Picture this: *waves hands* self-paying loans!

Picture this: *waves hands* self-paying loans!

Sounds fake, right? But then, at one time the internet sounded fake, FaceTime was just a Back to the Future pipedream, and cars that parallel park themselves were sci-fi punchlines. New technology is often hard to believe. Especially if it seems to defy laws of physics and reality that we thought were hard rules. When we try to imagine how new ideas and concepts can be used, the conceptions tend to be skeuomorphic—meaning they retain visual or ostensible features of older technologies, even if they’re not functionally needed. Eventually, however, new ideas completely change how we think about and do things.

I can’t tell you how many times I’ve kicked myself for forgetting my wallet at the check-out counter, only to remember NFC payments on my phone and watch would do the trick. This is what self-paying loans are aiming to do: change the way we think about savings, yields, and lending. So, how do they work? And, on a scale of “talkie”-motion-pictures to Theranos, how much of a scam are they?

Where to get a self-paying loan

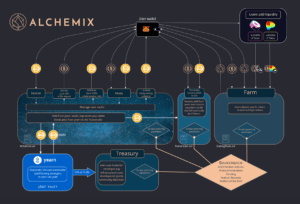

The big innovator that’s bringing self-paying loans to the DeFi scene is Alchemix. It’s the first into the space, so we’ll describe how self-paying loans work on this particular DeFi protocol. But as with most popular, new ideas, it wouldn’t be surprising if we see more DeFi protocols like it popping up in the future—especially if Alchemix does well for a few years. It was only launched in April of 2021, so it still has something to prove.

The big innovator that’s bringing self-paying loans to the DeFi scene is Alchemix. It’s the first into the space, so we’ll describe how self-paying loans work on this particular DeFi protocol. But as with most popular, new ideas, it wouldn’t be surprising if we see more DeFi protocols like it popping up in the future—especially if Alchemix does well for a few years. It was only launched in April of 2021, so it still has something to prove.

First, to get some context, crypto-backed loans have been pretty popular since the DeFi summer of 2020. There are a lot of yield farming DeFi protocols that use P2P lending and borrowing as a way to generate yield for individual lenders rather than just for banks. There are also ways to generate yields with staking, which you can read more about here. DeFi protocols like Yearn.finance, Curve, Compound, and Aave all offer various staking and lending services, but Alchemix is doing it with a twist.

How do self-paying loans work?

Let me not serve you a narrative: “self-paying loans” as a descriptor is largely a clever marketing pitch. The way lending works on Alchemix is more like borrowing future yields from yourself. So, it’s less of a self-paying loan and more of fronting yourself yields that you expect to make in the future. It’s definitely a clever mechanism, don’t get me wrong. I’m just not sure if “self-paying loan” is exactly how I would describe it, if it were up to me (it’s not). Here’s how it works though…

Deposit Dai

First, you deposit an amount of the stablecoin Dai into Alchemix—let’s say $1,000 worth. Dai is a crypto-backed stablecoin that’s soft-pegged to the value of USD.

Loan yourself 50%

Once your $1,000 of Dai is deposited in the vault, you can then borrow up to 50% of your deposit in alUSD. This is a synthetic stablecoin that Alchemix mints for you. This means that 100% of your Dai is still in the vault, but you can take 50% of the value in alUSD.

Dai yields pay back the loan

Now, while you’re out partying and aping into memecoins with your $500 worth of alUSD, your Dai collateral is in a Yearn vault gaining yields. These yields are used to pay back the alUSD that you borrowed. The protocol, of course, takes a 10% cut of the yields, but the longer you leave your Dai in the vault, the more of your loan will get paid back, until it’s completely paid.

Now, while you’re out partying and aping into memecoins with your $500 worth of alUSD, your Dai collateral is in a Yearn vault gaining yields. These yields are used to pay back the alUSD that you borrowed. The protocol, of course, takes a 10% cut of the yields, but the longer you leave your Dai in the vault, the more of your loan will get paid back, until it’s completely paid.

No liquidations

Because you are the borrower AND the lender, you likely won’t be liquidating yourself—if you do, you might want to have a heart-to-heart with yourself. That takes care of liquidation risk. Plus, if you decide you want your Dai back, you can pay off your crypto-backed loan at any time.

No bank overhead

Because DeFi protocols use smart contracts to automate, your yields as an investor can be higher than in traditional finance. There’s no banking intermediary taking a cut to pay employees, rent buildings, and do all the other things that cost overhead. And the higher the yields, the faster your money grows, obviously!

Use cases

You may be thinking to yourself…why do I need to borrow future yields? Why can’t I just get the yields and then use them? Well, certainly you could do that. But that takes time. You’re essentially just borrowing time from yourself. Which, depending on the rate of fiat inflation, may either be a good or bad thing. If your dollars buy more real-world goods today, why not spend them and get the most bang for your buck? Meanwhile, your crypto-backed loan is sitting in the vault, regaining its value in yields. Here are a few reasons you might want to use a self-paying loan.

Savings and yield

Nowadays, no one is a huge fan of saving in fiat currency. The Fed is keeping interest rates so low that even high yield savings accounts don’t keep up with inflation. At the time I’m writing this, you can’t even find 1% APY in a traditional high-yield savings account. Even if you’re not in desperate need of a loan, if you want higher yields in a currency that’s not deflating at the rate of the USD, yield farming with something like Alchemix can keep capital free and still grow your savings.

Funding expensive assets

If you have a large purchase you’ve been meaning to make but you don’t want to part with a huge chunk of cash, slap that moolah into a self-paying loan and wait for it to respawn over time. One guy did this to repurchase a $25,000 family boat that was lost.

Investing in crypto

Another great reason to do it is to have crypto exposure. You could take out a normal loan and support government-back fiat…or you could use DeFi protocols and support crypto-backed loans, growing the DeFi ecosystem.

Risk management

As with all things, there are risks to take into account. I wouldn’t lead you down the garden path without at least mentioning some potential risks to keep in mind.

As with all things, there are risks to take into account. I wouldn’t lead you down the garden path without at least mentioning some potential risks to keep in mind.

Smart contract risks

Like I mentioned earlier, Alchemix is a relatively new DeFi protocol. It has been audited for security, but there are always potential hack or bug risks. Smart contract automation is amazing—until it doesn’t work.

Collateral is tied up

While you are playing around with $500 awesome alUSD from your loan, don’t forget that you collateralized it with $1,000 of Dai. If you have a limited amount of capital that you anticipate needing to spend, it may not be worth tying it up and waiting to get your yields back in the future.

Yield rates fluctuate

Yield farming in DeFi has definitely gotten much better yields than traditional banking options of a similar nature. But, they’re not always constant. Like with everything in crypto, things can get wild and volatile. Sablecoins can lose their peg and yields can go down. Your loan could theoretically never be paid back if yields go to 0%. Hopefully that won’t happen but just know it’s technically possible.

Borrowing too much

If you’re not careful, you could over-leverage yourself. If you need help understanding your financial position and how much you can afford, consider hiring a licensed professional like a NAPFA certified financial planner or accountant to help you with your budgeting and financial planning.

Conclusion

As we discussed at the opening of this article, lots of technology, including DeFi protocols, are skeuomorphic. They look like things we know and recognize, but they’re fundamentally different. New ideas like self-paying loans and other, unimagined crypto-backed loans are taking crypto from skeuomorphic to unrecognizable—in the best way. That’s exciting if you ask me. These are early iterations and protocols in their infancy, so keep that in mind, but be bold. Try them out, see how they work. Try to understand them. You never know, you might just regain all your wild Christmas-shopping-spree spending!

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.