Welcome to the Decentral Weekly Crypto News Wrap-Up, where our colleagues Neil and Em review trending crypto news and debate, declare, or deny: “Is this a thing?”

This week’s news includes Facebook’s rebrand to Meta, Congress trying to regulate stablecoins, football players getting into Bitcoin, Ubisoft’s investment in play-to-earn games, and the SQUID scam.

Crypto market hits $3 trillion

Well, it’s been an incredible couple of weeks for crypto investors. Both Bitcoin and Ether have made new all-time highs, and the cryptocurrency markets have now hit $3 trillion. It’s quite a massive milestone for the sector, as it is clear that crypto markets are more “mainstream” than they were just a year ago.

Well, it’s been an incredible couple of weeks for crypto investors. Both Bitcoin and Ether have made new all-time highs, and the cryptocurrency markets have now hit $3 trillion. It’s quite a massive milestone for the sector, as it is clear that crypto markets are more “mainstream” than they were just a year ago.

The market cap of cryptocurrencies recently topped the $2 trillion mark several months ago. It’s clear that there is currently a lot of money flowing into crypto, and that momentum isn’t slowing down anytime soon. One of the reasons for the money flow is the rise of the DeFi sector. The rise of NFTs is undoubtedly another reason why there are more cryptocurrency investors than ever before.

The $3 trillion is a massive W in terms of cryptocurrency news…but is it really a major milestone?

Neil says:

This is obviously something we won’t disagree on: the $3 trillion milestone is massive, especially considering we just recently hit the $2 trillion mark.

Em says:

If you’re here, you love to see it. Why would any of us be interested in what crypto is doing unless we wanted it to succeed. (…lookin’ at you, Peter Schiff.)

Bottom line:

This is definitely a “thing”…and one of the biggest cryptocurrency news stories of Q4 2021.

We have a consensus – duh!

Is the flippening finally coming?

There’s been all sorts of positive cryptocurrency news, especially with major cryptocurrencies making all-time highs. However, some analysts are making quite a bold prediction. These people believe in “the flippening,” or the idea that Ethereum will “flip”—or overtake —Bitcoin’s market capitalization.

It’s understandable that some people may think that Ether will eventually overtake Bitcoin, especially with the rise of the DeFi sector. There’s also the fact that Ethereum has tripled its market capitalization in the same time that Bitcoin’s has doubled. Some crypto experts believe that even if it doesn’t happen soon, that the flippening is inevitable.

Of course, many analysts disagree on exactly when this will happen. Rahul Rai, a Gen Z crypto hedge fund manager, thinks that it could happen in as soon as six months. Others believe that it may take years.

Is “the flippening” something really worth considering?

Neil says:

There’s no way that the flippening is happening anytime soon. Is it ultimately possible down the line? Sure. It’s way too early to talk about it, though. I’m not sure that will happen in the cryptocurrency markets until many years from now.

Em says:

Ethereum is great. I really do hope it gets the updates rolled out and the network improved. I certainly don’t want to see ETH fail. Can it catch up with Bitcoin, though? Nah. I don’t think so. The flippening is fun to think about but if that happens for real, I’ll be shocked.

Bottom line:

Neil thinks this could be a thing, Em disagrees.

Who’s right about “the flippening”?

Comment on twitter with your predictions using the hashtag #theflippening and tag @decentralpub –> your tweet could be featured in an upcoming shout out

Zimbabwe may take the leap into crypto

One of the biggest cryptocurrency news stories of the year is the fact that El Salvador was the first country to designate Bitcoin as legal tender. Many crypto investors and enthusiasts have been wondering about which country will be second. In fact, El Salvador recently announced that it would use Bitcoin profits to build 20 new schools.

One of the biggest cryptocurrency news stories of the year is the fact that El Salvador was the first country to designate Bitcoin as legal tender. Many crypto investors and enthusiasts have been wondering about which country will be second. In fact, El Salvador recently announced that it would use Bitcoin profits to build 20 new schools.

It makes sense that an African country would be next: crypto adoption is up 1,200% over the past year, according to Chainalysis. Zimbabwe’s finance minister, Mthuli Ncube, previously called crypto “unstoppable.” It was rumored recently that Zimbabwe was in talks to embrace Bitcoin, which would be big news for the cryptocurrency markets.

One thing is for sure: more countries recognizing Bitcoin as legal is only positive for the cryptocurrency industry. Zimbabwe may take some time to decide, but this is certainly a good sign. The minister has publicly dismissed this idea, suggesting that Zimbabwe is more interested in a central banking digital currency.

El Salvador made the first move…will Zimbabwe follow suit soon?

Neil says:

Zimbabwe may not be a “power player,” but we’re already seeing some positive results from the El Salvador “experiment.” I think these first countries are really important, and it could end up helping their economies. Zimbabwe might not commit to anything publicly, but it seems like there’s a reason for the rumors.

Em says:

Honest question: could you point out Zimbabwe on a map? Be honest. No shade to Zimbabwe, but when the big players take the leap, that’s when my head turns. The Bahamas already has a CBDC but still everyone talks about China. Good for Zimbabwe, but frankly, it’s a small fish.

Bottom line:

Neil thinks this could be a thing, Em thinks Zimbabwe isn’t much of a factor.

Who’s right about Zimbabwe? Weigh in.

Eric Adams really really REALLY loves crypto

If there is one mayor in the United States right now that is making it very clear that they are supporting the cryptocurrency markets, it would have to be Eric Adams, the Mayor of New York City.

If there is one mayor in the United States right now that is making it very clear that they are supporting the cryptocurrency markets, it would have to be Eric Adams, the Mayor of New York City.

Eric Adams made news because he plans on taking his first three paychecks in Bitcoin, and claimed that New York City would soon be “the center of the cryptocurrency industry.” This is partially in response to Miami mayor Francis Suarez, who announced he would take his next check in Bitcoin on November 2. It all started because of a tweet from cryptocurrency influencer/podcaster Anthony Pompliano, who asked on Twitter: “Who is going to be the first American politician to accept their salary in Bitcoin?”

Adams is clearly taking things a step further, now suggesting that crypto should be taught in schools. He will also play a role in launching the New York City Coin (NYCCOIN). The cryptocurrency is being launched by CityCoins, who also did something similar in Miami. The MiamiCoin was the company’s first “CityCoin to market.”

Does Eric Adams really care about crypto, and if he does…is he going a little too far with this?

Neil says:

You’re the mayor of one of the most important cities in the world. It’s a bit weird to be a mayor and getting into a social media contest about who loves crypto more. In a pandemic where parents are trying to make sure their kids are well-adjusted and well-educated, saying that “schools should teach crypto” is too much pandering.

Em says:

Do I like Eric Adams? No. Do I like most politicians? Again, no. Buuuuuut…. no press is bad press, right? Most people pay attention to politics at the same level that they pay attention to crypto: only headlines. So, go hype BTC and do your part, Eric. That’s all we need from you.

Bottom line:

Neil thinks this comes across as forced, Em cares more about the PR.

Who’s right about Eric Adams’ enthusiasm? Weigh in.

Kevin Durant gets SPAC fever

If there’s one major non-crypto finance trend that has dominated the news, it has to be the rise of the SPAC. A SPAC is a special purpose acquisitions company that essentially acts like a shell company, but it allows companies to raise money to eventually acquire another company.

Okay, that’s nice, but what does it have to do with cryptocurrency news? Kevin Durant is apparently looking to launch a $200 million SPAC named Infinite Acquisition Corp. Durant will be launching it with his business partner Richard Kleiman, and the SEC filing specifically highlights digital assets and cryptocurrency.

Durant is no stranger to crypto profits, as he was an early Coinbase investor. Is this SPAC a good move for the crypto sector?

Neil says:

Durant isn’t new to crypto. If you’re an early Coinbase investor, I can see why you would double down on the sector. I like that crypto is democratic in that sense…the hedge fund world may not care about athletes, but the cryptocurrency sector embraces them. That’s smart.

Em says:

I’ve said before that sports interest me exactly zero. Sports guys making headlines in crypto news keeps happening, and good for them. The fact that they’re in the news doesn’t make me, personally, care more.

Bottom line:

Neil thinks this could be a thing, Em doesn’t care about sports or sports influencers.

Who’s right?

Bad idea of the week: FTX might have stolen Jack In The Box's logo

It wouldn’t be a cryptocurrency news wrap-up without our bad idea, and it involves…a fast-food lawsuit. Jack In The Box is suing FTX, the cryptocurrency exchange, claiming that it stole its mascot and made a “far inferior version.” FTX’s mascot is named Moon Man, and the lawsuit claims that FTX infringed on its IP and diluted its trademark.

It wouldn’t be a cryptocurrency news wrap-up without our bad idea, and it involves…a fast-food lawsuit. Jack In The Box is suing FTX, the cryptocurrency exchange, claiming that it stole its mascot and made a “far inferior version.” FTX’s mascot is named Moon Man, and the lawsuit claims that FTX infringed on its IP and diluted its trademark.

FTX was founded by crypto-billionaire Sam Bankman-Fried. The exchange was recently valued at $25 billion, and Bankman-Fried is considered to be one of the most influential people in the cryptocurrency sector. FTX is quite critical to the cryptocurrency markets in general, processing billions of dollars in volume daily.

Is this lawsuit really a big deal, and was it a bad idea for FTX to use a mascot like this in the first place?

Neil says:

Yeah…I know both of these companies have lots of money for legal fees, but I’m not even sure that FTX can get out of this one. It’s possible that they knew this was coming and just planned for it, because the mascot is very obviously a rip-off. It’s obvious.

Em says:

So he has a blue mouth instead of a red one, a round nose instead of a pointy one, and a moon textured face instead of matte white…you could argue he looks different enough from Jack. Then I saw the commercial. Oof. Honestly, don’t know what this marketing team was thinking.

Bottom line:

Yeah… this was definitely a bad idea on FTX’s part. How hard is it to get a logo these days? Sheesh.

We have a consensus! Do you agree?

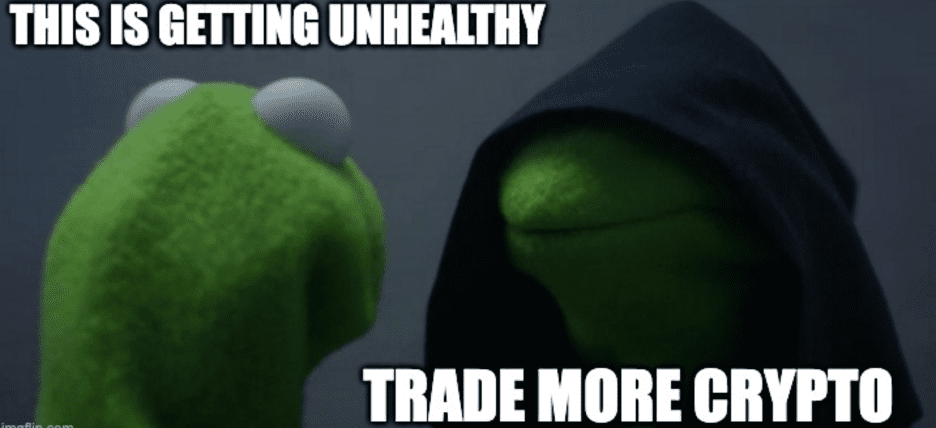

Meme of the week

We hope you enjoyed your weekly wrap-up of the cryptocurrency news!

Since we spoke about the flippening this week, it’s only right we offer you this meme:

See you next week!

The new name is a reference to the “metaverse,” which will be Facebook’s

The new name is a reference to the “metaverse,” which will be Facebook’s  There are

There are  The trial centers around a staggering

The trial centers around a staggering  All of a sudden, there was a cryptocurrency associated with the show, called SQUID. The cryptocurrency

All of a sudden, there was a cryptocurrency associated with the show, called SQUID. The cryptocurrency

It’s the latest dog-inspired cryptocurrency that is often compared to Dogecoin, another dog-inspired token that originally started as a joke. Its supporters even describe the cryptocurrency as the “dogecoin killer,” and it’s

It’s the latest dog-inspired cryptocurrency that is often compared to Dogecoin, another dog-inspired token that originally started as a joke. Its supporters even describe the cryptocurrency as the “dogecoin killer,” and it’s  Rand Paul is a well-known Republican senator from Kentucky. This isn’t the first time that Paul has made crypto news. He previously made headlines in 2015 when he announced that his campaign would

Rand Paul is a well-known Republican senator from Kentucky. This isn’t the first time that Paul has made crypto news. He previously made headlines in 2015 when he announced that his campaign would  Ether remains the second-largest cryptocurrency in the world. The Ethereum 2.0 Beacon Chain update has apparently

Ether remains the second-largest cryptocurrency in the world. The Ethereum 2.0 Beacon Chain update has apparently  There’s ONE little tiny baby minor catch [sarcasm]: Worldcoin wants to

There’s ONE little tiny baby minor catch [sarcasm]: Worldcoin wants to

The Bitcoin ETF was a major catalyst that was widely applauded by the cryptocurrency markets, so much so that Bitcoin has now made a new all-time high,

The Bitcoin ETF was a major catalyst that was widely applauded by the cryptocurrency markets, so much so that Bitcoin has now made a new all-time high,  It appears as though Coinbase has

It appears as though Coinbase has  Mariah Carey has had an incredible career in music, but it looks like she’s interested in crypto these days. The Queen of Christmas has teamed up with the cryptocurrency exchange Gemini, offering $20 worth of free Bitcoin once followers sign up for a Gemini account.

Mariah Carey has had an incredible career in music, but it looks like she’s interested in crypto these days. The Queen of Christmas has teamed up with the cryptocurrency exchange Gemini, offering $20 worth of free Bitcoin once followers sign up for a Gemini account.

Well, well, well.

Well, well, well.

How’d you like to live in a castle? That’s right. There’s a private hospital that claims to be the first center in the world to treat cryptocurrency addiction, and it’s run out of

How’d you like to live in a castle? That’s right. There’s a private hospital that claims to be the first center in the world to treat cryptocurrency addiction, and it’s run out of  As both novice and expert crypto traders know, Bitcoin’s price determines a lot in the cryptocurrency markets. This is one reason why many experts were concerned that Bitcoin had dipped down—twice—near the

As both novice and expert crypto traders know, Bitcoin’s price determines a lot in the cryptocurrency markets. This is one reason why many experts were concerned that Bitcoin had dipped down—twice—near the  Facebook is one of the most powerful tech companies in the world, but it has been having a terrible week. First, Facebook, Instagram, and Whatsapp

Facebook is one of the most powerful tech companies in the world, but it has been having a terrible week. First, Facebook, Instagram, and Whatsapp  What happens when one of the hottest “crypto trends” in cryptocurrency news teams up with the “trendiest” platform, famous for challenges, dances, and teenage discourse? You’ve guessed it: NFTs are coming to TikTok!

What happens when one of the hottest “crypto trends” in cryptocurrency news teams up with the “trendiest” platform, famous for challenges, dances, and teenage discourse? You’ve guessed it: NFTs are coming to TikTok!  Last week, we spoke about how El Salvador was embracing Bitcoin, and how the president of El Salvador, Nayib Bukele, seems to believe that Bitcoin will play a critical role in improving the country’s economy. Bukele, who many consider to be authoritarian and

Last week, we spoke about how El Salvador was embracing Bitcoin, and how the president of El Salvador, Nayib Bukele, seems to believe that Bitcoin will play a critical role in improving the country’s economy. Bukele, who many consider to be authoritarian and

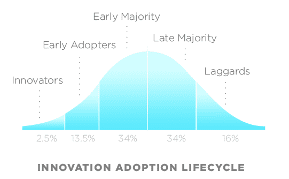

Well, chances are the adoption train will keep chugging in the next year.

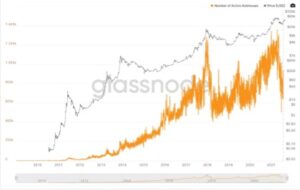

Well, chances are the adoption train will keep chugging in the next year. The number of active Bitcoin addresses has been steadily climbing, as well, almost doubling between January of 2020 and April of 2021. Active addresses are volatile, just like the price of Bitcoin, and have dipped in the second half of 2021, but the trend continues upward on the whole. In fact, by the time you read this article, Bitcoin will have reached another all-time high.

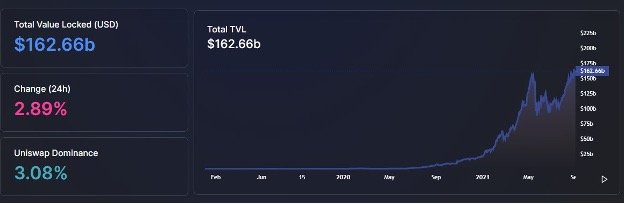

The number of active Bitcoin addresses has been steadily climbing, as well, almost doubling between January of 2020 and April of 2021. Active addresses are volatile, just like the price of Bitcoin, and have dipped in the second half of 2021, but the trend continues upward on the whole. In fact, by the time you read this article, Bitcoin will have reached another all-time high. The summer of 2020 was a huge DeFi extravaganza as investment dollars flowed into the ecosystem, and in August, asset value was growing by nearly half a billion dollars a week. In the ensuing year, DeFi continued to explode and by August of 2021, it had more than $160 billion total value locked (TVL). This growth is expected to continue into 2022 as more new projects get off the ground.

The summer of 2020 was a huge DeFi extravaganza as investment dollars flowed into the ecosystem, and in August, asset value was growing by nearly half a billion dollars a week. In the ensuing year, DeFi continued to explode and by August of 2021, it had more than $160 billion total value locked (TVL). This growth is expected to continue into 2022 as more new projects get off the ground. If you’ve been following cryptocurrency news for a while, you may not be too surprised to find out that China has recently

If you’ve been following cryptocurrency news for a while, you may not be too surprised to find out that China has recently  Since we started off with some bad news, let’s move on to something more fun: a hamster that is better at managing their portfolio than you may be. That would be the cryptocurrency trading hamster, Mr. Goxx, who lives on Twitch and has captured the hearts of many crypto traders. The hamster already boasts

Since we started off with some bad news, let’s move on to something more fun: a hamster that is better at managing their portfolio than you may be. That would be the cryptocurrency trading hamster, Mr. Goxx, who lives on Twitch and has captured the hearts of many crypto traders. The hamster already boasts  For those new to the cryptocurrency space, a crypto mystery has plagued the community for years. What

For those new to the cryptocurrency space, a crypto mystery has plagued the community for years. What  It might not have been publicized that much, but there’s something different about Twitter. Yes, the

It might not have been publicized that much, but there’s something different about Twitter. Yes, the  Several weeks ago, there was a huge milestone for countless cryptocurrency enthusiasts: a country

Several weeks ago, there was a huge milestone for countless cryptocurrency enthusiasts: a country  There are several stablecoins out there, and they serve a real purpose for the DeFi sector. However, all stablecoins are not necessarily equal in the eyes of the cryptocurrency investor. Tether has had all sorts of issues, with some critics calling it

There are several stablecoins out there, and they serve a real purpose for the DeFi sector. However, all stablecoins are not necessarily equal in the eyes of the cryptocurrency investor. Tether has had all sorts of issues, with some critics calling it