Real estate investment trusts (aka REITs) are basically companies that make their money by owning income-producing real estate or real estate-related assets. There’s been a renewed interest in REITs over the past 5 years, and even more so in the last 2 years, due in part to the pandemic, as a means to acquire high value, high-priced commercial real estate and land for development in cities that are being gentrified around the world.

This renewed interest in REITs has added tens of billions of dollars into the REIT industry. Further, the demand for access to these real estate investment trusts has opened up a few opportunities for individuals to gain access to what was once only reserved for the global elite.

But the resurgence of REITs and the newfound pseudo availability for the little people doesn’t dismiss its sordid past; and the surge in global adoption of digital currencies and advancements in blockchain technology and tokenization may carve new paths for investors like DAOs. Decentralized autonomous organizations – DAOs – don’t have the flawed past wrought with scandals like REITs do, and that is very attractive for the crypto-loving community.

For now, let’s explore the concept of REITs, get familiar with how they operate, and how they could potentially transform into a viable investment tool for us little people.

REIT terms to know

Before we dive into the future potential evolution of REITs, we’ve created a short list of real estate investment terms you may want to store in the ‘ole prefrontal cortex (aka “place in the brain where one stores short term memories”).

Warning: these are financial terms created by financial professionals – not marketers. So, put your thick glasses on and bring out your inner nerd to make it through some of these super dry terms with me. It will help you understand the concept of REITs: I promise.

Capitalization rate

This is the true net income generated by a property. It’s calculated as a percentage of the purchase price. Simply put: if a property costs $100,000, but it generates $5,000 of net operating income, it’s capitalization rate is 5%. Pro tip: the lower the cap rate, the lower the risk – and likely lower demand. Professional investors are more likely to lean towards higher cap rates because they want to maximize their returns on investment.

Funds from operations

You know how traditional stocks are judged on their “earnings”? Well, Real estate investment trusts have depreciating assets on the books (things that go down in value); so, the idea of using earnings and net income to determine a REIT’s profitability and success doesn’t work. Instead, REITs report their financial performance in terms of “funds from operations” where the profits also include depreciation expenses and a few other changes to more accurately show the profitability. (Side note: If you’re looking for a REIT to invest in, you’ll want to read up on how this is determined.)

Leverage

This is a term used to describe the amount of debt a REIT reports. If you’re researching REITs and you want to get an idea of how much debt it holds, you’ll probably see the percentage of debt as compared to the total capitalization.

What are REITS

So now that we’ve gone through some terms, let’s take a closer look at what REITs are and how they function.

Real estate investment trusts sell shares in the trust and invest the funds back into real estate. Then they charge fees/rents etc., collect the money that comes in, pay expenses, then distribute any remaining profits back to shareholders, which determines their “funds from operations”. Shareholders can benefit from income-generating real estate while minimizing taxes because real estate profit is typically taxed at lower rates than ordinary income, which means less tax for them.

And that profit can be staggering.

Since 2020, equity REITs have delivered around 26% in returns. In 2021 alone, dividends soared 14.6% from the previous year. This is a strong signal that the resurgence of REITs is back and gaining momentum.

Even the non-traded mega-REITs like Blackstone’s $50b venture, BREIT, have emerged from seemingly nowhere to massive success. The BREIT venture came to fruition around 2017 to address demands from the individual investor market to have access to private real estate markets. With a low minimum of $2,500, individual investors can purchase shares in BREIT, but they have to do so through a financial advisor.

Most real estate investment trusts, though, are publicly traded on a stock exchange and registered with the SEC, and have been since the 1960s when they were formed by the US government to provide a means for the average person to invest in real estate. However, there are now hoards of private REITs and public REITs that are non-traded, as well.

Are REITs available for individual investors?

Regardless of the type of REIT, make no mistake: real estate investment trusts are really a playground for wealthy investors to pool their assets for massive acquisitions. REITs are mostly sold to institutional investors. In fact, it’s only been in the past few years that an individual investor would be able to find a REIT that doesn’t reserve shares only for institutional investors. Even then, the low minimum of $2,500 a pop isn’t pocket change for the average cash-strapped American..

That’s the problem.

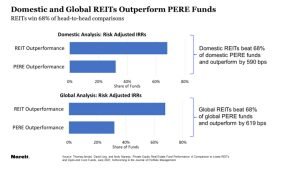

Public REITs like Equinix (AMT on the NYSE) earn over $8 billion in revenue; with that kind of income, public REITS have the buying power to invest in and transform cities across the country – and they do. They’re even outperforming PERE funds – aka private equity real estate funds. But, alongside the transformation comes skyrocketing real estate prices, which boost the bottom lines of the portfolios of these REITs.

The average person has very few options for investing in real estate right now, due in part to REITS. Neighborhoods are being gobbled up by REITs and flippers, and prices have been rising too quickly, outpacing the rise of income beyond what is considered affordable.

Let’s take a look at the current state of the real estate industry and how REITs could be transformed to put power back into the hands of the people.

How many types of REITs exist?

There are different types of REITs that allow different types of investments. The three most common are equity, mortgage, and hybrid REITs.

- Equity REITs make most if not all their money from owning properties

- Mortgage REITs make most if not all their money from real estate lending

- Hybrid real estate investment trusts are a mixture of both equity REITs and mortgage real estate investment trusts.

REITs have been trying to innovate for years. But, there’s a newer type of REIT that has emerged that we have our eye on; it’s called a private cryptocurrency-based REIT,. Crypto-based real estate investment trusts can serve as an equity, mortgage, or hybrid REIT. The major difference in the cryptocurrency REIT is that the funding stems from digital currency instead of fiat-based currencies.

The current state of the real estate industry

How can the average investor benefit from REITS? Well, it’s complicated… Let’s look at how far we have – and haven’t come – in terms of homeownership.

Over the last couple of decades, the white-picket-fence dream of “owning your own home” or having a piece of investment income real estate has steadily become more unattainable and more unaffordable for the average person.

With real estate prices constantly rising due to market demand increasing faster than supply, real estate investment trusts are being re-envisioned and leveraged for the average person to invest in real estate and real estate-related industries. One example of this is through a private cryptocurrency-based equity REIT. It’s an equity REIT that is funded through digital currency and is managed by its members.

Cryptocurrency-based equity REITs could use the technology of blockchain and smart contracts to their full potential, reap most if not all of the benefits from decentralization, transparency, security etc. Blockchain can also solve liquidity issues because it would be possible for investments made by equity REITs to move very quickly if they are funded by digital currencies.

Investing in the real estate industry has traditionally been viewed as a good choice because it paid off better than other asset classes over time, but since real estate has become so unaffordable more, more people have been staying away from these types of investments.

Homeownership is on the decline – still

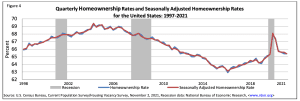

Let’s talk about the elephant in the room, shall we? When we look at the current state of the real estate industry, a picture says a lot about what happening – and well, it’s on the decline.

In the above graph from the US Census, you can see that homeownership in the US has taken a sharp decline from 1998-2000. It rebounded slightly, but not to 2004 levels, and in 2020, it took another sharp decline.

Why? Well, let’s take a look at homeownership by age.

Fact 1 – only 9% of all homeowners are under the age of 35

Further, just a little more than one third – or 38.6% – of people in the US under the age of 35 actually own a home. That means that over 60% of working adults in the US under the age of 35 have real estate.

Fact 2 – 34.7% of homeowners are between the ages of 35-54

An average of 62.1% of people in the US between 35-54 actually own a home. While nearly double that of homeowners under the age of 35, that still leaves nearly 38% of individuals between 35-54 that are renting.

Fact 3 – 55.5% of homeowners are over the age of 55

Not surprisingly, 76.5% of boomers (born between 1946-1964) and the silent generation (born between 1928 and 1945) own homes.

Using blockchain technology to improve traditional REITS

Blockchain technology is starting to infiltrate and impact the real estate market through practices like tokenization, in general, but also REITs, specifically. The use of smart contracts, tokenization, and DLT (distributed ledger technology) in real estate can solve issues plaguing the industry – from transparency to efficiency.

For example, smart contracts can link ownership of the property, all of the contracts and documents, directly into the blockchain. They can instantly make sure that all conditions are met and execute the contract for sale.

Tokenization can be used for fractional ownership. Fractional investing can also increase diversification for those who want to invest in multiple properties but cannot afford to own 100% of each investment. It can also benefit land and farm owners who could collateralize part of their property to raise capital without losing their livelihoods.

Distributed ledger technology can directly impact transparency because of how it stores data on the blockchain; DLT allows for information to be continually reconciled on the blockchain database, and it’s immutable, meaning it’s not able to be changed over time. So, if a new owner wants to see a full, unaltered record of a property’s history, DLT will make this possible.

Cryptocurrency-based real estate investment trusts may be the future of ownership

It seems like blockchain technology truly has the potential to bring a new life to real estate ownership, from DAOs (decentralized autonomous organizations) to REITs.

A decentralized platform for global real estate professionals to offer shares of their trust on an exchange where anyone can invest in these REITs seems promising – and profitable. With projects like private cryptocurrency-based REITs, the average person will in theory have more access to higher-value properties that they can pay for using their digital currencies exchanged for REIT shares.

It’s still fractional ownership, though.

I gotta be honest; I have mixed feelings about the viability of real estate investments, in general, though in the form of a REIT. Crypto-based REITs are something I can really get behind, and DAOs have some really fascinating potential, as well. It just feels like big money is still driving up prices and now the little guy is still having to settle for fractional ownership when – not too long ago – whole ownership was possible. It feels like another bandaid on a bigger problem of inequity that needs to be addressed in order for viable change to occur.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.