As technology evolves, it’s natural for baby boomers to feel like they are falling behind the times.

Your millennial or Gen Zer children and grandchildren might be a trusted source to help you with your Wi-Fi works or how to create an account on a social media platform. While millennials tend to be more techno-saavy and are undoubtedly interested in crypto, the truth is that in recent years baby boomers have become very interested in and finding success with cryptocurrency investing. A study performed between July 2022 and January 2023 found that 8% of baby boomer respondents across major population countries own cryptocurrencies. While 46% millennial respondents were found to own cryptocurrencies, baby boomers have something going in their favor. New research suggests that boomers make better crypto investors than millennials or zoomers as they tend to do significantly more research before investing in cryptocurrency. Go boomers!

It can be overwhelming to dip your toes into the “crypto pool.” Where do you start? After a basic understanding of Bitcoin, what’s next? A cryptocurrency is a digital form of currency, but how EXACTLY does crypto work, and what crypto trading tools can help the average boomer investor on their crypto journey.

Why crypto won’t go away

Over the past decade, many high-profile figures in finance have downplayed cryptocurrency. Some have argued that Bitcoin was “a fraud” or suggested that only criminals used it. These days, with more institutional adoption than ever before, it’s clear that Bitcoin is here to stay. Some billionaires make headlines for praising various cryptocurrencies like Mark Cuban recently did by declaring Bitcoin as the “best store of value.”

Over the past decade, many high-profile figures in finance have downplayed cryptocurrency. Some have argued that Bitcoin was “a fraud” or suggested that only criminals used it. These days, with more institutional adoption than ever before, it’s clear that Bitcoin is here to stay. Some billionaires make headlines for praising various cryptocurrencies like Mark Cuban recently did by declaring Bitcoin as the “best store of value.”

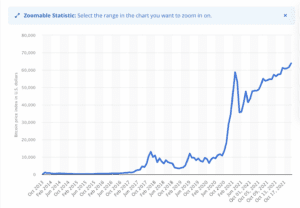

One reason Bitcoin won’t go away is because of its scarcity. Since there will only ever be 21 million Bitcoin in the world, the demand for Bitcoin increases as its supply diminishes. This is one of the reasons that Bitcoin has grown exponentially over the past decade.

Of course, blockchain, the underlying technology, isn’t going anywhere because of its many use cases. With the rise of DeFi, it’s very difficult to dismiss cryptocurrency or crypto trading as some “fad.”

Three myths about crypto trading

The first myth is that the whole crypto space is super volatile. Many baby boomers are worried about investing in crypto or learning crypto trading tools because they feel like they might end up losing their life savings. With more stablecoins and DeFi products, it’s clear that even conservative investors can reap the benefits, such as investors that are interested in staking (internal link) for passive income rather than trading on a daily basis.

The second myth is the belief that you can only make money with Bitcoin. As new investors begin researching the sector, many altcoins and other cryptocurrencies have increased in value significantly. Solana (SOL) may not be in major headlines anymore like Bitcoin, as it’s been in steady decline since it’s meteoric rise in value a couple years ago. The crypto space is bigger than just Bitcoin!

The third myth is that cryptocurrency is mostly used for illegal intent! Many skeptics try to claim that people use Bitcoin to purchase drugs or participate in other illegal behavior. Some try to associate Bitcoin with the dark web, for example. It’s time to wake up! It’s 2021, and hedge funds are buying millions of dollars of Bitcoin. This criticism is incorrect and outdated.

Three things boomers can do today to begin trading crypto

First and foremost, one of the best ways to begin trading crypto is to get a basic understanding of technical analysis. There are experts that have studied technical analysis for decades, so don’t expect to become a master of the terms immediately. Start by learning about terms like RSI, moving average, and consolidation.

Second, it might be best to study the price action of Bitcoin (internal link) for at least a week or so. If you check in on an hourly chart, you can learn more about support, resistance, and the way that volume flows in and out of Bitcoin on a weekly basis. You may also learn more about how catalysts affect Bitcoin, and how Bitcoin affects altcoin markets. Rather than rushing to trade crypto, waiting and observing can teach you about the cryptocurrency markets.

Third, begin to learn the vocabulary around cryptocurrencies. If you want to invest in a cryptocurrency, you will need to know basic crypto terminology. The best crypto trading tools in the world can help you make some winning trades, but if you want to find the next undervalued token, you’ll need to know the crypto lingo. The whitepapers for Bitcoin and Ethereum are two great places to start when it comes to laying a foundation for understanding crypto.

What else should I know about cryptocurrency?

There’s a whole lot to catch up on when it comes to understanding how to trade crypto.

There’s a whole lot to catch up on when it comes to understanding how to trade crypto.

Some newer investors want to learn more about blockchain and how it’s already being implemented throughout the world. Other traders are more focused on finding undervalued coins and holding them until they can get some real returns. A boomer who is used to traditional stocks might also take some time to adjust to the 24/7 nature of crypto markets.

It can be challenging to understand the rise of cryptocurrencies, but the truth is that digital assets are going mainstream more than ever before. It’s never been easier for traders to find out information about the sector through YouTube videos, podcasts, books, social media, and more. Lastly, the most obvious investing advice STILL applies to any boomer: don’t ever invest more than you can afford to lose!