Keeping an eye on banking trends is important because the banking industry can have a huge impact on the future of cryptocurrency and crypto banking. Crypto has caused some upheaval in the traditional financial world, but recent trends point toward conventional banks starting to embrace it as they prepare to head into a digital future.

Below, we’ll get into five banking trends that are worth watching.

5 crypto and non-crypto banking trends

1. Traditional banks becoming more crypto-friendly

According to a survey by American Banker, 44% of banking executives plan to offer crypto banking services in 2022. More traditional banks are dabbling in crypto by offering to hold users’ coins and integrating with popular crypto platforms like Coinbase.

However, banks are somewhat limited in the services they can provide until official regulations are created. These regulations will likely come in 2022, as banks are anxious to offer crypto services to meet customer demand.

2. Crypto banking becoming more regulated

Regulation has been a hot topic in the crypto industry as a whole, but regulations will likely come first for crypto banking in particular. In 2021, the Office of the Comptroller of the Currency, Federal Deposit Insurance Corp., and Federal Reserve issued a statement saying they would bring regulations to banks sometime in 2022.

These regulations will define how conventional banks can engage with crypto, which could end up shaping the future of crypto banking more broadly.

3. Digital wallets gaining more popularity

E-wallet apps like Apple Wallet and Google Pay have been popular for a while now, but this trend of digital wallets and contactless payments is likely to keep growing. In fact, Visa reported a 30% increase in digital transactions in 2021.

The transition away from cash and hard money to e-wallets and digital transactions is pushing banks toward a digital future. It could also spur businesses and banks to start accepting crypto as a form of payment.

4. Banks opening more virtual branches

Visits to physical bank branches have been on the decline in recent years, a trend that will continue in 2022 as digital banking becomes more popular.

Banks will shift toward opening more virtual branches that utilize digital tools like video and online chat to help customers. This means banks will optimize their websites and mobile apps to give their customers a more convenient user experience.

5. Crypto banks increasing in number

Lastly, crypto banking services will become more popular as the cryptocurrency industry continues to grow.

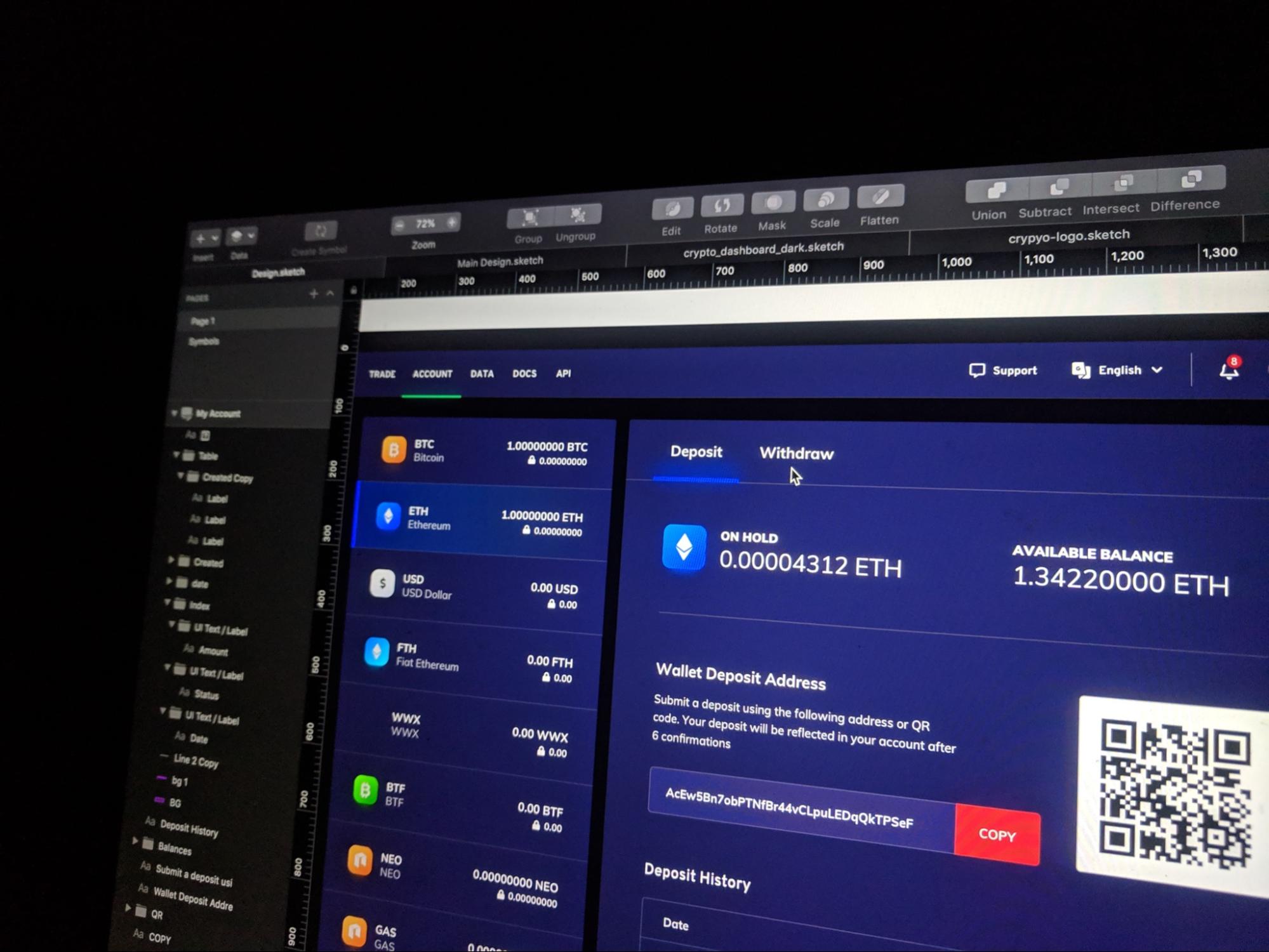

Crypto banks provide several important financial services for crypto holders, including crypto savings accounts, crypto debit cards with cashback in the form of crypto, and crypto-backed loans. These services will only become more necessary as a larger number of people start using crypto.

The impact of banking trends on crypto

As shown by these five banking trends, traditional banks are becoming more digital to keep up with an increasingly digital society. These banks are starting to embrace many of the technologies that crypto already uses, like digital wallets and contactless payments.

This move toward the digital, combined with the introduction of regulations for crypto banks, could help bring more consumers into the world of crypto.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.