Welcome to the Decentral Weekly Crypto News Wrap-Up, where our colleagues Neil and Em review trending crypto news and debate, declare, or deny: “Is this a thing?”

This week’s news includes Facebook’s rebrand to Meta, Congress trying to regulate stablecoins, football players getting into Bitcoin, Ubisoft’s investment in play-to-earn games, and the SQUID scam.

Only because we have to...let’s talk about Meta

If there is one massive story in terms of cryptocurrency news in the past week, it would probably have to be Facebook’s rebrand to Meta.

The new name is a reference to the “metaverse,” which will be Facebook’s immersive digital world. Many cryptocurrency enthusiasts are ecstatic about the news, given the fact that this metaverse will likely require cryptocurrencies to pay for goods and services and NFTs to designate ownership of virtual property. Facebook has confirmed that the metaverse will support NFTs.

The new name is a reference to the “metaverse,” which will be Facebook’s immersive digital world. Many cryptocurrency enthusiasts are ecstatic about the news, given the fact that this metaverse will likely require cryptocurrencies to pay for goods and services and NFTs to designate ownership of virtual property. Facebook has confirmed that the metaverse will support NFTs.

A lesser-known cryptocurrency, Decentraland, benefited from the announcement. MANA, the native token of Decentraland, experienced a 400% surge thanks to the fact that it is a metaverse platform that enables users to purchase virtual land.

Will crypto be important to the metaverse? Will Facebook’s rebrand to Meta succeed, and could the metaverse “save” Facebook, given the fact that the company is going through some serious PR issues right now?

Neil says:

I can understand why investors and enthusiasts are excited about this cryptocurrency news. The metaverse will probably be a huge driving force in the NFT sector moving forward, even if you think that the idea is a bit dystopian.

Em says:

Considering everyone calls it boomerbook and Zuc is the meme poster-child of the internet, it’s understandable why they’re trying to do something “cool.” The only problem is that, at least in my circles, nobody thinks it’s cooooooooool.

Bottom line:

Neil thinks this is good cryptocurrency news, Emily is less impressed.

How “meta” are you feeling about Facebook turning “Meta”?

Comment on twitter using the hashtag #meta4meta and tag @decentralpub –> your tweet could be featured in an upcoming shout out

Mr. Rodgers gets paid in crypto

There was major cryptocurrency news for those who are both crypto and football enthusiasts. Aaron Rodgers, the quarterback of the Green Bay Packers, will be taking part of his salary in Bitcoin. (Aaron Rodgers also got Covid this week, but I digress…)

Rodgers also announced that he will be teaming up with CashApp to give away $1 million in Bitcoin to his fans. In the video, Rodgers was dressed up as John Wick for Halloween. He pointed out that Bitcoin could be “intimidating,” but hoped that the giveaway made it more accessible. He began the video by stating, “Bitcoin to the moon.”

Rodgers is not the only NFL player who has decided to take part of their salary in Bitcoin. Trevor Lawrence teamed up with Blockfolio previously to have some of his signing bonus placed into a cryptocurrency account.

Will it help with crypto adoption if athletes are getting paid in crypto?

Neil says:

Sure, I think this is pretty good PR for Bitcoin, and he’s a pretty famous quarterback. I’m not sure this is a major milestone, though – I think this is part of athletes realizing that cryptocurrency can make them a lot more money than just accepting fiat.

Em says:

Getting paid is getting paid, amirite? If Aaron Rogers wants to stack Sats, more power to him. I do wonder though…how deeply do these sports guys understand crypto? I’m not saying jocks are dumb but like…what do the Vitaliks of the world have going for them if Aaron Rodgers is a crypto whiz?

Bottom line:

Neil thinks this is a good look, Em questions Rodgers’ crypto knowledge.

Who’s right about the pro athletes’ influence on crypto adoption?

Ubisoft invests in “play to earn” games

Ubisoft is one of the largest gaming companies in the world, and it has created massive games such as Assassin’s Creed and Just Dance. It also has no problem repeatedly mentioning blockchain in its earnings calls, and it is clear that the video game company wants to begin developing “play to earn” NFT and blockchain-based video games.

There are billions of people who play video games in the world, and it’s obvious that blockchain technology has a lot to offer in the future in terms of enhancing the gaming experience. Mythical Games, a platform that allows for game creation with NFTs, recently just raised $150 million at a $1.25 billion valuation. It looks like the future of gaming will involve a whole lot of blockchain.

There are billions of people who play video games in the world, and it’s obvious that blockchain technology has a lot to offer in the future in terms of enhancing the gaming experience. Mythical Games, a platform that allows for game creation with NFTs, recently just raised $150 million at a $1.25 billion valuation. It looks like the future of gaming will involve a whole lot of blockchain.

Is this a major move for blockchain and gaming, or is Ubisoft just making the most logical move?

Neil says:

It’s very clear that NFTs—even if some people think they are overhyped—will revolutionize the gaming industry. There are billions of people who play games, so it only makes sense that Ubisoft would try to enter the space ASAP.

Em says:

Everyone goes where the money is. And right now, signs are pointing to money in P2E games. I think it’s a necessary move for gaming. Ubisoft is making smart moves, imo.

Bottom line:

Both Neil and Em think this is a thing, and that blockchain will be big for gaming.

Who’s right about the future of blockchain and gaming? Weigh in.

US Congress tries to regulate stablecoins

There’s a new report suggesting that stablecoins can transform the way Americans can pay for goods and services. This report was highly anticipated and recently released by the Biden administration. Apparently, the White House is very interested in regulating stablecoins.

A Treasury-led panel thinks that there should be a regulatory framework for stablecoins as soon as possible. The report also points out that stablecoins can disrupt the financial services industry by offering a quicker form of payment than many existing companies.

Jeremy Allaire, the founder of Circle, praised the report, claiming that it was “huge progress in the acceptance of stablecoins and provides a path for adoption.” Circle is a fintech startup that recently went public at a $4.5 billion valuation.

Is this really progress in terms of cryptocurrency regulation, or is Congress just dragging their feet?

Neil says:

I see so much news about crypto regulation and Congress that I’m not really sure exactly how to take it. I think the Bitcoin ETF was a good start, but I’m not sure that the U.S. Congress is going to be launching a stablecoin anytime soon. Even if they did, it might happen too late. It would be nice to see some more action here, but I’m not too optimistic.

Em says:

Of course it’s in the government’s interest to look for ways to regain a monopoly on the monetary system. A CBDC would be a step in that direction and regulating stablecoins is a step toward a step in that direction. But, if they actually manage to shake up the crypto space by regulating stablecoins, people will be mad.

Bottom line:

Neil doesn’t think this is a thing, Em thinks it could be.

Who’s right about the future of CBDC?

Will the real Satoshi please stand up?

There has been all sorts of speculation regarding who Satoshi Nakamoto is, whether it’s a person or a group of people, or whether Bitcoin was created by NSA researchers. The question is now more relevant thanks to a new trial.

The trial centers around a staggering $69 billion worth of Bitcoin, around 1.1 million Bitcoin. This is a civil trial regarding Craig Wright, an Australian computer scientist, and Ira Kleiman. Kleiman alleges that his late brother helped Craig Wright with the early development of Bitcoin, and is entitled to a share of the Bitcoin wallet. Wright has repeatedly claimed to be Satoshi Nakamoto, to the skepticism of the majority of the crypto community.

The trial centers around a staggering $69 billion worth of Bitcoin, around 1.1 million Bitcoin. This is a civil trial regarding Craig Wright, an Australian computer scientist, and Ira Kleiman. Kleiman alleges that his late brother helped Craig Wright with the early development of Bitcoin, and is entitled to a share of the Bitcoin wallet. Wright has repeatedly claimed to be Satoshi Nakamoto, to the skepticism of the majority of the crypto community.

Craig Wright supposedly began distancing himself from David Kleiman (Ira’s brother) after his death. The suit alleges that Wright formed a partnership with David, but Wright has repeatedly denied this claim. The trial is expected to last three weeks. While the court won’t directly rule that either individual is Satoshi, it certainly is a legal battle that many in the crypto sector will be watching.

Neil says:

Craig Wright is a bit of a clown when it comes to the crypto sector. That tends to happen when you’re the kind of person who claims to be Satoshi, but there are all sorts of holes in his logic. I’m honestly not sure this trial is important besides the fact that it’s such a massive amount of money.

Em says:

If you have a million BTC, you’re gonna be a target. Good guy, bad guy, neutral guy—doesn’t matter. I think these kinds of fights are bound to happen because people want to get their cut of anything they can. The question is, how much will big chunks of the supply moving around rattle the market?

Bottom line:

Neil doesn’t think this is a thing, Em thinks it only matters if it rattles the market somehow.

Who’s right? Will pseuds keep pretending to be Satoshi?

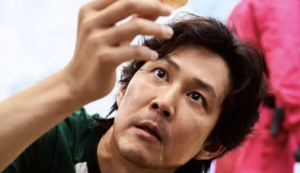

Bad idea of the week: Squid Game scammers cash out

Squid Game is a South Korean survival drama series that has now become the most-watched show in Netflix history. If you’re reading this, there’s a good chance that you’ve seen it (did you know that the series was rejected for nearly a decade?)

All of a sudden, there was a cryptocurrency associated with the show, called SQUID. The cryptocurrency exploded 2400% in 24 hours, and its whitepaper claimed that the token presale sold out within one second. If all that sounds too good to be true, that’s because…it is.

All of a sudden, there was a cryptocurrency associated with the show, called SQUID. The cryptocurrency exploded 2400% in 24 hours, and its whitepaper claimed that the token presale sold out within one second. If all that sounds too good to be true, that’s because…it is.

Yes, that’s right—the Squid Game cryptocurrency was a massive scam, and SQUID plunged to $0. This may have been one of the more obvious in terms of crypto scams, but that didn’t stop investors from losing around $2.67 million.

Neil says:

I’m a huge fan of the show, but this is definitely one of those depressing scams that give crypto a bad name. It’s a bit ironic given the fact that the show is about a game where players participate for money because they are down on their luck. That being said – this was one of the most obvious crypto scams in recent history.

Em says:

Wellllllll, if you bought into SQUID, I hope for your sake you did it for the lolz. If you can’t spot a sh*tcoin as obvious as that one, you might want to stick with a target-date fund in your 401K—that would get you more positive news to look forward to re: your portfolio.

Bottom line:

Both Neil and Em agree that this was a bad investment, and an obvious scam.

We have a consensus! Do you agree?

Meme of the week

We hope you enjoyed your weekly wrap-up of the cryptocurrency news!

Here is your beloved meme of the week.

This meme is just too good, given the fact that it uses Squid Game dialogue to poke fun at the recent SQUID cryptocurrency debacle. We urge you to stay away from any and all hype cryptocurrencies inspired by popular TV shows. Until next week!