Welcome to the Decentral Weekly Crypto News Wrap-Up, where Neil and Em review trending crypto news and try to answer the all important question: “Is this a thing?”

There’s been a lot of positive cryptocurrency news over the past several months, and the past week is no exception. This week, we’re covering the following cryptocurrency news topics: Miami’s Bitcoin dividend, the largest new crypto VC fund, Ukraine wanting to be more crypto-friendly than ever before, an NFT horror story, and more.

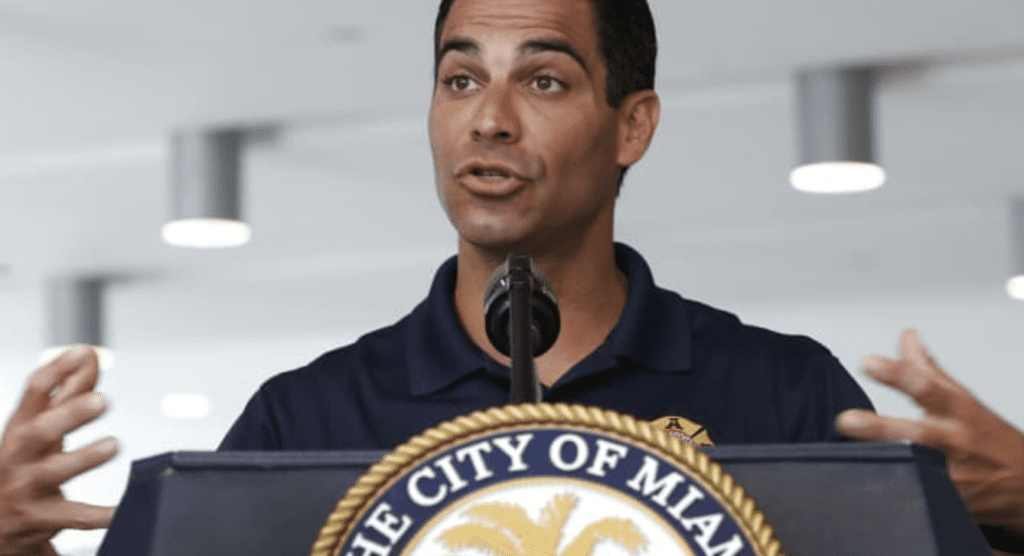

Miami wants to hand-out free crypto

In historic cryptocurrency news, Miami wants to give out free Bitcoin to its residents. Miami would be the first city to offer a Bitcoin yield, thanks to the city’s profits from MiamiCoin. MiamiCoin is a cryptocurrency launched by CityCoins that has generated $21 million for the city. MiamiCoin is also used to fund municipal projects.

Miami residents do not have to own any MiamiCoin to receive the dividend. The mayor of Miami, Francis Suarez, has said that this was about getting Bitcoin “into the hands of more people,” and that the city would create Bitcoin wallets for residents.

This is part of the overall race to become the country’s cryptocurrency hub. Eric Adams, the mayor of New York City, has also followed in Suarez’s footsteps, launching a NewYorkCoin with CityCoins. With this latest move, Suarez is arguably the most crypto-friendly politician in the United States.

It’s positive cryptocurrency news, but what about those who may not have the savvy to set up their Bitcoin wallet? Plus, Miami’s median age is 40.1…how much Bitcoin will be left on the table?

Neil says:

Look, this guy clearly wants to be the most crypto mayor in the country, and he seems to be backing up all the talk. Not everyone will get a Bitcoin wallet, sure, but this is clearly a huge positive. I guess the only downside is that I hope his career doesn’t take a downturn, since he’s so closely associated with the sector now.

Em says:

I’m tempted to up and move to Miami! I think this is a cool idea and I say it’s all the better for people who want to capitalize on this new way to use crypto in certain municipalities. Plus, with all the retired folks in Florida, it would be hilarious to make them start using crypto.

Bottom line:

Neil thinks it’s a good thing (for now), and Em thinks it’s a good thing, too.

What do you think about Miami handing out crypto?

Comment on twitter with your predictions using the hashtag #freeBTCinMiami and tag @decentralpub –> your tweet could be featured in an upcoming shout out

Paradigm’s new 2.5B fund

With crypto markets on fire over the past year, it’s not too surprising that more traditional financial institutions are changing their attitude on cryptocurrency in general. Paradigm has now debuted a 2.5 billion dollar fund. Paradigm was founded by Coinbase co-founder Fred Ehrsam and Matt Huang, a former Sequoia Capital partner.

This dethrones the previous $2.2 billion raised by Andreessen Horowitz, one of the world’s most powerful and influential VC firms. Paradigm has invested in Web 3.0 projects in the past, but the announcement did not elaborate on where the money would be invested. We all know that there’s a rift between traditional finance and crypto.

Will Paradigm help legitimize the concept of a “crypto VC” and pave the way for similar funds in the future?

Neil says:

Sure, many enthusiasts will say that this is great crypto news. I’m not so positive about that…VCs can definitely help to grow the crypto sector, but shouldn’t we be wary of traditional finance entering the sector that’s supposed to change it for the better?

Em says:

More money flowing into crypto? Not surprised but definitely not mad. Institutional investors would be crazy to ignore what’s happening in the crypto space and, of course, this was inevitable. We’re looking at the future of tech, and people are starting to realize that.

Bottom line:

Neil thinks this could be a bad thing, Em thinks more money flowing in can only be a good thing.

Who’s right?

Bloomberg likes Solana

Most cryptocurrency news revolves around the two biggest cryptocurrencies, Bitcoin and Ethereum. Solana’s native token, SOL, has had an incredible year, rising by a staggering 16,000%. Solana is also known for its speed and the fact that it uses a proof-of-history validation model.

Solana is now the third cryptocurrency to be tracked by the Bloomberg terminal. The price tracker is called the “Bloomberg Galaxy Solana Index.”

Solana is a public blockchain platform that is often compared to Ethereum, as it can be used to run dApps. Solana’s rise has been quite incredible, as it now outperforms all non-Ethereum smart contract platforms, and many believe that it will be an eventual “Ethereum killer.” Solana is now the fourth-largest cryptocurrency in the world, behind Bitcoin, Ethereum, and Binance Coin.

Will Solana really be the “Ethereum killer,” or is it all hype?

Neil says:

Well…Bloomberg now tracks Solana—that’s great, I guess? I think it’s proof that Solana is clearly here to stay, but it’s more of a symbolic move than anything else. Bloomberg looks “smart” by tracking it, but it’s not like Solana needed validation from them.

Em says:

Just another example of institutions waking up to the fact that crypto is the place to be. There’s a tightrope to walk for balancing the capital impact of institutions and the increased awareness drawing regulation. But overall, it’s probably a good thing.

Bottom line:

Neil thinks this isn’t a thing, Em thinks this is a good thing but remains cautious.

Who’s right about what all of this Solana means? Weigh in.

Ukraine wants to be the crypto capital

Ukraine is looking to be the crypto capital of the world, according to a recent New York Times article. In September, the Ukraine parliament made it clear that it was embracing crypto by passing a measure that legalizes and regulates digital assets.

The country has always tried to attract entrepreneurs, and its low taxes and software engineer talent have made it a more attractive option for startups over the years. However, Ukraine remains one of the poorest countries in Europe.

Many entrepreneurs appreciate that the country has “no rules” and an “anything goes” ethos, but there are also serious problems to consider. Ukrainians are known for crypto adoption, but many believe this is mainly because of severe issues with Ukrainian banks and financial service companies.

Ukraine isn’t exactly a power player in terms of the global economy. Can Ukraine become a crypto capital, or are those expectations a bit too high?

Neil says:

I think there’s a big difference between “anything goes” when it comes to innovation, and “anything goes” when it comes to crime. Ukraine has very real crime and corruption problems that crypto cannot fix…I think Ukraine would have to solve a lot of problems before it becomes a “capital” of any kind.

Em says:

This is probably an only-option kind of move for Ukraine to try to make. When their narrative for so long has been corruption, lack of industry, and population loss, this is a perfect opportunity for them to reinvent themselves…let’s just hope they can pull it off.

Bottom line:

Neil thinks this is a bad thing, Em thinks it might just be Ukraine’s ONLY thing.

Who’s right?

Cops nab $30M crypto gang

Unfortunately, all cryptocurrency news can’t be positive news. Yikes!

Recently, a 39-year-old cryptocurrency trader was kidnapped in China and tortured for almost a week. Luckily, the victim has now been rescued by police.

Seven individuals were arrested for the kidnapping operation. The kidnappers are aged between 25 and 32, and all of them are members of the Sun Yee On triad. The gang lured the crypto trader by setting up a $4 million Hong Kong dollar Tether purchase. The group originally demanded an 8 million HKD ransom but increased the ransom to 30 HKD million eventually. Police believe that there are more individuals involved that are currently on the run.

The victim was able to escape through a window in a metal hut where he was kept. Police, already in ambush, were able to rescue the victim and raid the hut once he was safe. Thankfully, the victim is now under 24-hour police protection.

Will crypto millionaires be at a higher risk of kidnapping and ransoms?

Neil says:

I obviously have empathy for the victim, but I have to point out that he was meeting someone in person for a cryptocurrency deal, in China, which has cracked down on crypto, almost in the same way that people meet for drug deals. I don’t think it’s fair to blame “crypto” for this…criminals saw an opportunity to kidnap someone and did it.

Em says:

All I can say is: “Hide yo keys, hide yo wife.” Meeting sketchy people to make a trade is not advisable but still a big bummer for the guy who got held hostage. This is why we don’t talk about, advertise, or do sketchy stuff with our crypto holdings. Don’t make yourself a target.

Bottom line:

Both Neil and Em feel for the victim, but wonder about whether crypto is necessarily to blame here.

We have a consensus! Do you agree?

Bad idea of the week: an NFT sale disaster

You may think that it’s good news that an artist could sell an NFT for $19,000. However, in this case, it is undoubtedly bad news. This is because a CryptoPunks NFT worth millions was “accidentally” sold for this amount, far below its true value.

This mistake likely occurred because of a fat finger trade, a well-known concept in the finance world. Fat finger trades have caused “flash crashes” in the past. It is likely that the seller hoped to offer the CryptoPunk for 444 ETH, but instead listed it as 4.44 ETH.

The rise of the NFT has been critical in terms of the rise of the DeFi sector. However, there are some legitimate concerns to consider regarding this incident. The buyer “bribed” Ethereum miners to front-run their buy order, sending them 3.3 ETH to make sure that they purchased the NFT before anyone else.

Was the seller’s hastiness to blame or could the platform have done more to prevent this?

Neil says:

Man…the wrong fat finger trade can ruin your day, or even your year. Not even a month ago, Binance had a Bitcoin flash crash because of a similar mistake. It’s certainly not good PR for CryptoPunks, but I doubt this will affect the NFT sector much beyond being a cautionary tale.

Em says:

As someone who regularly mistypes, makes mistakes, and fumbles apps, I feel this person’s pain. Oof. One little zero can mean big losses. Be careful out there, y’all. If you’re as clumsy as me, know it will happen and double, triple, quadruple checkkkkkkkk pleaseeeeee.

Bottom line:

Watch your fingers, or it might just cost you a lot of money.

We have a consensus! Do you agree?

Meme of the week

Here’s our meme of the week by our very own Em!

We hope you enjoyed the weekly wrap-up, and we will see you next week! Happy investing!