Welcome to the Decentral Weekly Crypto News Wrap-Up for the week as of October 15, 2021, where our colleagues Neil and Emily discuss cryptocurrency-related headlines and debate, declare, or disagree: “Is this a thing?”

Still no word from Mr. Goxx, but between the Fed, Edward Snowden, and big brands jumping on the NFT bandwagon, there is so much to discuss in the cryptocurrency world this week.

Lucky for you, we are still reading all the juicy crypto headlines so that we can provide a weekly wrap-up for you to peruse.

NFTs: brands are overdoing it and it’s getting weird

It doesn’t matter how massive the hype; there’s always a limit where the “new thing” goes too far. NFTs have been a red hot commodity over the past year, but it looks like the trend might be cooling off. Even though more money is pouring into NFTs than ever before, there’s something to be said for understanding when corporations are hopping on a trend—well—JUST to hop on, and nothing more.

We reported previously that TikTok was going to get in on the NFT action with none other than music megastar Lil Nas X, but it looks like things are getting rocky. How, you ask? Well, one massive problem is that the NFT never dropped. On top of that, Bella Poarch is apparently thinking about pulling out of the program, and this is AFTER a Lil Uzi Vert-related NFT scandal.

The “Macarena” was massive, but it had its moment. These scandals could potentially mean that the average investor begins viewing NFTs as a “fad” rather than a real sector, the same way that we all collectively decided that a summer anthem outlasted its stay, or that a TV show is more cringeworthy than we’d like to admit. The TikTok NFT partnership already appears to be flopping, and TikTok is one of the most popular apps in the world.

These are problems that don’t even take into account the environmental concern surrounding NFTs. Will this affect the NFT market moving forward, or not really?

Neil says:

Yeah, this is a pretty terrible week for the NFT space. Lil Nas X is a superstar, so the fact that the TikTok NFT didn’t even drop isn’t good publicity. This might not be cryptocurrency news that affects someone who already knows about NFTs, but it could pose a publicity problem in the future. The environmental debate about NFTs will continue, but with scams on top of that? It could get ugly.

Em says:

Say what you want about NFTs, but they’ve penetrated pop culture in a way that even Bitcoin hasn’t. Of course, Bitcoin built the credibility that crypto now has as a foundation, but NTFs are everywhere because they have cache in the culture. It’s not for nothing.

Bottom line:

Neil thinks there’s a chance, but Em thinks NFTs are just as solidified as Bitcoin at this point.

Who’s right?

Comment on twitter using the hashtag #NFTbandwagon and tag @decentralpub –> your tweet could be featured in an upcoming shout out

60 more days: SEC postpones decisions again, but approves Crypto ETF

One of the most frustrating aspects of cryptocurrency news over the past several years is the fact that the U.S. government doesn’t seem too interested in finding any solutions. For years, there has been talk about “regulation,” but the SEC has failed to make concrete decisions regarding cryptocurrency, how it should be regulated, and how it should be taxed.

It appears as though this trend will only continue for the time being, considering that the SEC decided to extend the decision timeline for four Bitcoin ETFs. This has happened various times before, but many believed that Gensler, who has been vocal about his support for an ETF for some time now, would offer some concrete regulation rather than continued delays.

Are these just the same old delays…when will this ever be resolved? When will there FINALLY be some real guidance regarding cryptocurrency regulation?

Neil says:

I think a decision has to be made soon. It’s been a long time coming, and it will finally be the cryptocurrency news that so many have been waiting for. While some might say “It took long enough,” I think it could also help propel Bitcoin to all-time highs, depending on the timing.

Em says:

No surprise. Postponing things and slow motion innovation is kind of a baseline for government operations. I’d be more surprised if they actually accomplished something, to be honest. Keep holding your breath, everyone.

Bottom line:

Neil thinks the decision will come soon, but Em thinks this is par for the course.

Who’s right?

Corporate cash grabs or legitimate research?

It wasn’t too long ago that many traditional financial institutions were downplaying Bitcoin, or arguing that cryptocurrencies would never be that much of a factor in finance. It seems as though all of them are singing quite a different tune these days. In fact, they seem to be going out of their way to let potential clients know that they are researching the space.

Bank of America is apparently now releasing crypto reports. They aren’t the only financial company interested in diving into crypto, either. Apparently, Visa sees massive potential in a future “universal payment channel” across interconnected blockchain networks. As if that wasn’t enough, apparently even Morgan Stanley wants to get in on the action. Is this important cryptocurrency news or just a corporate cash-grab?

It might feel satisfying to actually SEE Bank of America admit that crypto is “too large to ignore,” but will they actually bring any value to the sector? In a sector that values decentralization, is there REALLY a place for these corporations?

Neil says:

This all seems very artificial to me. This is clearly more about PR than any meaningful research, and I don’t really know how committed they are to actual research or investment. It’s really just about being backed into a corner because crypto is here to stay.

Em says:

Well, I think this was an inevitable outcome. Crypto is too big to ignore now, even though institutions are late to the game. I say, let them join the fun. The pace fintech evolves at will just leave them behind again anyway.

Bottom line:

Neil leans towards no, while Em feels like it could be a good thing.

Who’s right?

Six new billionaires

In a world where global business has had to deal with the wrath of an unrelenting pandemic, there’s been some good cryptocurrency news. There are now six new crypto billionaires on the Forbes 400 list, with a combined wealth of somewhere around $55.1 billion dollars. These six individuals have landed on the list of the nation’s richest people. Check back for new profiles we’re releasing on crypto billionaires.

The billionaires are not too surprising to anyone who follows the cryptocurrency sector closely. The six include Brian Armstrong and Fred Ehrsam, co-founders of Coinbase. Coinbase is one of the largest and most influential cryptocurrency companies in the world. Jed McCaleb also joined the list, who is famous for founding Mt. Gox, an early cryptocurrency exchange that was hacked and closed down in 2014.

Forbes remains one of the most prestigious business publications in the world, and they are world-renowned for their “lists” specifically. While these new additions might not single handedly lead to massive retail investor interest, it does help to legitimize the sector and bring in new eyeballs and investors that may not otherwise be interested.

Neil says:

The world doesn’t exactly love billionaires right now. It’s obvious that this proves that wealth is possible, but I’m not sure it’s the kind of cryptocurrency news that gets people that excited. Regardless, it might be inspiring to future investors/traders.

Em says:

Millennials and everyone younger feel shafted by legacy economics. They can’t earn, they can’t save, they’re unwillingly getting drowned in debt. Crypto finally gives them their own way to “make it” and that’s hopeful! I think we can expect more of this.

Bottom line:

Neil thinks this isn’t much of a thing, but Emily disagrees.

Who’s right?

Edward Snowden weighs in on crypto

For those who don’t know, Edward Snowden is arguably the most famous whistleblower in the world. A former NSA agent, Snowden leaked documents regarding various global surveillance programs. He is a polarizing figure, with many Americans divided over whether Snowden was justified in revealing classified documents, even if it exposed illegal and/or unconstitutional activity.

Whether you like him or not, Snowden’s opinion on anything technology-related is bound to hold weight. Some Americans view Snowden as a modern hero of our times, thankful for the fact that he exposed global surveillance programs that the government didn’t know about. Others feel like Snowden betrayed his country, or should come back to America to face his charges. For crypto enthusiasts, you can count this as overall positive cryptocurrency news.

Snowden tweeted on October 3, 2021, pointing out that Bitcoin was up around “10x” since a March 2020 tweet where he claimed that he was interested in buying the cryptocurrency for the first time. Snowden pointed out that Bitcoin was resilient, even despite the recent China crypto ban.

While this might not be monumental cryptocurrency news, the fact that Snowden is now pro-crypto is probably a net positive for the crypto markets.

Neil says:

I think Snowden’s opinion definitely means something, even if you’re not a fan. If you have almost 5 million Twitter followers, and you’re respected in the tech world—your voice “matters” in the crypto sector, 100%. Good to see him on board.

Em says:

Edward Snowden is a big voice in tech. And he definitely sees himself that way with the way he tweets. Big voices do influence people, but Snowden is a refugee for a reason. Should the Elons and the Snowdens of the world be the biggest factors in adoption?

Bottom line:

Neil thinks this is a thing, but Emily isn’t the biggest fan.

Who’s right?

The Fed launches digital currency review committee

Well, well, well.

Well, well, well.

It appears as though officials at the Federal Reserve want to study whether creating its own digital currency is a smart move. On behalf of Decentral, I’d like to honor the Fed with the “Late to the Party” award. This is also apparently a passive-aggressive party, considering Jerome Powell was bashing cryptos several months ago, suggesting they were mere vehicles for speculation. Now, they’re thinking about launching a CBDC (central bank digital currency).

It’s strange to think that the Fed suddenly believes that ITS version of cryptocurrency is valid, given the fact that the existence of a federal reserve isn’t something that many cryptocurrency die-hards are excited about. The Fed has been exploring the concept of a digital dollar for some time now, and this certainly doesn’t mean that they are embracing crypto—as much as trying to see how they can make blockchain technology work for their purposes.

Many crypto investors would argue that the Federal Reserve and the crypto sector are at odds, given that one is a centralized institution and the other sector hopes to emphasize the importance of decentralization.

Is this just a means to try to control or regulate the sector?

Neil says:

It makes sense that a “digital dollar” can solve all sorts of problems. I’m not really sure how the crypto community would react to a stablecoin issued from a central bank…but I don’t think it’s good for the sector. Maybe it’s inevitable, but right now, it doesn’t even seem like they can agree on much.

Em says:

Most governments in the world are looking into CBDCs. Of course the USA has to do it also. They don’t want to get caught with their pants down if when crypto creeps up on fiat adoption. But, I suspect they’re just trying to find a new way to restore their monopoly on trust.

Bottom line:

Neil thinks this is bad cryptocurrency news, but Emily thinks this is just about credibility.

Who’s right?

This week’s bad idea: mining at the office on the taxpayers’ dime

There is some cryptocurrency news that is just terrible publicity, no matter how you try and spin it. This week’s bad idea belongs to Christopher Naples, a Suffolk County IT supervisor who was running a cryptocurrency mining operation out of a government office. Apparently, Naples was mining so much cryptocurrency that it inflated the electricity bill by $6,000.

He was charged, but apparently investigators are still trying to find out whether he profited from the scheme. Naples was charged with public corruption, grand larceny, computer trespass, and official misconduct. Incredibly, at least ten of the machines had been running since February.

Naples had been a county employee since 2020. The mining devices were hidden under floorboards, inside server racks, and even inside an electrical wall panel. The devices were found in six separate rooms.

Neil says:

Well, if he made some money…it will probably go to legal fees. It’s pretty nuts that he decided to use taxpayer resources to do this, and it’s more surprising that he didn’t get caught earlier.

Em says:

Ummmmmmmm…where to begin. You go to the trouble of hiding your mining rig in the floorboards, meanwhile, the electricity bill ran up $6k. Seems like a flawless plan, tbh. Don’t know how he got caught.

Bottom line:

Both Neil and Emily think this was a very bad idea.

Looks like we got a consensus!

Meme of the week

We hoped you enjoyed your weekly wrap-up of the cryptocurrency news from Decentral Publishing!

Here is your beloved meme of the week.

Take some time away from refreshing your headline news app while you wait for the Fed to approve ETFs … and we’ll see you next week.

How’d you like to live in a castle? That’s right. There’s a private hospital that claims to be the first center in the world to treat cryptocurrency addiction, and it’s run out of

How’d you like to live in a castle? That’s right. There’s a private hospital that claims to be the first center in the world to treat cryptocurrency addiction, and it’s run out of  As both novice and expert crypto traders know, Bitcoin’s price determines a lot in the cryptocurrency markets. This is one reason why many experts were concerned that Bitcoin had dipped down—twice—near the

As both novice and expert crypto traders know, Bitcoin’s price determines a lot in the cryptocurrency markets. This is one reason why many experts were concerned that Bitcoin had dipped down—twice—near the  Facebook is one of the most powerful tech companies in the world, but it has been having a terrible week. First, Facebook, Instagram, and Whatsapp

Facebook is one of the most powerful tech companies in the world, but it has been having a terrible week. First, Facebook, Instagram, and Whatsapp  What happens when one of the hottest “crypto trends” in cryptocurrency news teams up with the “trendiest” platform, famous for challenges, dances, and teenage discourse? You’ve guessed it: NFTs are coming to TikTok!

What happens when one of the hottest “crypto trends” in cryptocurrency news teams up with the “trendiest” platform, famous for challenges, dances, and teenage discourse? You’ve guessed it: NFTs are coming to TikTok!  Last week, we spoke about how El Salvador was embracing Bitcoin, and how the president of El Salvador, Nayib Bukele, seems to believe that Bitcoin will play a critical role in improving the country’s economy. Bukele, who many consider to be authoritarian and

Last week, we spoke about how El Salvador was embracing Bitcoin, and how the president of El Salvador, Nayib Bukele, seems to believe that Bitcoin will play a critical role in improving the country’s economy. Bukele, who many consider to be authoritarian and

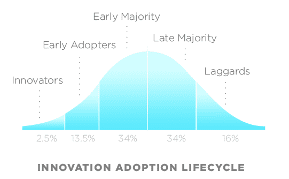

Well, chances are the adoption train will keep chugging in the next year.

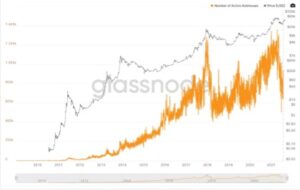

Well, chances are the adoption train will keep chugging in the next year. The number of active Bitcoin addresses has been steadily climbing, as well, almost doubling between January of 2020 and April of 2021. Active addresses are volatile, just like the price of Bitcoin, and have dipped in the second half of 2021, but the trend continues upward on the whole. In fact, by the time you read this article, Bitcoin will have reached another all-time high.

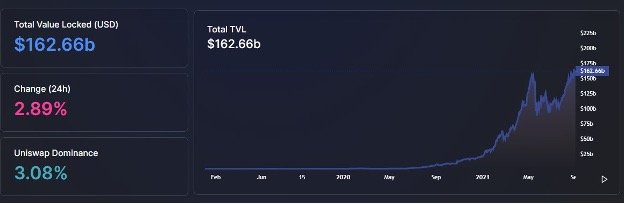

The number of active Bitcoin addresses has been steadily climbing, as well, almost doubling between January of 2020 and April of 2021. Active addresses are volatile, just like the price of Bitcoin, and have dipped in the second half of 2021, but the trend continues upward on the whole. In fact, by the time you read this article, Bitcoin will have reached another all-time high. The summer of 2020 was a huge DeFi extravaganza as investment dollars flowed into the ecosystem, and in August, asset value was growing by nearly half a billion dollars a week. In the ensuing year, DeFi continued to explode and by August of 2021, it had more than $160 billion total value locked (TVL). This growth is expected to continue into 2022 as more new projects get off the ground.

The summer of 2020 was a huge DeFi extravaganza as investment dollars flowed into the ecosystem, and in August, asset value was growing by nearly half a billion dollars a week. In the ensuing year, DeFi continued to explode and by August of 2021, it had more than $160 billion total value locked (TVL). This growth is expected to continue into 2022 as more new projects get off the ground. If you’ve been following cryptocurrency news for a while, you may not be too surprised to find out that China has recently

If you’ve been following cryptocurrency news for a while, you may not be too surprised to find out that China has recently  Since we started off with some bad news, let’s move on to something more fun: a hamster that is better at managing their portfolio than you may be. That would be the cryptocurrency trading hamster, Mr. Goxx, who lives on Twitch and has captured the hearts of many crypto traders. The hamster already boasts

Since we started off with some bad news, let’s move on to something more fun: a hamster that is better at managing their portfolio than you may be. That would be the cryptocurrency trading hamster, Mr. Goxx, who lives on Twitch and has captured the hearts of many crypto traders. The hamster already boasts  For those new to the cryptocurrency space, a crypto mystery has plagued the community for years. What

For those new to the cryptocurrency space, a crypto mystery has plagued the community for years. What  It might not have been publicized that much, but there’s something different about Twitter. Yes, the

It might not have been publicized that much, but there’s something different about Twitter. Yes, the  Several weeks ago, there was a huge milestone for countless cryptocurrency enthusiasts: a country

Several weeks ago, there was a huge milestone for countless cryptocurrency enthusiasts: a country  There are several stablecoins out there, and they serve a real purpose for the DeFi sector. However, all stablecoins are not necessarily equal in the eyes of the cryptocurrency investor. Tether has had all sorts of issues, with some critics calling it

There are several stablecoins out there, and they serve a real purpose for the DeFi sector. However, all stablecoins are not necessarily equal in the eyes of the cryptocurrency investor. Tether has had all sorts of issues, with some critics calling it