Decentralized exchanges (DEXs) have existed almost as long as centralized exchanges, starting with a few projects way back in 2014. But they really became popular with the explosion of DeFi in the summer of 2020. And in September of 2021, the popular exchange dYdX surpassed Coinbase in trading volume. DEXs are still a very new niche in DeFi and they are constantly iterating, innovating, and pioneering new projects.

Here’s what you need to know about DEXs before you dive into altcoin trading or perhaps even yield farming.

What is a decentralized exchange?

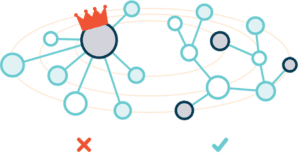

DEXs attempt to take various points of concentrated control and disperse them to increase security and maintain user control of assets. This could be anything from using smart contracts to make it possible to direct, non-custodial trading, to not requiring personal KYC info, to using Web3 dApps and domains. All of these decentralization efforts push exchanges away from single points of failure to protect your assets from hacking, central authority control, and even regulation.

DEXs attempt to take various points of concentrated control and disperse them to increase security and maintain user control of assets. This could be anything from using smart contracts to make it possible to direct, non-custodial trading, to not requiring personal KYC info, to using Web3 dApps and domains. All of these decentralization efforts push exchanges away from single points of failure to protect your assets from hacking, central authority control, and even regulation.

One thing to note about DEXs is that you can’t trade fiat for crypto directly on them. Instead, you’ll need to use a fiat gateway as an on/off-ramp. This could be a CEX (centralized exchange) where you buy crypto and then send it to a wallet connected to a DEX. If an exchange allows buying and selling of fiat, it will have to comply with regulations. Therefore, it will likely be managed by a centralized company, and it will also require KYC because, of course, governments want to know where their currencies are going and how much tax people owe. If you’re planning to use a DEX, you’ll need to have some cryptocurrency already in a wallet.

Another thing to consider is that many decentralized exchanges are built on a specific blockchain. Ethereum is the most popular layer-1, but there are others like Binance Smart Chain, Polygon, and there are even a few DEXs on Bitcoin like Bisq, though they’re not as popular. Be sure you’re willing to hold the tokens used on the DEX’s chain and that you’re prepared for the transaction fees.

Why do exchanges need decentralization?

Some of the downfalls of centralized exchanges have lost people a lot of money. Sure, by using a CEX you gain convenience, usability, and the option to exchange fiat. But there are significant risks and constraints that investors are exposed to with centralization.

Some of the downfalls of centralized exchanges have lost people a lot of money. Sure, by using a CEX you gain convenience, usability, and the option to exchange fiat. But there are significant risks and constraints that investors are exposed to with centralization.

- CEXs can be hacked, and many have been. Large centralized asset holdings are very attractive targets for hackers and, while they’re not unheard of on DEXs, more centralization means more risk of losing your coins in a hack.

- You don’t hold your own assets, as the exchange acts as a custodian. It’s not just hackers that can swipe your wealth on a centralized exchange. If a CEX decides you can’t access your funds anymore, you’re out of luck.

- Because they’re regulated, you have to provide KYC. One of the attractions of cryptocurrency is that it can provide a little more anonymity than fiat. Providing KYC is precisely what many crypto users are trying to avoid.

- A lot of CEXs also experience downtime during high volume trading. Downtime is the last thing you want to experience when prices are soaring but you’re unable to sell. Missing out on profits is a huge risk when the exchange is simply not operational.

- There are fewer coins available on CEXs. Because they’re more regulated, big exchanges vet coins more thoroughly before listing them. If you’re looking for that unknown coin that’s about to skyrocket to the moon, you probably won’t find it on a CEX.

Like the principles that drove the creation of cryptocurrency itself, DEXs try to continue breaking up power concentrations and singular points of failure to improve security and anonymity for users who want to protect their assets without relying on third-party trust.

Where did DEX come from?

Some of the early attempts at decentralized exchanges used “colored coins.” This was a method of representing assets with colored coins that were then traded on the exchange. The problem, however, was that it still required trust to redeem the asset represented by the colored coin.

The next DEXs used a central limit order book (CLOB) model where orders were placed in a CLOB but transactions were settled on the blockchain. Some of the early popular DEXs like IDEX used order books but allowed users to maintain self-custody. This model still lacked decentralization in the order book though.

Uniswap really shook up the DeFi scene as it gained popularity in 2019 by using an automated market maker (AMM) algorithm and liquidity pools to set the trading price instead of using the mid-points of user bids and orders. This allowed for more liquidity since everyone’s orders and bids were pooled together. It also popularized yield farming through liquidity pools, which rewards liquidity providers with fee percentages. Cross-chain trading was still a problem, at this point, since many DEXs were limited to ERC-20 or other specific token trades.

Another move toward decentralization on DEXs was through atomic swaps. These opened the ability for cross-chain trades by using automated smart contracts that self-executed, ensuring the trade couldn’t happen unless both parties met the contract obligation. Atomic swaps completely eliminate the need for a third party and can even happen between two users outside an exchange, but a DEX that facilitates atomic swaps can increase speed and liquidity to compete better with CEXs.

Which decentralized exchange should you use?

Now that you’re probably itching to get your crypto off a centralized exchange to start tapping those yield farming returns and hunting down the next about-to-blow-up coin, here are some tips for deciding which DEX you want to use. We’ve already discussed some of the characteristics that make a good DEX, but keep in mind that not all DEXs are created equal. Before using an exchange, it doesn’t hurt to confirm that it uses the most fundamental decentralization methods.

Now that you’re probably itching to get your crypto off a centralized exchange to start tapping those yield farming returns and hunting down the next about-to-blow-up coin, here are some tips for deciding which DEX you want to use. We’ve already discussed some of the characteristics that make a good DEX, but keep in mind that not all DEXs are created equal. Before using an exchange, it doesn’t hurt to confirm that it uses the most fundamental decentralization methods.

Non-custodial. Make sure that the exchange you choose allows you to keep custody of your own coins. After all, that’s one of the main reasons for using a decentralized exchange over one of the easier, more accessible centralized exchanges.

Interoperability. Lots of the most popular exchanges in DeFi run on Ethereum, which means they trade ERC-20 tokens. But interoperability is becoming more widespread. If you can find a DEX that facilitates trades across chains, you’ll save a lot of hassle.

Decentralized web. What’s the point of creating a decentralized infrastructure for an exchange if you then access it on the centralized web? Look for a DEX that either uses its own dApp or a Web3 domain. This will reduce the risk of having your coins phished through your browser.

Volume. The more trading volume an exchange has, the more liquidity it will have, and the more people are likely to trust it. Because this is such a new segment of the DeFi world, the larger, more established exchanges can provide a little more peace of mind.

Low fees. There are a couple kinds of fees you can expect on almost any exchange. The first is transaction fees and these are unavoidable and will vary depending on which blockchain the exchange runs on. But, you can look for a DEX that has relatively low trading fees.

What's next?

There are more criteria that you can use to identify a good decentralized exchange. And you can read more about that here. Once you decide what characteristics are important to you, you can begin exploring the various exchanges on places like defiprime.com, which has some filter options to help you begin your search.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.