So you want to dip your toe in the crypto-backed lending waters, do you? If you’ve read much about or experimented yourself with DeFi, you know how it can get pretty confusing pretty fast. Especially since there are so many platforms and services, and they all do things a different way and very few have clear or understandable instructions.

So you want to dip your toe in the crypto-backed lending waters, do you? If you’ve read much about or experimented yourself with DeFi, you know how it can get pretty confusing pretty fast. Especially since there are so many platforms and services, and they all do things a different way and very few have clear or understandable instructions.

It’s difficult to navigate the concepts of loan repayment, loan proceeds, and figuring out how to redeem earnings without having a bunch of prerequisite DeFi lending knowledge about stablecoins, DEXs, staking, pooling, and the list goes on. It’s enough to make you want to flip a table. But thankfully, I have a lot of spare tables lying around so, for you, I’m willing to flip them to understand crypto-backed lending and break it down for you in understandable terms. Really, I just have your table’s wellbeing in mind.

As a starting point, crypto-backed lending uses crypto assets as collateral for loans, which are also made in crypto. Pretty much, it’s the new and blossoming space of P2P lending in the decentralized cryptosphere. There are different types of DeFi lending, and you can find an overview of self-paying loans here, but in this article, we’ll get into the nitty gritty of a specific protocol—Alchemix. They’ve done a good job breaking down the crypto lending process into three phases: generate the loan, automate the loan repayment, and redeem earnings. This will take some explanation but let’s start with context.

Traditional vs crypto-backed lending

There are lots of ways that crypto-backed lending is different from traditional lending. For our purposes, we’ll just review a handful.

It’s peer-to-peer

Unlike when you take a loan from a traditional bank or lending service, in DeFi lending, there’s no middle man. When you deposit money into a bank, you’re the lender, the bank is the intermediary, and the borrower, of course, is the borrower. Blockchain and DeFi have allowed people to eliminate the intermediaries that used to be required for trust between borrower and lender.

There’s no KYC

When you take a loan in DeFi, there are (for now) no credit checks and no personal information vetting. The loan amounts are determined largely by two things: available liquidity on the lending platform and the borrower’s available collateral. Because crypto-backed lending uses crypto collateral as a guarantee, the limiting factor on how much you can borrow is determined by what assets you can place as collateral.

Smart contracts automate

Much of what lending intermediaries do in traditional lending is define and oversee the terms of the loan. When smart contracts verify requirements and execute transactions automatically, that oversight is no longer needed.

Gain higher yield

Because intermediaries are cut out and costs are reduced through P2P transactions, you can get greater loan proceeds with crypto-backed lending. The fees are also lower because smart contracts, unlike bankers, don’t need a cut.

You can lend to yourself

Weirdly enough, you can lend to yourself in crypto. There are a couple of ways to do it, liquid staking is similar in that a synthetic asset can be used while staking the original asset. But today, I want to talk about exactly how to borrow future yields from yourself on Alchemix.

Phase 1: Become a lender

When you put your money in a bank, you’re becoming a lender. Most of the time, we don’t think about it that way because we think we’re trying to save, but that’s how banks work. The problem is, banks are largely the ones taking the loan proceeds, not you, the real lender, who gets pitiful return interest. In our case study of crypto-backed lending, you become a lender and you borrow from yourself. Here’s how it works.

When you put your money in a bank, you’re becoming a lender. Most of the time, we don’t think about it that way because we think we’re trying to save, but that’s how banks work. The problem is, banks are largely the ones taking the loan proceeds, not you, the real lender, who gets pitiful return interest. In our case study of crypto-backed lending, you become a lender and you borrow from yourself. Here’s how it works.

Deposit crypto into Alchemix

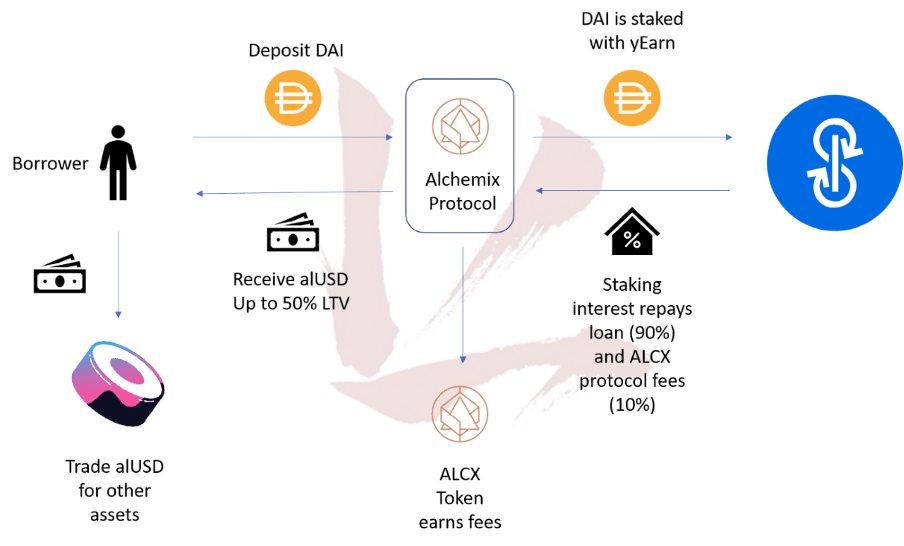

First you “generate the loan” as is described on the website. You can deposit Dai or Ether. By doing this, you’re providing loan liquidity in the market with your asset. This essentially means you’re lending out your Dai or Eth to be used by others. The Alchemix platform places your crypto in a Yearn vault, which then generates loan proceeds with the investment yields.

How-to steps

You may wonder how to do all of this. It’s fairly easy.

You may wonder how to do all of this. It’s fairly easy.

- Go to the Alchemix vault page

- Connect your wallet (Metamask or WalletConnect)

- Toggle the switch to either DAI or ETH

- Enter the amount you’d like to deposit.

- You’ve now generated the loan and can start gaining loan proceeds

Phase 2: Set it and forget it

You could just leave your crypto in the Alchemix vault and let the loan proceeds accumulate. But, if you were going to do that, you might as well deposit it straight into Yearn without involving Alchemix. The whole point is to then borrow the future yields. Here’s how phase 2 works.

Borrow from yourself

Imagine you deposited DAI. Say, $10,000 worth. Alchemix would then mint up to 50% ($5,000) of your deposit in alUSD, which is a synthetic asset. This “loan” that you give yourself is really just future yields that Alchemix fronts to you in the form of alUSD.

Automated yield optimization

Meanwhile, your original $10,000 of Dai is being optimized in a Yearn vault, which uses algorithms and smart contracts to automate the management of your asset. The automation will move your assets to opportunities with higher yields, auto-compound, and rebalance for you, similar to an actively managed fund in traditional finance. In this way, loan repayment is also automated.

Pays back the alUSD you borrowed

If you take out a traditional loan, you have to make sure to repay it. The closest automation you can get is auto-drafts from your bank account, not yields from the loan itself. With crypto-backed lending, however, the yields from your $10,000 of Dai will be put toward your $5,000 alUSD debt (less a 10% cut for the protocol, of course).

How-to steps

This part is pretty easy since, after all, it’s automated.

- Go to the “borrow” tab on the Alchemix vault page

- Enter the amount (up to 50%) you want to borrow

- Hit borrow

Phase 3: Thank future-you and redeem earnings

Once you’ve borrowed alUSD from your future self, what do you do with it? Great question.

Use your alUSD

There are several things you can do with alUSD. You can swap it for DAI or some other crypto and use it. You could even swap it all the way back to fiat and use it to make a dope-ass purchase. You could also stake it in a liquidity pool in the Alchemix farm to generate even more yields.

Yields roll in

![]() While your initial Dai deposit is rolling around in the Yearn vault, picking up yields like a tumbleweed picking up leaves along its merry way, you redeem earnings and go to town with them. The loan proceeds automate the loan repayment and you can sit back fat and happy while DeFi does its crazy thing.

While your initial Dai deposit is rolling around in the Yearn vault, picking up yields like a tumbleweed picking up leaves along its merry way, you redeem earnings and go to town with them. The loan proceeds automate the loan repayment and you can sit back fat and happy while DeFi does its crazy thing.

How-to steps

Depending on what you want to do with your alUSD, the steps will be a little different. Staking or using the transmuter are both a little more complicated than if you simply redeem earnings back to fiat. Staking and transmuting would probably require their own guides.

Conclusion

The future of loans is more digital, not less. Tokenization of assets, DeFi, and smart contracts can make real-world purchases easier with crypto-backed lending. And even if you’re not looking to borrow a great deal, you can use the loan proceeds, redeem earnings, and reinvest them for even bigger yields while the loan repayment takes care of itself. It’s truly a fascinating and exciting new opportunity in the world of crypto-backed lending. I’m confident that more cool innovations like this will be heading our way soon. Are you using crypto-backed lending and have you been able to redeem earnings yet?