There’s no way to downplay it: digitization has transformed finance forever. Technology has made it so that financial services are more accessible than ever, whether you’re a novice trader hoping to trade crypto on your smartphone or a young professional downloading a mobile app to monitor your credit score. However, digital transformation has also given rise to a massive problem: digital fraud.

Many experts and analysts believe that blockchain technology will transform the finance sector forever, including the financial services industry. Here, we examine three of the worst financial services scandals in history and how blockchain can address many issues with respect to digital fraud, data security, and more.

The Equifax hack

Equifax is one of the largest credit reporting agencies in the world. The company is part of the “Big Three” credit reporting agencies, along with TransUnion and Experian. It is also a company that recently experienced one of the biggest data security breaches ever, affecting the personal information of over 147 million people. The attack occurred in 2017, and hackers were able to take advantage of a third-party software exploit.

The sensitive information involved in the hack also makes it not just one of many financial scandals, but a digital fraud scandal as well. Cybercriminals could then use the personal information to steal identities, sell data on the dark web, or for credit card fraud purposes.

While blockchain technology cannot 100% ensure data security, it is much more difficult to hack than a centralized server. It’s the fact that blockchain is decentralized that can help keep financial services companies more accountable and transparent.

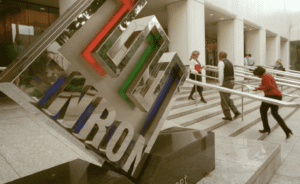

The Enron scandal

If we are going to talk about some of the biggest financial services scandals of the past 20 years, we would have to mention Enron. The Enron scandal was an accounting scandal involving Enron Corporation, a now-defunct energy company trading in energy derivatives markets. Enron first emerged thanks to a merger between two natural gas companies.

The energy giant was able to appear legitimate for years, thanks to innovative and deceptive accounting practices. Enron was consistently inflating its revenues, claiming that it was earning billions in revenue that didn’t exist. Even worse, the SEC, investment banks, and even credit rating agencies were accused of negligence for not recognizing what was happening. The high-profile scandal ended with criminal charges.

The energy giant was able to appear legitimate for years, thanks to innovative and deceptive accounting practices. Enron was consistently inflating its revenues, claiming that it was earning billions in revenue that didn’t exist. Even worse, the SEC, investment banks, and even credit rating agencies were accused of negligence for not recognizing what was happening. The high-profile scandal ended with criminal charges.

The fact that Enron was able to fool the world for so long helps highlight why so many people are disillusioned with traditional financial institutions. How was Enron able to fool even the most complex regulatory agencies? Was the system rigged? The scandal became a symbol of corporate crime, and it had broader implications throughout the business world.

Blockchain allows for real-time intelligence sharing and transparency, which means that financial services scandals are much more difficult to conceal. The public ledger ensures that records are accessible. The fact that blockchain also offers enhanced data security means that it can offer a more comprehensive view of company transactions.

The Wells Fargo banking scandal

Cryptocurrency enthusiasts often talk about why banks aren’t to be trusted, and this is one of the most obvious financial services scandals to consider. In this instance, it was actually management that was pushing employees to meet unrealistic goals. The employees, in turn, resorted to digital fraud, opening up millions of accounts in customers’ names without their consent. The bank paid billions to settle with the SEC regarding the incident.

The rise of Bitcoin is often associated with distrust for financial institutions in the wake of the Great Recession. However, the Wells Fargo scandal also proves that toxic leadership can cause irreparable damage and encourage fraudulent activity among its ranks.

Thanks to blockchain, individuals and businesses can operate without having to deal with centralized financial institutions like Wells Fargo. The rise of DeFi also highlights the demand for decentralized financial services and products, so that banks like Wells Fargo—and these types of banking scandals—can be avoided.

Can blockchain help?

Even as technology advances, the rise of digital fraud is proof that cybercriminals will always find some way to infiltrate systems. There have been major cryptocurrency hacks despite blockchain technology, and criminals have stolen hundreds of millions of dollars in cryptocurrency from centralized exchanges.

Blockchain may not be able to completely prevent financial services scandals, but it can certainly improve accessibility and transparency within the financial sector. While it might not be able to prevent any and all schemes, blockchain can reduce digital fraud significantly.

It can also offer data security solutions in a world where cybersecurity is more important and relevant than ever before. Still, we have yet to see just how critical the technology will be to shaping the future of the financial services industry.

About the Author

Michael Hearne

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.