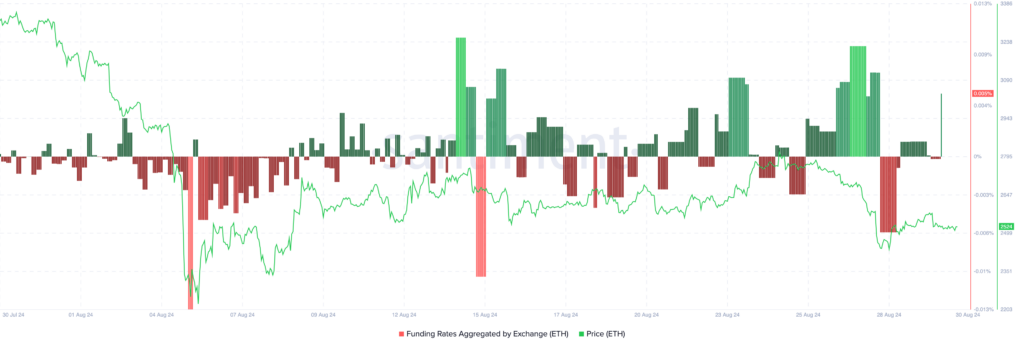

The Ethereum funding rate, a key metric used by traders to gauge market sentiment, has recently reached its highest level in eight months. This surge has sparked speculation among market participants about the possibility of an upcoming price correction for ETH. In this article, we will break down what the funding rate is, why it matters, and what this development could mean for the future price movement of Ethereum.

Understanding Ethereum Funding Rates

The funding rate is a mechanism used in perpetual futures contracts to ensure that the contract price closely aligns with the underlying asset’s spot price. In the Ethereum market, as in others, funding rates are periodic payments exchanged between long (buy) and short (sell) traders.

Positive Funding Rate: When the funding rate is positive, long traders pay short traders. This typically indicates a bullish sentiment, as more traders are betting on price increases.

Negative Funding Rate: Conversely, a negative funding rate suggests bearish sentiment, with short traders paying long traders.

By analyzing funding rates, traders can identify market sentiment and potential imbalances that may lead to price corrections.

What Does the 8-Month High in Funding Rates Mean?

The recent spike in Ethereum’s funding rate suggests heightened optimism among traders, with many expecting the price of ETH to rise further. However, when funding rates reach unusually high levels, it can indicate an over-leveraged market.

Over-leverage Risk: High funding rates often reflect excessive long positions, increasing the risk of liquidations if the price moves against these positions.

Market Sentiment Shift: A surge in funding rates can also signal an impending market reversal, as overconfidence among traders may lead to a correction once the buying momentum wanes.

Historical Analysis: Funding Rates and Price Corrections

Examining past instances where funding rates peaked can offer insights into the current situation. Historically, elevated funding rates have often preceded significant price corrections for Ethereum.

April 2021: A spike in Ethereum’s funding rate was followed by a sharp correction, with ETH dropping by over 20% within weeks.

November 2021: Similar conditions led to a market-wide sell-off, impacting Ethereum and other major cryptocurrencies.

The current scenario bears similarities to these past events, raising concerns about whether Ethereum is poised for another correction.

Current Market Conditions

Several factors beyond the funding rate are contributing to the current market dynamics:

1. Ethereum Price Performance

Ethereum has been on a strong uptrend recently, fueled by a mix of positive developments, including the growing adoption of decentralized finance (DeFi) and advancements in Ethereum 2.0. However, this upward momentum has led to overbought conditions, as indicated by technical analysis tools such as the Relative Strength Index (RSI).

2. Broader Crypto Market Sentiment

The overall cryptocurrency market sentiment has been bullish, with Bitcoin leading the charge. Ethereum often follows Bitcoin’s price movements, but the heightened leverage in ETH’s perpetual futures market could make it more vulnerable to corrections.

3. Macroeconomic Factors

Global economic conditions, including inflation concerns and regulatory developments, also play a role in shaping market sentiment. Recent hawkish statements from central banks have introduced uncertainty, which could impact the crypto market.

What Could Trigger a Price Correction?

Several catalysts could lead to a price correction for Ethereum in the near term:

1. Liquidation Cascades

High funding rates suggest a crowded long trade. If the price of ETH drops unexpectedly, it could trigger a cascade of liquidations, amplifying the downward pressure.

2. Resistance Levels

Ethereum is approaching critical resistance levels. Failure to break through these levels could lead to a pullback as traders take profits.

3. External Market Shocks

Unexpected developments, such as regulatory crackdowns or negative macroeconomic news, could act as triggers for a broader market correction.

What Happens if the Correction Occurs?

If Ethereum undergoes a correction, the extent of the price drop will depend on several factors:

Support Levels

Key support levels to watch include $1,800 and $1,600. These levels have historically acted as strong buying zones.

Market Sentiment

The speed and depth of the correction will also depend on whether market sentiment shifts significantly from bullish to bearish.

Impact on DeFi Ecosystem

A price correction in Ethereum could have ripple effects on the DeFi ecosystem, as many DeFi protocols are built on the Ethereum blockchain. This could lead to liquidations in DeFi platforms, further exacerbating the downward pressure.

Could Ethereum Avoid a Correction?

While the high funding rate increases the likelihood of a correction, it is not a guarantee. Several factors could sustain Ethereum’s bullish momentum:

1. Institutional Demand

Growing interest from institutional investors could provide strong support for Ethereum prices, offsetting the impact of over-leveraged retail positions.

2. Network Upgrades

Ongoing developments in Ethereum 2.0, including scalability and energy efficiency improvements, could drive long-term bullish sentiment.

3. Broader Crypto Adoption

The increasing adoption of cryptocurrencies for payments, investments, and other use cases could support Ethereum’s price growth.

Strategies for Traders

Given the current market conditions, traders should consider the following strategies:

1. Risk Management

Implementing stop-loss orders and reducing leverage can help mitigate risks associated with potential corrections.

2. Monitoring Key Indicators

Traders should closely monitor funding rates, open interest, and other metrics to gauge market sentiment.

3. Diversification

Allocating investments across different assets can help reduce exposure to Ethereum-specific risks.

Conclusion

The 8-month high in Ethereum’s funding rate is a double-edged sword. On the one hand, it reflects strong bullish sentiment and optimism about Ethereum’s future prospects. On the other hand, it raises concerns about a potential price correction, as over-leveraged markets are prone to sudden reversals.

Traders and investors should remain vigilant, keeping an eye on key market indicators and potential catalysts that could influence Ethereum’s price movement. Whether Ethereum continues its upward trajectory or experiences a correction, understanding these dynamics will be crucial for navigating the market effectively.