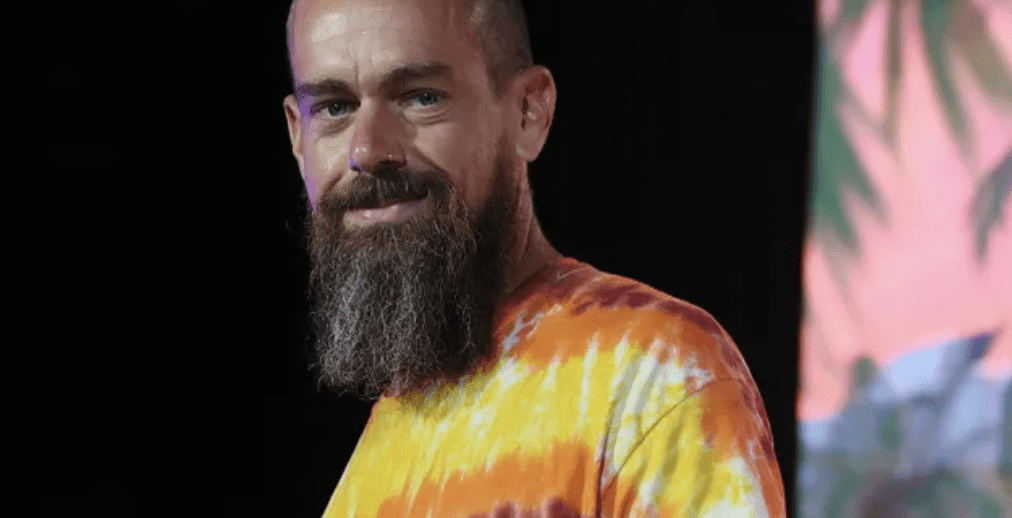

Dorsey feuds about Web3

It doesn’t matter what your industry is—the general public is always interested when it seems like two titans are fighting. Whether it’s Conor McGregor trash-talking for a fight or Elon Musk baiting the SEC on social media, it can be interesting to see what rich and powerful people are fighting about and why.

Jack Dorsey, known for his hipster look, eccentric diet, and calm demeanor, is making it clear that he’s not a fan of Marc Andreessen. It’s interesting considering that Andreesen’s accomplishments stack up nicely even next to the Square CEO’s feats. Marc is a general partner at one of the most respected VCs in Silicon Valley and co-founded Netscape. He also helped invent Mosaic, one of the Internet’s first web browsers.

Dorsey is revisiting the feud even after Andreesen blocked him late last year. The tension went public when the two argued over Twitter about the future of “Web3.” Jack Dorsey believes that Web3 will only benefit VCs like Andreesen, and that it is ultimately a “centralized entity with a different label.”

Does Jack have a point? Whose side are you on, if you had to choose between the two?

Neil says:

I think that VCs will invest in whatever makes sense for them, so I’m not entirely sure about the point that Jack is trying to make. It’s almost like saying, “Cryptocurrencies are useless because now hedge funds are buying them.” Sure, VCs are going to invest into large emerging technologies. This seems more personal than about Web 3.0.” For a man who said that Bitcoin could help bring about “world peace,” he sure seems cynical here.

Em says:

Is this high school? I think the real question here is what everyone is arguing about. The concepts and philosophy of Web3 are different from the reality of implementation. Knowing what you’re arguing about is a prerequisite to getting anywhere. But I guess if they’re both blocked, they’re not really trying to get anywhere.

Bottom line:

Neil thinks this is a confusing argument thing, Em thinks it’s a high school thing.

Who do you agree with?

Mickey Mouse, meet the metaverse

There’s no question that Disney has done an incredible job at branding its theme parks as a family destination, but it looks like they want to take things to the next level. Disney has been approved for a patent that would create “personalized interactive attractions” for visitors at their theme parks. In other words, Disney theme parks will feature metaverse experiences to “unlock new layers of storytelling.”

The patented technology means that 3D images and other virtual effects will be projected onto real-world objects. Disney already incorporates augmented reality technology at its theme parks, but it will ensure that the experience is more personalized. Last year, Bob Chapek, the CEO of Disney, stated that the entertainment giant was ready for its “own metaverse.”

The technology would be tracking individual visitors the entire time. The goal is for Disney theme parks to offer virtual world technology without visitors having to wear bulky AR headsets or similar equipment. The company claims it has “no current plans” on using the technology.

Is this dystopian, or will it just be another way to entertain the millions of children who visit Disney parks every year?

Neil says:

Yeah, you could see this coming from a mile away. Disney will probably end up making billions in their own metaverse thanks to their IPs, patents, and characters. This is going to be a big deal, and I can see how this technology can add a bit of “magic” to their parks that will attract more visitors.

Em says:

I’d probably put a small bet on the metaverse being the next NFTs as far as reach, influence, and adoption outside of the cryptosphere. It looks like companies like Disney and Facebook (Meta) are trying to get ahead of the puck. Either that or they’re trying to create the puck…

Bottom line:

Both Neil and Em agree this is a thing.

What do you think?

GameStop gets into NFTs

It was a record year for NFTs last year, and there is more interest in gaming NFTs and blockchain-based games than ever before. That’s why it isn’t too surprising to find out that GameStop is busy creating an NFT marketplace. Apparently, the video game retailer has a team of 20 working on an “online hub” where users can buy, sell, and trade NFTs.

Shares jumped 20% on the news, given the fact that NFTs remain one of tech’s most popular “buzzwords.” GameStop is reportedly hoping to launch the NFT marketplace by late 2022. Does the video game chain have what it takes to compete with other major NFT platforms?

With more eyes on GameStop than ever, can the company leverage that new attention into big-name metaverse partnerships? Some critics are even questioning whether the article is legitimate, as well, given the Wall Street Journal’s lack of “named sources.”

GameStop became a “meme” stock last year after its stock price skyrocketed in early 2021. Are they serious or is this a pure cash grab?

Neil says:

I’ll go ahead and be the cynic here: I don’t think this is going to work. GameStop had a massive moment last year as a “meme stock”

Em says:

After the r/wallstreetbets debacle last year, GameStop had its rise from the ashes coming. Let the hedge funds and even Robinhood bet against you, then join the people in crypto and get the last laugh. At least, I hope that’s how it plays out for GameStop. If only for the lolz.

Bottom line:

Neil thinks this isn’t a thing, Em thinks it is.

Who do you agree with?

Bad idea of the week: Damon didn’t deliver

The crypto news-wrap up just wouldn’t be complete without our “bad idea.”

Many pro-crypto enthusiasts have been excited about crypto companies making major advertising moves, like Crypto.com recently nabbing the naming rights to the Staples Center and the fact that both Crypto.com and FTX will be shelling out millions for Super Bowl ads.

Many cryptocurrency traders believe that Crypto.com made a power move with the Los Angeles sports center, but it does look like they may have made a bit of a branding mistake. A Matt Damon ad has gone viral on social media for how cringe-inducing it is…and the roasting was pretty bad. The advertisement featured the slogan “Fortune favors the bold,” and compared crypto investors to history’s explorers, adventurers, and astronauts.

In the end, there’s no other way to put it: if the ad was meant to attract people who tend to be skeptical about cryptocurrency, it clearly failed. Matt Damon might be an award-winning actor, but the thing about actors…they’re limited to scripts, and this one didn’t cut it. Check out the commercial here.

Neil says:

Crypto.com has hundreds of millions of dollars to spend on advertising, so it’s not like this is their “last shot” by any means. However, I think that many of these crypto companies need to understand that not everyone is ecstatic about crypto, and a cringe-worthy commercial like this where Matt Damon compares astronauts to crypto investors isn’t going to play out well. Not the worst ad I’ve ever seen, but I see why it went viral for the wrong reasons.

Em says:

No press is bad press is a legit phrase, but I’ll be honest, this ad wasn’t even cringey enough to be good cringe-porn. It was just bad and boring. I’d be lying if I said I hated it as much as Twitter did—but not because it wasn’t bad, just because I fell asleep out of disinterest.

Bottom line:

Both Neil and Em think the commercial was underwhelming.

What do you think?

Meme of the week

As always, Em brings you your meme of the week:

And that’s our crypto news wrap-up! What cryptocurrency are you most excited about for 2022? Are you “buying the dip” right now, or nervous about your cryptocurrency portfolio? Make sure to let us know at @decentralpub on Twitter.