Imagine taking out a loan or holding liquid assets without a bank. Imagine making an online purchase without a credit card or PayPal. Imagine trading without a brokerage on a permissionless exchange. Decentralized finance transforms these scenarios from imagination to reality.

Decentralized finance (DeFi) is a term that has taken the blockchain world by storm since it was coined back in 2018. By 2020, a hot DeFi summer saw Ethereum’s blockchain explode with decentralized applications (dApps) developed on it to achieve projects that could have only been imagined before. Even Shark Tank’s Kevin O’Leary is so bullish on the idea that he’s a major stakeholder in a DeFi investing company. So, what is this buzzword?

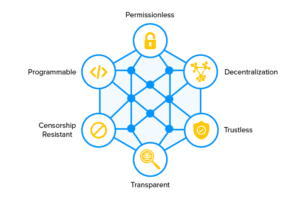

DeFi is a catch-all term referring to an ecosystem of applications that aim to replace traditional centralized financial systems with—you guessed it—decentralized alternatives. By using smart contracts executed on a blockchain, it becomes possible to conduct direct peer-to-peer transactions and cut out intermediaries like banks, brokerages, and exchanges, and thus circumvent monopolies that keep tight reins on legacy finance.

Smart contracts can automatically liquidate collateral if contract terms are not met, eliminating the need for a third party and giving people more control over their own money. Decentralizing also prevents institutions from creating permission barriers for user participation. For example, you may remember that during the GameStop short squeeze back in January of 2021, trading app Robinhood blocked users from trading GME. In contrast, on a decentralized exchange, users can trade crypto tokens directly without the need for a broker. DeFi has the ability to make all kinds of financial transactions happen outside the traditional centralized financial system.

Financial hubs like New York and London dominate the financial economy, and activity flows from those centers of economic influence. This can create massive crises that could easily crumble whole economies if balance sheet problems at the financial hubs waterfall to subservient entities. By decentralizing balance sheets and services, failure points cannot domino to cause such devastating consequences.

What does DeFi do?

There are many ways that DeFi can remove friction in financial services and break away from the monopolistic hold that concentrated power centers currently have on the system. Here are a few:

Without the need for intermediaries like banks, financial services become available to more than 1.5 billion people who are currently unbanked and excluded from the system. Anyone with a smartphone and an internet connection can use dApps without the typical identifying information or minimums required to access traditional services and which force so many people to stay in a cash economy.

By using open-source protocols to build services and applications, implementations become transparent. Closed-door decisions can’t be made by institutions without the user’s ability to see how and where transactions are being made.

Payment processing with traditional financial services takes days to complete as ledgers are slowly updated through an intermediary. Direct transactions on the blockchain can happen much faster in contrast to the days it can take to move money around with traditional financial services.

Traditional lenders often deny loans that are not profitable enough for them, reducing capital access to potential entrepreneurs. Peer-to-peer lending enables a wider range of loan terms, which allows for more business ventures that could drive economic activity and growth.

In legacy finance, everyone takes a cut. From brokers to merchants to banks, fees are dictated by the institutions providing the service. DeFi cuts out middlemen and reduces the amount of fees end users have to pay.

Current implementations of DeFi

There are all kinds of dApps and services currently available in the DeFi ecosystem, and these implementations are drawing interest from speculators looking for great returns, developers who want to create new solutions, unbanked people in economies with unstable currencies, and those who simply want to see DeFi more widely adopted. Current implementations include:

There are all kinds of dApps and services currently available in the DeFi ecosystem, and these implementations are drawing interest from speculators looking for great returns, developers who want to create new solutions, unbanked people in economies with unstable currencies, and those who simply want to see DeFi more widely adopted. Current implementations include:

DEXs: Decentralized exchanges like Uniswap, PancakeSwap, and dYdX allow users to trade currencies directly and without giving up control of their money. These exchanges never close and make converting assets easy.

Stablecoins: Cryptocurrencies tend to be extremely volatile, but stablecoins like Tether, USD Coin, and Dai are pegged to a reserve asset like USD or the euro. Less volatile digital currencies are useful for those who want to know what the value of their assets will be tomorrow or next week.

Lending: Platforms like MakerDAO, Aave, and Compound use smart contracts to allow peer-to-peer lending without a middleman. It also uses collateral-based lending, which protects user privacy by not requiring identity verification.

Prediction markets: Betting on outcomes is streamlined by using smart contracts to execute winner distributions after oracles provide the needed data from the outside world. Augur, Gnosis, and Omen are some popular prediction markets.

Big ideas for the future

The hope of many DeFi proponents is that legacy finance will soon be edged out completely as creaky, bloated systems recede into obsolescence. Because it is such a fast growing and rapidly evolving ecosystem, new innovations are constantly being made in DeFi while centralized services are too slow-moving to keep up. As more people embrace decentralization, the future of revolutionizing traditional financial systems brightens.

Blockchain protocols are open-source, which means that applications can be built by anyone, and “money legos” can be stacked on all DeFi layers to create the most efficient tools. This composability is what drives innovation much faster than in traditional fintech.

There are scaling and security problems, however, that must be ironed out in the future as DeFi evolves. One of the improvements soon to be rolled out is Ethereum 2.0, which aims to ease scalability with horizontal distribution and proof-of-stake consensus protocol rather than proof-of-work, which slows down transaction times and is very energy inefficient.

Another innovation on the horizon in DeFi is multichain interoperability. Right now, composability is same-chain, meaning that apps and services are built on one blockchain (like Ethereum), but operability is restricted to that chain. Developers are beginning to shift focus from creating the most competitive chain to making multiple chains compatible, which will allow seamless, multichain transfers. This interoperability achievement will also drive adoption as user experience becomes less complex and requires less effort for the average user.

Mass adoption is also a goal for the future of DeFi. Simplifying services so they are easily understood and used by all will increase how many people use dApps. This is crucial for overtaking the stranglehold that institutional monopolies have on how, where, and when people make financial transactions and the cost of those transactions.

What’s next: the impact of DeFi on financial systems

The exciting thing about DeFi is the impact it can have on how every person conducts financial transactions. Until recently, cryptocurrency and blockchain in general have often been viewed by the public as a niche and silly game for nerds on the internet. But the concepts of DeFi can truly revolutionize everyday financial transactions for people all over the world.

Decentralizing can lower the bar of participation to include anyone, even the unbanked in developing countries with poor monetary policy or that block capital access. It also reduces the leverage that power centers have on markets and users all over the world by removing control from any single entity. The mass adoption of DeFi would mean that governments could not so easily crash economies, and economic hardship would not so easily be imposed on those who have no power to change their circumstances.

Imagine a financial system where limitations are removed, users maintain their privacy, and transactions are simply and easily made from a phone, anywhere in the world, regardless of government, socioeconomic status, or institutional barriers. That’s the power of DeFi.