When it comes to NFTs, there’s no one-size-fits-all answer as to when investors should sell their tokens. You may have read headlines about NFTs selling for millions, but that’s very rare. For the average investor, investing in NFTs is tricky, especially if you really want to maximize their value. it’s tempting to sell when the market becomes volatile and it can be hard to know when to pull the plug.

“Did I sell too soon? Or “should I have “hodled” longer?”

These are the questions that often go through an NFT investor’s mind. It’s too bad there’s not a magical “sell now” button that appears in your wallet when all signs point to “drop this hot potato asap”. Or a shiny “hold on because you’ll see results soon” flashing across your screen.

Here are three key signs that suggest it might be time to cash in on your NFT investments.

Here are three key signs that suggest it might be time to cash in on your NFT investments.

1-Failed promises or no new progress

The first sign is if the project you invested in has stopped developing or progressing. If the team behind the NFT project you invested in is no longer active, or has failed to deliver on its promises, it might be time to move on.

2-Market saturation

The second sign is if the NFT market becomes saturated. If there are too many NFTs out there and demand for them starts to dwindle, selling your tokens might be the best way to preserve your NFT investment.

3-Gotta pay the bills

The third sign is if you need quick cash. NFTs are a great long-term investment option, but they may not generate returns as quickly as other financial assets. If you’re in urgent need of funds, selling NFTs could help pay off any debts or expenses you might have.

Summary

If your NFTs meet any of the above criteria, though, then it might be time to cash out before its value decreases even further.

Is there a downside to “when” you decide to sell? Sure, but if you don’t see significant growth potential for your NFT portfolio, selling your collections would be better than holding onto something that’s likely to decrease in value, right? These are risks that every investor has to make – especially if they are volatile.

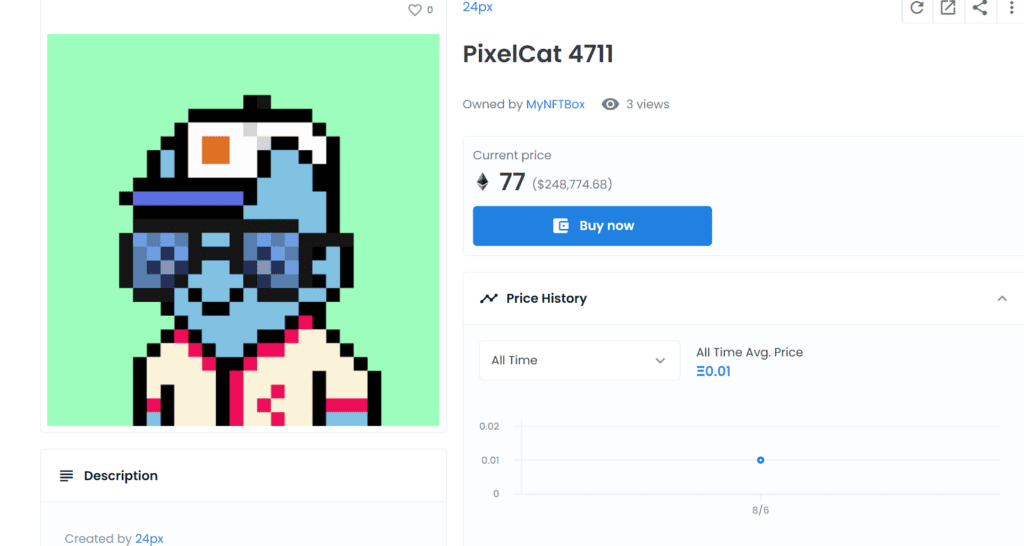

Speaking of volatility: NFTs are volatile assets, which means NFT prices can change quickly. That’s why NFT investors often hold their NFTs for a few days (or even weeks) before they decide to sell them or not.

Speaking of volatility: NFTs are volatile assets, which means NFT prices can change quickly. That’s why NFT investors often hold their NFTs for a few days (or even weeks) before they decide to sell them or not.

If you’re unsure whether the NFT will increase in value or not, it might be better to wait and see how the market reacts before making any decisions. On the other hand, if you just don’t feel comfortable with an investment, you should liquidate.

The bottom line is that not all decisions are rooted in analysis. Some of them are simply subjective. So, if you can’t find the data to prove why you should buy or hold, don’t wait until you lose your shirt to make a decision that you might later wish you had done sooner.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.