No one knows exactly what crypto trends will come to fruition in the rapidly changing cryptocurrency world.

Innovations are happening so quickly it can be difficult to keep up with what is happening, let alone guess what will happen. But, there are trends that we have on our radar. Cultural attitudes, project successes, and institutional responses all create narratives that foreshadow where the crypto space may be headed.

Here are some crypto trends to keep your eye on in the next year.

#4 Increased Bitcoin adoption

Everyone has their own opinions about Bitcoin.

You may hear, “Bitcoin to the moon!” from your favorite celebrity on Twitter, and “Bitcoin will be gone in five years,” from the guy at your gym, and “Bitcoin is high-risk, but high-reward,” from your buddies on Discord.

But maybe you’ve also noticed a theme: everyone is talking about it.

Adoption has always been the song of those who make predictions about Bitcoin-especially for “Bitcoin maximalists“. Whether they’re bullish or bearish on crypto in general, everyone can agree that mass adoption is a key factor in the fate of crypto.

Well, chances are the adoption train will keep chugging in the next year.

Well, chances are the adoption train will keep chugging in the next year.

- Today, Bitcoin adoption is comparable to internet adoption in 1997.

- The growth rate indicates that Bitcoin’s trajectory is steeper than the internet’s was and will reach 1 billion users by 2025, three and a half years faster than the internet.

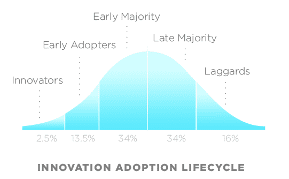

- On an adoption curve, early adopters are followed by the early majority, then after the peak, late majority and laggards follow.

Analysis suggests that Bitcoin is still in the early adopters phase of the curve, but that it’s on track to move into the early majority in the next several years.

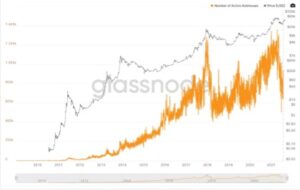

The number of active Bitcoin addresses has been steadily climbing, as well, almost doubling between January of 2020 and April of 2021. Active addresses are volatile, just like the price of Bitcoin, and have dipped in the second half of 2021, but the trend continues upward on the whole. In fact, by the time you read this article, Bitcoin will have reached another all-time high.

The number of active Bitcoin addresses has been steadily climbing, as well, almost doubling between January of 2020 and April of 2021. Active addresses are volatile, just like the price of Bitcoin, and have dipped in the second half of 2021, but the trend continues upward on the whole. In fact, by the time you read this article, Bitcoin will have reached another all-time high.

Another good sign for Bitcoin adoption is the increase in retail investors.

Some speculate that the stimulus checks people received in the last year and a half ushered retail investors into Bitcoin faster than usual. That, along with increased awareness and soaring prices, makes this bull market attractive to brave newbies willing to take on some risk. If this bull run is anything like the one in 2017, there could be an activity dropoff as the price comes down, but retail investors aren’t the only ones entering the market this time.

Institutional investors, corporations, and billionaires are beginning to buy in. Big players like JP Morgan, Tesla, and MicroStrategy are all getting exposure. And major corporations like PayPal allowing Bitcoin usage will likely encourage others to get in the game as well. In addition to the big companies, some governments are even beginning to consider Bitcoin as an alternative to hyper-inflated fiat.

El Salvador is one of the first countries to make BTC legal tender and others like Panama may soon follow. These trends confirm that Bitcoin has multiple attractions and adoption will press forward both in large developed economies and weaker economies wanting to join the global marketplace.

#3 WIDESPREAD cryptocurrency adoption

Mention cryptocurrency adoption in mainstream circles over the last ten years and you might get some chuckles or jokes cracked about “fake internet money.”

These days, digital currencies are swiftly gaining ground as a legitimate asset class in people’s minds.

It’s not just Bitcoin that’s legitimizing crypto in the minds of the public either.

Altcoins and stablecoins are getting their come up as well. Ethereum’s success with smart contracts and Dogecoin’s memeability are just a couple of examples of use cases that legitimize and increase cryptocurrency adoption.

Here are a few more signs that cryptocurrency adoption is going mainstream.

Billionaires and celebrities are also realizing new investment and fintech possibilities and are generating good PR by talking about crypto, which is increasing its clout in pop culture.

- Jack Dorsey thinks crypto is the future and is creating a business revolving around DeFi.

- Elon Musk is known for hyping (and tanking) crypto on Twitter, skyrocketing Dogecoin and other altcoins.

- Mark Cuban has been a vocal supporter of crypto projects and is even accepting Dogecoin at the Mavericks merch store.

Other large projects that could push wider crypto adoption are things like Facebook’s Novi wallet, which is planned to hold Diem, the stablecoin that Facebook is working on.

Novi was supposed to be rolled out by the end of 2021, but that didn’t happen. While this project has been in the works for several years–and has been modified and scaled back over time–if a crypto wallet finally happens, Facebook’s 2.9 billion+ users will have an easy way to begin using cryptocurrency.

NFTs are also still a hot topic.

- Visa bought CryptoPunk, one of the OG NFTs, to understand how they work and encourage clients and partners to participate in the ecosystem.

- Budweiser is also going in big on NFTs, making its Twitter profile picture an NFT and purchasing the Beer.eth domain–among other things.

Related to NFTs, but uberworthy of it’s own tab:

Play-to-earn NFT games are also growing rapidly, especially in developing countries like the Philippines, where a few hundred dollars of earnings can make a big economic impact.

Earning real money by playing games is helping get the unbanked into the economy faster than many other DeFi projects.

#2 DeFi explosion: DAOS, DExs, and More

Speaking of DeFi (decentralized finance), this area of the crypto space still has projects popping up like dandelions in the spring.

Decentralized finance one of the most promising movements in crypto and is attracting the most enthusiasm and eagerness.

Even before “DeFi” was coined as a term a few years ago, fans of decentralization were looking for it on the horizon. Charles Hoskinson, the founder of Cardano, was talking decentralized financial services back in 2014–and DeFi momentum has gone parabolic in the last year. Smart contracts and other blockchain technologies are fast coming into the collective consciousness as a real alternative to current centralized apps and services.

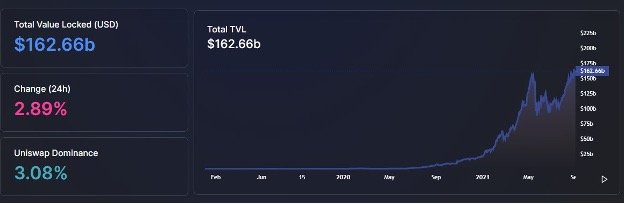

The summer of 2020 was a huge DeFi extravaganza as investment dollars flowed into the ecosystem, and in August, asset value was growing by nearly half a billion dollars a week. In the ensuing year, DeFi continued to explode and by August of 2021, it had more than $160 billion total value locked (TVL). This growth is expected to continue into 2022 as more new projects get off the ground.

The summer of 2020 was a huge DeFi extravaganza as investment dollars flowed into the ecosystem, and in August, asset value was growing by nearly half a billion dollars a week. In the ensuing year, DeFi continued to explode and by August of 2021, it had more than $160 billion total value locked (TVL). This growth is expected to continue into 2022 as more new projects get off the ground.

Despite its massive growth, there are a few reservations that diehard decentralization advocates have with current DeFi implementations. Interoperability is one of those issues, but projects like Ethereum 2.0 and Polkadot are working to solve it. Making applications operable across multiple chains will be a huge improvement for DeFi, and as these kinks get worked out, more investors will continue to buy in.

Decentralized autonomous organizations (DAOs) are also looking trendy in the near future. The DAO, the pioneer of this organizational structure, did not survive a hack and an SEC ruling that determined DAO tokens to be securities subject to federal securities laws. But it solved the principal-agent dilemma by eliminating administrative power, giving members voting rights and making all decisions governed by consensus and transparent on the blockchain. Now, DAOs like MakerDAO and Aragon are becoming popular in the decentralization space.

Perhaps one of the most compelling aspects of DeFi is the potential to bank the unbanked in developing economies around the world.

Like El Salvador adopting Bitcoin, other DeFi solutions are poised to usher millions of the unbanked into the global economy. Stablecoins can offer more reliable payment and remittance opportunities for expat and low-wage workers; DEXs ease currency exchange friction for those wanting to conduct business outside of capital controls; and microlending and insurance opens the door for underbanked in all economies who want greater financial opportunity.

#1 Cryptocurrency regulation

It’s not all sunshine and roses in the crypto world though, with cryptocurrency regulation looming.

Because decentralization threatens the interests of governments and institutions that currently have a monopoly on the world economy, it’s no surprise that there are massive efforts going into regulating cryptocurrencies. SEC chair Gary Gensler has described crypto regulations as intended to protect investors from fraud and scams. However you choose to see it, the SEC has been working hard in the US to keep up with fast-changing fintech and craft regulations for crypto and DeFi.

More governments including the US are beginning to research central bank digital currencies (CBDCs) as well. Rolling out fiat on the blockchain will certainly drive regulations as they compete directly with Bitcoin and altcoins.

A $1 trillion infrastructure bill passed in the Senate in August of 2021, potentially putting big tax burdens on the crypto community.

Defining “brokers” very broadly, the bill seeks to require KYC and transaction reporting to raise $28 billion in taxes over ten years. The House voteed on the bill on September 27, and the struggle will likely continue in the coming years as Wile E. Coyote regulators chase Roadrunner crypto advancements.

There is a case to be made that some regulation may not be all bad. Despite the conflicting interests of centralized powers and crypto movements, some clear regulations could make developing projects easier. The current, murky, and frustrating game of cat and mouse between developers and bureaucracies has caused many projects to lose steam or be shut down.

Crypto enthusiasts would much rather be solving technical problems and creating new innovations than negotiating with regulators over every little thing. A few clear regulations may allow that.

What's next for crypto trends?

The biggest narrative in evaluating crypto trends has always been around centralized power versus the decentralizing foils. And this continual arms race for control will keep going next year and beyond, regardless of the project and market volatility that makes so many people unsure.

What are some crypto trends you foresee in the next year or two?

About the Author

Emily Weber

About Decentral Publishing

Decentral Publishing is dedicated to producing content through our blog, eBooks, and docu-series to help our readers deepen their knowledge of cryptocurrency and related topics. Do you have a fresh perspective or any other topics worth discussing? Keep the conversation going with us online at: Facebook, Twitter, Instagram, and LinkedIn.