The financial system is on the brink of a massive overhaul, and a select group of cryptocurrencies is quietly positioning itself at the center of this transformation.

While much of the crypto world remains fixated on Bitcoin, Ethereum, and the latest meme coin craze, ISO 20022-compliant cryptocurrencies are emerging as potential game-changers in the future of digital finance.

But what exactly are ISO coins, and why are some investors becoming increasingly bullish on them? More importantly, how have these assets performed during the recent waves of market volatility? Let’s dive in.

What Are ISO Coins?

ISO 20022 is the new international standard for financial messaging—essentially, a universal language for payments and transactions that banks, institutions, and fintech companies worldwide are adopting. Unlike the outdated SWIFT messaging system, which has long been plagued by inefficiencies, ISO 20022 is designed to facilitate faster, cheaper, and more transparent financial transactions.

ISO-compliant cryptocurrencies align with this new framework, making them prime candidates for institutional adoption.

The major ISO 20022-compliant cryptos include XRP (Ripple), XLM (Stellar), XDC (XinFin), ALGO (Algorand), IOTA, HBAR (Hedera), and QNT (Quant). These digital assets are built for real-world utility, focusing on enterprise solutions, cross-border payments, and decentralized financial infrastructure.

With financial institutions gearing up for a transition to ISO 20022 by 2025, these cryptos could play a crucial role in the next evolution of the global financial system.

The Case for Being an ISO Coin Bull

If you’re looking for an edge in the crypto markets, ISO coins offer a unique investment thesis that sets them apart from speculative meme coins or purely decentralized projects.

Here’s why some investors believe these assets could be the future of finance.

1. Integration with the Global Banking System

The ISO 20022 transition isn’t just another blockchain trend—it’s a structural shift in global finance. Banks and financial institutions are being forced to upgrade their outdated messaging systems to this new standard. Cryptos that are already compliant have a clear advantage when it comes to institutional adoption.

Unlike Bitcoin, which operates outside traditional finance, ISO coins are built for seamless integration. If banks begin using blockchain for settlements and transactions, ISO-compliant cryptos are likely to be their preferred assets.

2. Institutional and Government Adoption Potential

Regulation remains one of the biggest uncertainties in crypto. But here’s the kicker—ISO-compliant cryptocurrencies are playing by the rules.

Rather than resisting regulation, these cryptos are positioning themselves as compliant assets that financial institutions can legally adopt. Governments and central banks are far more likely to approve and integrate cryptos that align with regulatory frameworks rather than decentralized projects that operate in legal gray areas.

Could these be the first cryptos to gain mass approval from financial institutions? Many investors think so.

3. Utility, Scalability, and Long-Term Viability

Most ISO coins aren’t just another Ethereum competitor or NFT play. They serve real-world functions that banks and businesses need.

XRP and XLM specialize in fast, low-cost cross-border payments. XDC is revolutionizing trade finance. ALGO, IOTA, and HBAR are focused on enterprise-grade blockchain solutions.

The takeaway? These cryptos aren’t just moonshot bets—they’re assets with fundamental value.

Recent Market Performance: How Have ISO Coins Fared?

Crypto is no stranger to volatility, and ISO coins have seen their fair share of wild price swings in early 2025. Some of these assets have outperformed the broader market, while others are still struggling to reclaim their all-time highs.

XRP (Ripple)

XRP has shown remarkable resilience in recent weeks:

- Plunged 40% to $1.77 on February 3, 2025, during a broader market sell-off.

- Rebounded to $2.70 by the end of the day, closing 5% higher.

- Currently trading at $2.49 as of February 4, 2025.

Despite the volatility, XRP’s ability to recover quickly suggests strong market confidence in its long-term potential.

XLM (Stellar)

Stellar has moved in lockstep with XRP in recent months:

- Trading just below $0.50, significantly up from $0.10 in late 2024.

- Still well below its 2021 all-time high of $0.90.

XLM remains a strong player in the cross-border payments sector and could see increased demand as more financial institutions adopt ISO 20022.

HBAR (Hedera)

One of the best-performing ISO coins recently, HBAR has been on a steady climb:

- Surged from $0.05 in October 2024 to over $0.36 in early 2025.

- On track to challenge its all-time high.

With major enterprise partnerships and a scalable, energy-efficient blockchain, Hedera is gaining traction among institutional investors.

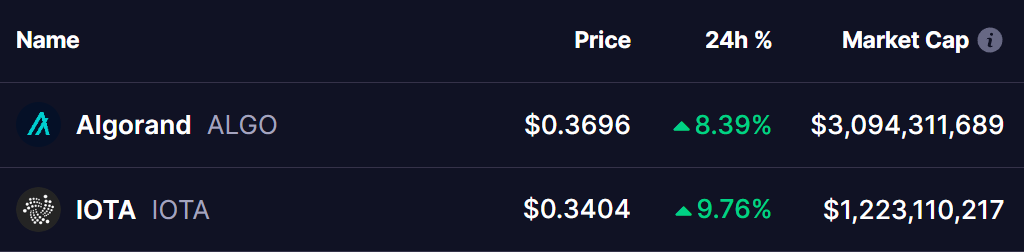

ALGO (Algorand) & IOTA

Both have recovered from their 2024 lows but still have ground to cover:

- ALGO has climbed from $0.10 to $0.50.

- IOTA has risen from $0.10 to $0.40.

While both remain far below their all-time highs, they are showing signs of recovery and could benefit from the broader adoption of ISO 20022.

QNT (Quant) & XDC (XinFin)

These two assets have seen mixed performance:

- QNT is still down 72% from its all-time high.

- XDC, on the other hand, is only 30% below its peak and has surged from $0.03 to over $0.13 in recent months.

XDC, in particular, has been a strong performer as global trade finance digitization accelerates.

Potential Risks and Challenges

While ISO coins have plenty of reasons for optimism, investors should also consider the risks:

- Centralization Concerns – Many ISO coins work closely with banks, which goes against crypto’s decentralization ethos.

- Adoption Uncertainty – Just because these assets are ISO-compliant doesn’t mean banks will actually use them.

- Competition from Other Technologies – Banks and financial institutions might develop their own blockchain solutions instead.

Despite these risks, ISO 20022-compliant cryptos remain one of the most compelling narratives in the crypto space today.

Are ISO Coins the Next Blue-Chip Cryptos?

The financial landscape is evolving, and ISO-compliant cryptocurrencies are perfectly positioned to capitalize on this shift.

Unlike purely speculative assets, these cryptos have real-world utility, regulatory-friendly structures, and the potential for mass adoption by financial institutions.

Could ISO coins become the next generation of blue-chip crypto assets? If banks and governments start integrating them into global finance, they may very well be.