There’s the popular narrative of tokenization that everyone knows, even if they don’t know it’s the tokenization narrative. Outside of crypto circles, your average Joe on the street has probably heard of NFTs. He may not know exactly how NFTs are part of the tokenization story in crypto, but non-fungible tokens (whatever those are) have become such a strong narrative driving crypto that more people are talking about it than even Bitcoin, the original crypto narrative!

But despite the NFT “craze” or “bubble,” that’s mainly driven by hype, there’s a deeper, more important story about tokenization the average person probably isn’t aware of. So why are NFTs currently driving the tokenization narrative, and will it help or hurt the real story of how tokenization will change how we think of data ownership and governance?

What is tokenization?

Before diving into the tokenization crypto narrative, here’s a simple review of what tokenization is. You can read more in-depth about it here, along with some of the trends in this crypto space.

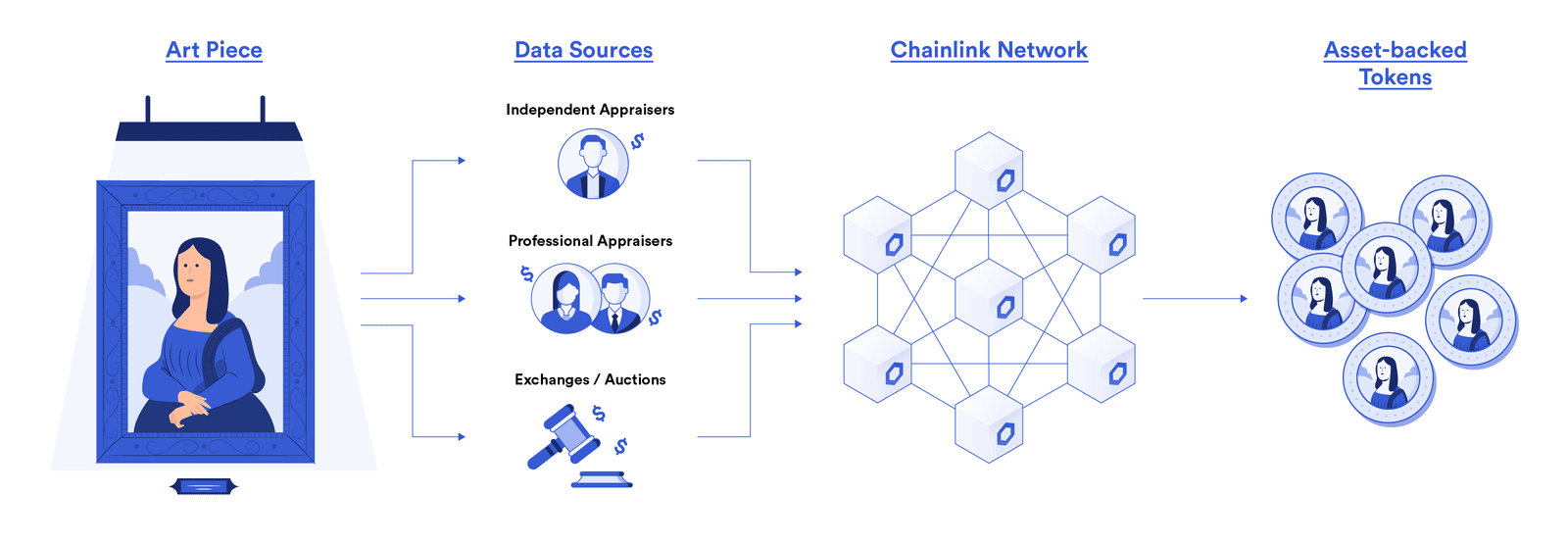

The basic idea of tokenization is to take an asset, whether digital or physical, and create a digital representation of its ownership that is then documented on a blockchain. This is useful not only for verifying ownership, removing the need for deeds, copyrights, and titles, but also for fractionalizing ownership. For example, a piece of real estate could be tokenized and sold in smaller pieces to many people—something that is currently difficult to do.

Tokenization also allows data to be completely controlled by the owner of the token. It’s even possible to verify data (like credit history, for example) without revealing the information itself. There are thousands of potential use cases for tokenized assets and data. The question for today is: how will the narrative drive public understanding and investor interest?

The popular narrative: NFTs

Non-fungible tokens are what everyone knows. If you were paying attention in early 2021, there was buzz in all kinds of circles about the potentials of NFTs. Many people talked about it in terms of revolutionizing the art industry or providing intellectual property rights to creators like musicians. The reality saw a huge digital art market spring up almost out of nowhere.

Things like cryptopunks and bored apes started ruling the internet as every brand and celebrity jumped on the bandwagon and began creating their own NFTs. From Quentin Tarantino to Snoop Dogg to Steph Curry and McDonald’s, it seems like everyone is getting into the NFT game because “they’re the future,” “there’s money to be made,” or “I have a collectible.”

And while NFTs are certainly an interesting use case for tokenization that will probably be around for a while, if you’re inside crypto enthusiast circles, you know collectible .jpgs aren’t the revolutionary play. There’s a bigger, more hard-hitting crypto narrative to be told.

The real narrative: DID and DAOs

Look, no one will begrudge you a little flipping of some .jpgs on OpenSea to make a quick buck on NFT arbitrage. It’s certainly been “a thing.” But there are a few ways that tokenization can truly change the game for data and, believe it or not, even how we govern organizations and communities. The real story about tokenization is that it can give people their sovereignty back when it comes to personal data, and it has the potential to restore power imbalances with transparency, provability, and individual consent.

Decentralized identity

The problem of big data and an ever-increasing surveillance state is becoming more and more urgent. Not only did Edward Snowden wake everyone up to the government’s hand in collecting our personal information, it’s also the kind of joke you must laugh at to keep from crying when you think about how much data big tech has on every one of us. Between Meta, Amazon, and Google, there’s information out there about you that you never even imagined could be collected.

With tokenization and decentralized identity (DID), individuals can reclaim ownership of all their personal information. Not only that, instead of corporations surreptitiously using you as the product off which they profit, you would be able to monetize your own data if you choose to. You could potentially create income out of anything from your shopping and browsing habits, to opt-in advertising, to demographic info that’s useful for research. With tokenized DID, you are in control of your own information.

DAOs

In a similar way, decentralized autonomous organizations (DAOs) use tokenization to create new governance structures. That sounds complicated but it basically means distributing decision-making power among token holders in a more deliberate way than pure, majority rule. Using tokens to give voting power in administrative and governing strategy, complicated decisions that used to be made by CEOs and politicians could be made by individual stakeholders through secure and transparent voting.

The concept of this kind of decision-making structure is easy enough to think of — many people have — the problem comes in execution. Because blockchain removes so much trust and brings so much transparency and automation to transactions, DAOs could ensure that every vote is secure and every vote counts for exactly as much as it’s worth. The DAO-governing model can play out on any scale, too. From small, online communities, to crowdfunding, to organization management, to entire governments, the power of DAOs is part of the game-changing narrative of tokenization.

Piggybacking on the popular narrative

Just because people only know the NFT narrative doesn’t mean that popularity can’t still drive the real narrative. Momentum is momentum. While the general public may understand the story of tokenization to be cool Twitter avatars and pop culture memorabilia, the money flowing into NFTs and tokenization can help to drive the development of pivotal, world-changing innovations in tokenizing personal data and shaping the future of democracy with DAOs.

As with most new technologies, it takes time for people to understand exactly how it can be used and why it’s important. From the internet to smartphones, people want to see how it works before they buy into the concept. So while the NFT narrative is pushing the ship forward, a tailwind in the form of DID and DAOs may be hot on our stern.

How to invest

Knowing all of this about the crypto narrative for tokenization, how should that affect your future investments in the long and short term? Well, that’s for you to decide, but here are a couple of ideas to consider.

Short-term investing: Buy NFTs. Maybe it’s a bubble and maybe it’s not the true underlying value of tokenization, but plenty of people with fat wallets will tell you that NFTs — at least for now — are a good short-term play. Try to catch the next crypto punk or grab some celebrity merch if you can and hope it appreciates.

Long-term investing: If you believe in the underlying crypto narrative for tokenization, invest in projects in which you see a good future. If DID and DAOs are going to be important in the future, things like oracles (ex. Chainlink), tokenization platforms (ex. Ontology), and DAOs whose mission you support are the way to go.

Conclusion

It’s all happening! The crypto narrative of tokenization not only busted its way into popular culture, it also has the potential to actually change how we think about data and community decision making with DID and DAOs. Personally, I’m very excited about this crypto narrative and I can’t wait to see how it plays out in the future.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.