Welcome to the New Years Eve edition of the Decentral Weekly Crypto News Wrap-Up, where Neil and Em examine the latest crypto news and attempt to answer the age-old question: “Is this a thing?”

This week, we discuss the NFT boom, Snoop Dogg entering the metaverse, crypto Super Bowl Ads, Blockbuster Video, and more. If you’re confused, keep reading: we promise it will all make sense.

The NFT numbers are looking good

Even last week, we spoke about the fact that both Adidas and Nike plan on fighting it out for competition in the metaverse, and there are certainly many corporations that will follow suit. What does that mean for the NFT sector in general? Also, what can we conclude about the NFT boom of 2021?

Well, it generated over $23 billion in trading volume. The numbers come from DappRadar, and they are incredibly impressive when you consider that the NFT trading volume in 2020 was only $100 million! This was certainly “the year of the NFT,” but they certainly have many critics. Even Keanu Reeves isn’t a fan.

Should we still be cautious about NFTs, or is it time to admit that this is more than just a fad?

Neil says:

There’s no way to deny that NFTs had an incredible year. The issue is that I wonder whether many projects will lose their value this year or whether the momentum will continue. I wonder whether a lull in the NFT market could cause things to slow down in 2022.

Em says:

Of course this is the story. NFTs are literally the only crypto-related thing I hear about in mainstream gossip. No one outside crypto is talking about DeFi or P2E or Web3. It’s all NFTs all the time. Brands, celebs, institutions are all on the train. It is what it is.

Bottom line:

Em thinks this is a mainstream thing, Neil thinks it’s more of a “wait and see” thing now.

Who do you agree with?

Comment online and tag @decentralpub. Your comment could be featured in an upcoming article.

Snoop Dogg out to smoke the competition

Snoop Dogg might not dominate rap music the way that he once did in the 1990s, but he has certainly evolved as an entrepreneur. The New York Times recently profiled the hip-hop legend, pointing out that he never seems to dilute his brand despite being associated with so many various companies and ventures.

It looks like the real world might not be enough for Snoop Dogg’s ambitions. He has announced plans to create his own metaverse, the “Snoopverse.” If you thought that there’s no way his metaverse would be successful, let me point out that someone has already paid half a million dollars to be his neighbor. Not a bad start.

Snoop Dogg was recently mentioned as a “major” player in the metaverse, according to the Thomson Reuters Foundation News Twitter account. The account also mentioned companies like Boeing, platforms such as Decentraland, and main metaverse “builders” like Meta and Roblox.

Will the Snoopverse survive, or is this a short-term money play that we’ll forget about by next year?

Neil says:

Look, the thing about Snoop is that he’s everywhere: he’s a very brand-friendly rapper with credibility across generations. Will he become the new overlord of the new metaverse? No, but the fact that someone wants to pay that much to be his neighbor is a bullish sign, I would say. He’s been famous and relevant for 30 years now – I think this could be bigger than people realize.

Em says:

Yeah, I think this is a short-term money play. After all—that’s what we know Snoop for. His face is everywhere on every product. Does it mean anything? No. He just has a lot of name and face recognition. Obviously he’ll make a metaverse play, that’s what he does!

Bottom line:

Neil thinks Snoop is a sure thing, Em doesn’t believe that much in the Dogg.

Who do you agree with?

Kraken gets creative

In the first story, we talked about the NFT boom. Many crypto experts have been wondering about where the space goes from here. Will we see more NFT marketplaces pop up? Will NFTs be a driving force for DeFi for a long time, or is this just its moment in the spotlight?

Kraken is a cryptocurrency exchange that was founded in 2011. The exchange is reportedly working on a marketplace where NFTs can be used as collateral for loans. The CEO of Kraken, Jesse Powell, has previously stated that he hopes that Kraken can launch an NFT marketplace by February.

Powell thinks this is about moving into the “third phase” of NFTs: where users begin exploring more “functional uses.” Kraken recently made crypto news because it acquired Staked, a non-custodial staking platform. Will staking and loaning with NFTs help the “NFT craze” continue into the new year?

We just spoke about NFTs and if they are sticking around. In your opinion, does this make a difference? Is Kraken making a major move here, or not really?

Neil says:

See, now we’re talking. I can imagine how an NFT collector would be excited about the fact that they can actually loan and borrow crypto based on their NFTs. Even if you’re a big NFT skeptic, I think you have to admit that this would be a game-changer for Kraken. I imagine they’ll have competition soon, too – but yes: big move here.

Em says:

I think it’s to be expected with DeFi trying to make new ways to do financial services. However, I do also think it could be a bit dangerous because… I mean, let’s be real: do NFTs actually have enough real value to be used as collateral? Only time will tell, but it seems iffy to me.

Bottom line:

Neil thinks this is definitely a thing, Em thinks it’s “kind of” a thing.

Who do you agree with?

Crypto ads are coming to the Super Bowl

One of the biggest cryptocurrency stories of the past year is that the Staples Center will be renamed the Crypto.com arena. It doesn’t look like Crypto.com plans on slowing down on spending, either. Crypto.com will be running its first Super Bowl ad this year, and they aren’t alone.

FTX, the crypto exchange founded by billionaire Sam Bankman-Fried, will also be spending millions to reach a more mainstream audience. While details about the exact nature of the cryptocurrency-related ads are unavailable, the Wall Street Journal reports that NBCUniversal is asking for at least $6.5 million per 30-second advertisement.

There’s no bigger advertising event than the Super Bowl. Could this backfire, or is it safe to say that this is a win?

Neil says:

Yes, this is a big deal – but there’s a little bit of risk here. I imagine that one ad that backfires might actually do a lot of damage to the average viewer than most. Overall, this is great – but the stakes are higher in the Super Bowl. It’s possible that a lackluster ad could mean a big misfire for these companies. I hope the ad can remain memorable amongst the competition?

Em says:

I remember as a kid seeing GoDaddy ads and having no idea what a domain registrar was—but I knew the GoDaddy brand! Seems like this will be a similar thing. Everyone will still be like, umm what is crypto and what is FTX….but at least they’ll know the brand.

Bottom line:

Neil thinks this is a good thing that can backfire; Em thinks it’s a good, and nostalgic, thing.

Who do you agree with?

The case of the vanishing Bitcoin

We’ve talked about the fact that El Salvador has embraced Bitcoin to the point where the country was able to build schools thanks to crypto profits. Many El Salvador citizens are still not fans of cryptocurrency and protested the legislation. However, there is a bit more depressing crypto news this week: apparently, some of that Bitcoin is vanishing.

Hundreds of El Salvadorans are claiming that Bitcoin is disappearing from their accounts. An anonymous Twitter user who calls himself “El Comisionado” is exposing this, claiming that the government isn’t responding. He also thinks that Chivo wallets may not be secure.

The president of El Salvador, Nayib Bukele, is still very pro-crypto. He recently stated that the dollar was dead, and that Bitcoin was the future. He hasn’t commented on the stories of vanishing Bitcoin. In other crypto news, Turkey’s Parliament will soon be debating a new crypto law.

Should we stop using El Salvador as a positive example for Bitcoin? Is the bad PR worth it, or is it still too early to judge?

Neil says:

The good news is that this isn’t happening to a lot of people, but I should point out that this is kind of getting passed off as a “distraction” or a “failure” already. I’m not sure this is the best crypto news, and I wonder whether El Salvador will give us more negative crypto stories in 2022. I’m hoping that isn’t the case, but I’m not sure.

Em says:

Sure, this is some bad PR. But haters will always look for bad PR angles. From the reports, they only had 50 cases. In all of El Salvador, 50 is not that many. This is new tech, there will be bumps in the road. Of course they should be fixed, but they’re also to be expected.

Bottom line:

Neil thinks El Salvador might lead to more bad news, Em thinks it’s a minor bump in the road.

What do you think?

Bad idea of the week: Will ‘90s nostalgia help Blockbuster?

If there are any 20-year-olds reading this newsletter, you might scoff at the fact that people once went to a physical location to rent movies. Blockbuster Video boasted thousands of locations where families could check out movies and video games. Unfortunately, the company ended up filing for bankruptcy in 2010 amidst the rise of streaming services.

Blockbuster may be coming back…as a DAO. That’s correct: investors hope to raise at least $5 million to rebrand Blockbuster Video as a decentralized streaming service. The group is openly appealing to ‘90s nostalgia and claiming that they hope to “liberate the brand from purgatory.”

They plan to raise the cash through NFT sales. This marks a new trend of DAOs entering the “offline world,” with the concept of DAOs eventually replacing real corporations. One of the most interesting cryptocurrency stories of the past year, for example, was the fact that a group of investors wanted to purchase the Constitution.

BlockbusterDAO: All the ‘90s nostalgia aside, is this a good idea? Will it succeed?

Neil says:

I’m Team Blockbuster Video, it’s that simple. It was cool to grow up actually picking and choosing movies and video games and finding out what was good or not. I think a lot of millennials (who are into crypto) will be interested.

Em says:

The last vestiges of a nostalgic analog era are the perfect thing to tug on millennial heart strings. We all remember browsing Blockbuster in our youth. Meme culture and the inclination to avenge a lost but beloved brand should not have gone unnoticed!!

Bottom line:

PLOT TWIST: Both Neil and Em agree that it was a bad idea to ever DOUBT the mighty Blockbuster Video. The Constitution is cool, but…

What do YOU think?

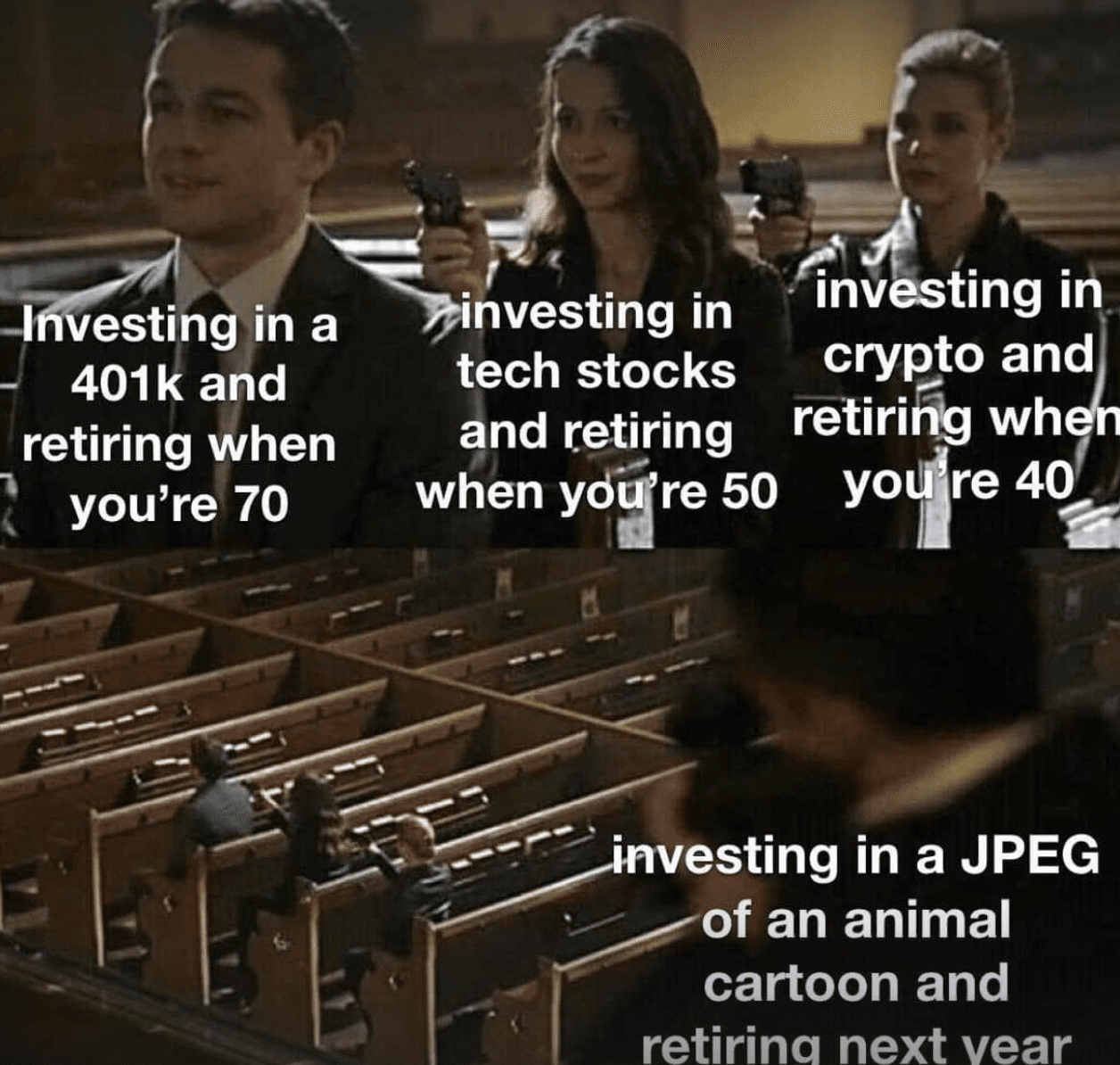

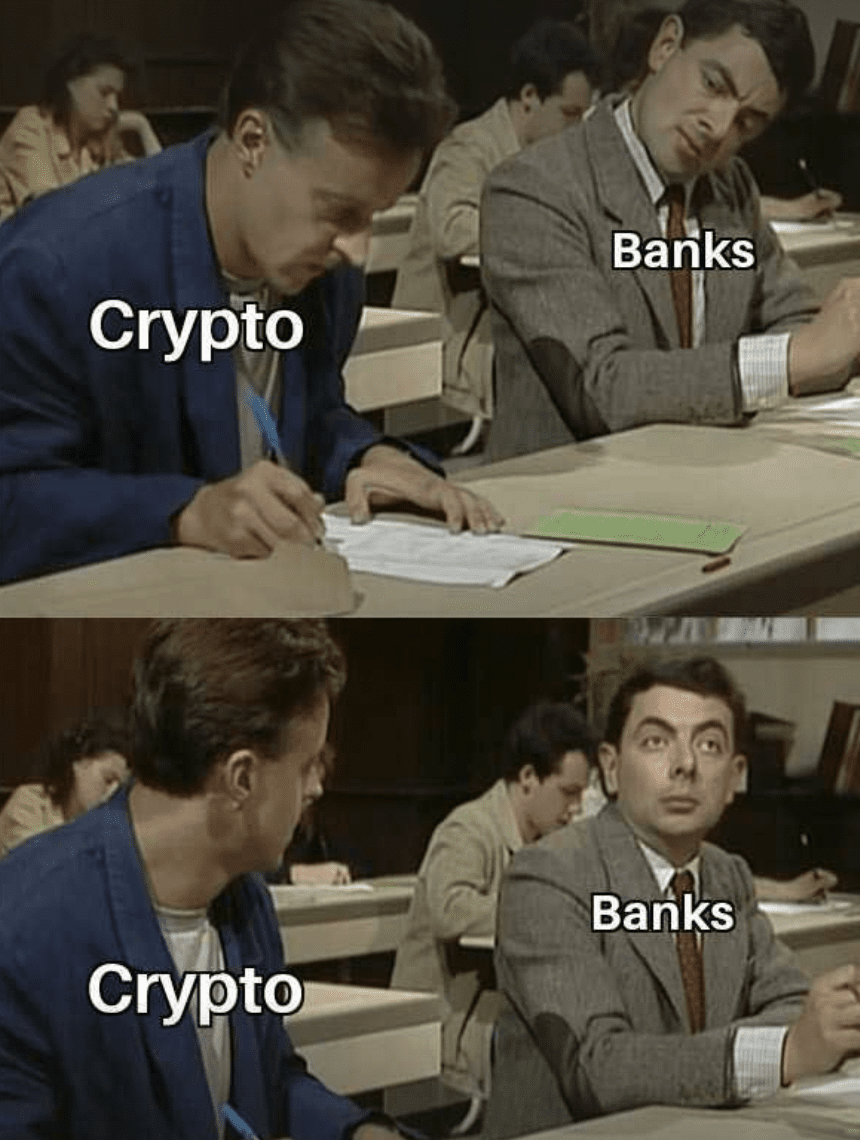

Meme of the week

As always, Em brings you your meme of the week:

Thanks for reading before you pop champagne tonight.

How was your year as far as cryptocurrency markets go? Did any of your coins “go to the moon?” Did you “ape” into a project and are now having doubts about it? Are you headed to Puerto Rico off your Solana gains?

Make sure to let us know at @decentralpub on Twitter.

This is the last Decentral Publishing Weekly Crypto News Wrap-Up of the year. The next time we’ll see you, it’ll be 2022. We’re not getting emotional, you are!

We will be back next week on January 7th with our first Decentral Publishing Weekly Crypto News Wrap-Up of the new year. Have a safe and Happy New Year!

If we are talking about weekly crypto news that sets social media on fire, we would have to talk about the

If we are talking about weekly crypto news that sets social media on fire, we would have to talk about the  Over the past several years, we’ve seen more traditional financial institutions embrace cryptocurrency. That trend doesn’t seem to be slowing down, and it’s no surprise that we are seeing more of that from Switzerland, one of the most

Over the past several years, we’ve seen more traditional financial institutions embrace cryptocurrency. That trend doesn’t seem to be slowing down, and it’s no surprise that we are seeing more of that from Switzerland, one of the most  It may be nearing Christmas time, but

It may be nearing Christmas time, but

The crypto news in 2021 has been dominated by NFTs: record NFT sales, NFT startups getting funding, and artists being able to make

The crypto news in 2021 has been dominated by NFTs: record NFT sales, NFT startups getting funding, and artists being able to make  PayPal remains a fintech giant, but it looks like good crypto news for bullish investors: Bitcoin is

PayPal remains a fintech giant, but it looks like good crypto news for bullish investors: Bitcoin is  We have seen various high-profile executives decide to make their way to the crypto sector, but this may take the cake. Jack Dorsey, the billionaire founder of Twitter, has decided to

We have seen various high-profile executives decide to make their way to the crypto sector, but this may take the cake. Jack Dorsey, the billionaire founder of Twitter, has decided to  Around this time last year, one of the biggest crypto news headlines was the fact that the U.S. government had seized the largest amount of cryptocurrency in history: to the tune of around $1 billion. What’s changed since then? Well, its

Around this time last year, one of the biggest crypto news headlines was the fact that the U.S. government had seized the largest amount of cryptocurrency in history: to the tune of around $1 billion. What’s changed since then? Well, its

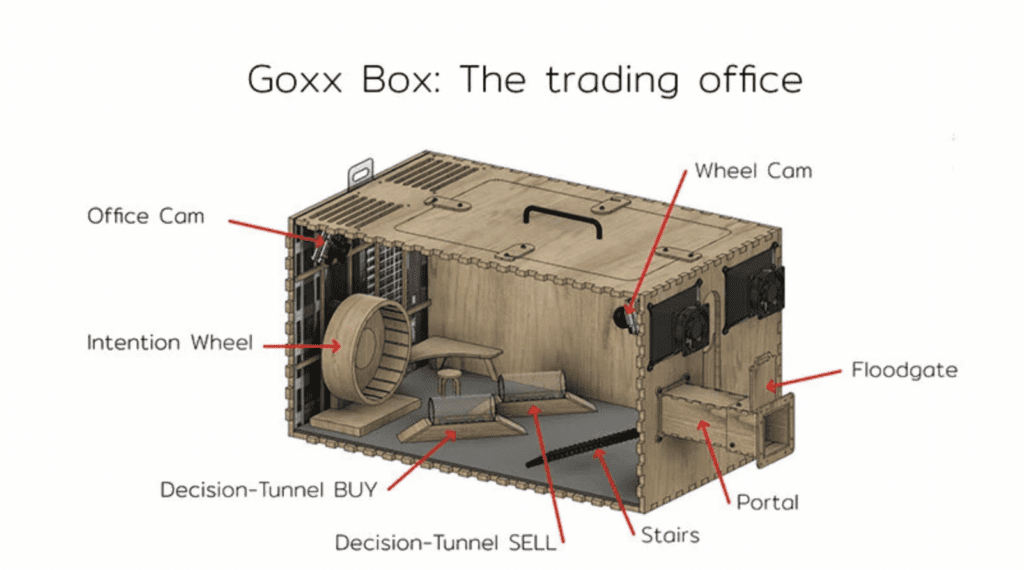

Unfortunately, Mr. Goxx has

Unfortunately, Mr. Goxx has  Mr. Goxx wasn’t afraid of the spotlight, either. He was racking up Twitch followers quicker than many of his human competitors, and did it with style, grace, and elegance. He was a

Mr. Goxx wasn’t afraid of the spotlight, either. He was racking up Twitch followers quicker than many of his human competitors, and did it with style, grace, and elegance. He was a

Goodbye, Mr. Goxx. We hope hamster heaven is treating you well. We will be back next week with our December 10th Decentral Weekly Wrap-Up. Until then!

Goodbye, Mr. Goxx. We hope hamster heaven is treating you well. We will be back next week with our December 10th Decentral Weekly Wrap-Up. Until then! There are famous directors and then there’s Quentin Tarantino, easily one of the most acclaimed directors of all time. What does Tarantino have to do with crypto news, you may ask? Good question. Miramax is apparently

There are famous directors and then there’s Quentin Tarantino, easily one of the most acclaimed directors of all time. What does Tarantino have to do with crypto news, you may ask? Good question. Miramax is apparently  Let’s say that there’s

Let’s say that there’s  We’ve spoken a lot about the rise of the DeFi world, and the popularity of

We’ve spoken a lot about the rise of the DeFi world, and the popularity of

Well, it’s been an incredible couple of weeks for crypto investors. Both Bitcoin and Ether have made new

Well, it’s been an incredible couple of weeks for crypto investors. Both Bitcoin and Ether have made new  One of the biggest

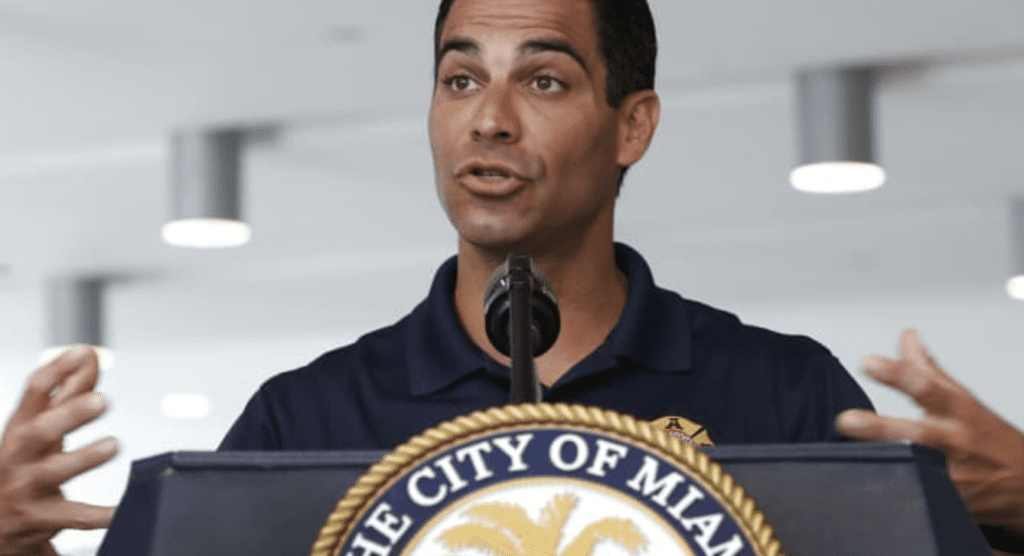

One of the biggest  If there is one mayor in the United States right now that is making it very clear that they are supporting the

If there is one mayor in the United States right now that is making it very clear that they are supporting the  It wouldn’t be a cryptocurrency news wrap-up without our bad idea, and it involves…a fast-food lawsuit. Jack In The Box is suing FTX, the cryptocurrency exchange, claiming that it

It wouldn’t be a cryptocurrency news wrap-up without our bad idea, and it involves…a fast-food lawsuit. Jack In The Box is suing FTX, the cryptocurrency exchange, claiming that it

The new name is a reference to the “metaverse,” which will be Facebook’s

The new name is a reference to the “metaverse,” which will be Facebook’s  There are

There are  The trial centers around a staggering

The trial centers around a staggering  All of a sudden, there was a cryptocurrency associated with the show, called SQUID. The cryptocurrency

All of a sudden, there was a cryptocurrency associated with the show, called SQUID. The cryptocurrency

It’s the latest dog-inspired cryptocurrency that is often compared to Dogecoin, another dog-inspired token that originally started as a joke. Its supporters even describe the cryptocurrency as the “dogecoin killer,” and it’s

It’s the latest dog-inspired cryptocurrency that is often compared to Dogecoin, another dog-inspired token that originally started as a joke. Its supporters even describe the cryptocurrency as the “dogecoin killer,” and it’s  Rand Paul is a well-known Republican senator from Kentucky. This isn’t the first time that Paul has made crypto news. He previously made headlines in 2015 when he announced that his campaign would

Rand Paul is a well-known Republican senator from Kentucky. This isn’t the first time that Paul has made crypto news. He previously made headlines in 2015 when he announced that his campaign would  Ether remains the second-largest cryptocurrency in the world. The Ethereum 2.0 Beacon Chain update has apparently

Ether remains the second-largest cryptocurrency in the world. The Ethereum 2.0 Beacon Chain update has apparently  There’s ONE little tiny baby minor catch [sarcasm]: Worldcoin wants to

There’s ONE little tiny baby minor catch [sarcasm]: Worldcoin wants to