Markets never move in a straight line.

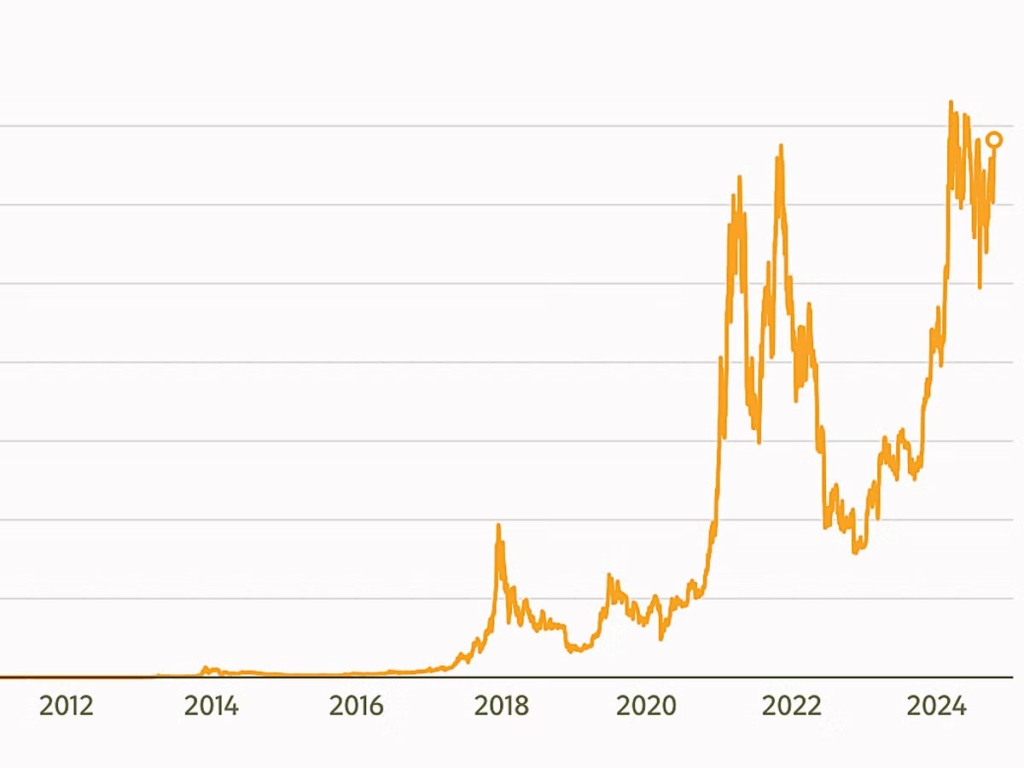

What we’re seeing with Bitcoin’s recent price dip isn’t a cause for alarm—it’s a much-needed pause after an incredible streak of daily all-time highs (ATHs).

This pullback is largely driven by profit-taking from long-term holders who’ve seen substantial gains, as well as some shifts in ETF flows.

Let’s unpack what’s happening, where the money is going, and how to think strategically about the market right now.

Why Is Bitcoin Dipping?

- Profit-Taking is Healthy:

When Bitcoin soars to new heights, smart investors lock in some profits. Long-term hodlers, who’ve weathered years of volatility, are taking advantage of their gains to rebalance portfolios. This isn’t a sign of weakness—it’s a natural part of the market cycle and signals a maturing ecosystem. - Institutional Dynamics:

ETFs have absorbed some selling pressure, but recent outflows show institutional players temporarily pulling back. Combined with profit-taking by hodlers, this has led to short-term price volatility. - Retail FOMO Builds:

Meanwhile, the retail crowd is just starting to pile into the market. Historically, this influx can fuel wild swings in either direction, making it all the more important to have a solid strategy.

Where Is the Capital Flowing?

When long-term holders take profits, their capital tends to flow in two main directions:

- Into Alts:

Many hodlers rotate their gains into altcoins, which often lag behind Bitcoin’s movements but have historically delivered outsized returns later in the cycle. This “altcoin season” is shaping up, with attention shifting to:- Ethereum, the leader in DeFi and smart contracts.

- Layer-2 solutions like Polygon.

- Emerging Layer-1 platforms like Solana and Avalanche.

- DeFi, NFT, and gaming projects with strong fundamentals.

- Rising trading volumes and price spikes in these sectors suggest some of the Bitcoin profits are flowing into high-potential alts.

- Into Fiat or Stablecoins:

Some funds are being parked in fiat or stablecoins like USDT and USDC. This is a defensive move, either to lock in gains, reduce exposure, or await re-entry at more favorable prices. These liquid positions allow investors to remain flexible and take advantage of opportunities as they arise.

Keep Your Eyes on the Prize

Even after this pullback, Bitcoin’s price is still significantly higher than just a few months ago. The fact that we’re discussing a dip from $93,000 highlights how far this asset has come. The big picture remains intact: Bitcoin is reshaping global finance, and every correction has historically paved the way for higher highs.

For long-term believers, this dip is a reminder to focus on the fundamentals. Bitcoin’s track record shows that temporary sell-offs are part of its DNA—and they’ve always been followed by growth over time.

Alts: The Lagging Opportunity

While Bitcoin takes a breather, altcoins offer an attractive opportunity. Historically, they’ve surged after Bitcoin consolidates, often delivering explosive returns. However, if you’re an investor, it’s crucial to focus on projects with real utility and strong fundamentals rather than chasing hype. If you are a trader or speculator, the field is rife with both diamonds and land mines.

Strategy Over Emotion

Whether Bitcoin is rallying or correcting, staying level-headed is the key to long-term success. Here’s how I play the game:

- Think Long Term: Crypto is a marathon, not a sprint. Stick to your investment thesis.

- Diversify: Balance your portfolio across Bitcoin, Ethereum, and carefully selected altcoins.

- Avoid FOMO: Don’t let emotions drive your decisions—plan your entries and exits.

Bitcoin’s pullback is a natural part of its growth story, and the rotation of capital into alts and fiat is a sign of a maturing market. The key is to stay focused on your strategy, zoom out, and remember that the crypto revolution is just getting started.